Tax Return 2023

What is the 502W Tax Form?

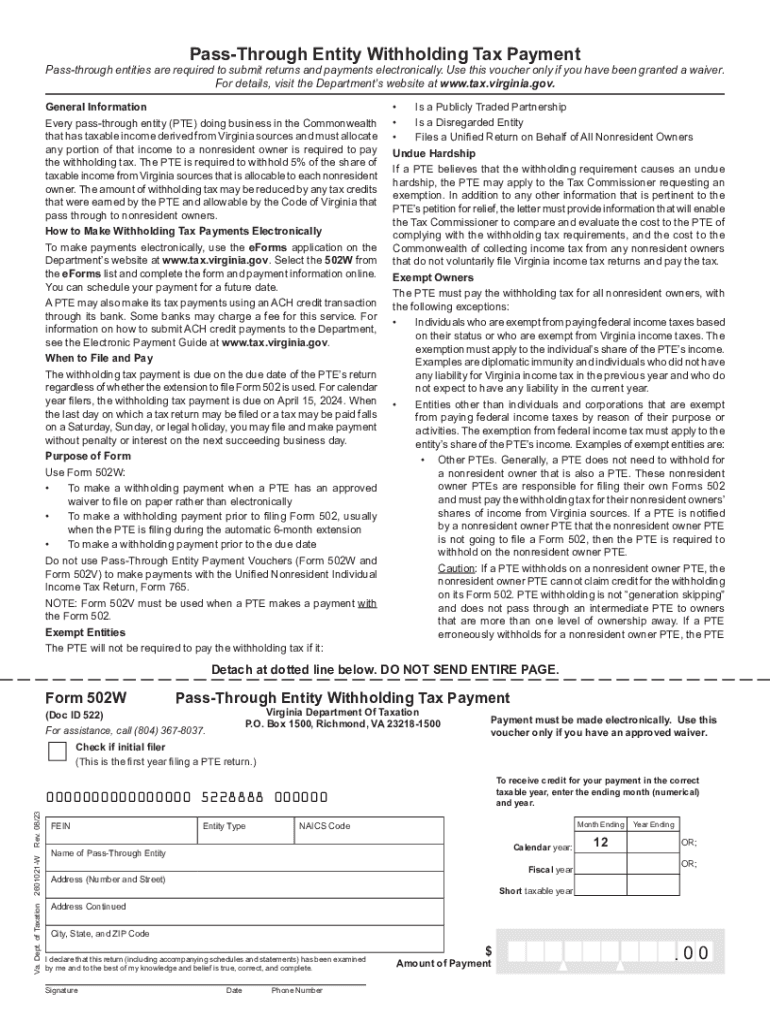

The 502W tax form is a Virginia state tax document used primarily by pass-through entities to report and pay withholding taxes on behalf of their owners. This form is essential for entities such as partnerships, S corporations, and limited liability companies (LLCs) that elect to be taxed as pass-through entities. By filing the 502W, these entities ensure compliance with Virginia tax laws while facilitating the accurate reporting of income distributed to their members or shareholders.

Steps to Complete the 502W Tax Form

Completing the 502W tax form involves several key steps:

- Gather necessary information, including the entity's name, address, and federal employer identification number (EIN).

- Identify the owners or shareholders, along with their respective ownership percentages.

- Calculate the total income subject to withholding and the corresponding tax amount based on Virginia tax rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

Key Elements of the 502W Tax Form

The 502W tax form contains several important sections that must be completed:

- Entity Information: This includes the name, address, and EIN of the pass-through entity.

- Owner Information: Details about each owner, including their names, addresses, and ownership percentages.

- Income Calculation: A section for reporting the total income subject to withholding.

- Tax Calculation: The calculated withholding tax amount based on the reported income.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the 502W tax form to avoid penalties. Typically, the form must be filed by the due date of the entity's income tax return. For most pass-through entities, this is the 15th day of the fourth month following the close of the tax year. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day.

Form Submission Methods

The 502W tax form can be submitted in various ways to accommodate different preferences:

- Online Submission: Entities can file the form electronically through the Virginia Department of Taxation's website.

- Mail Submission: The completed form can be printed and mailed to the appropriate tax office.

- In-Person Submission: Entities may also choose to deliver the form directly to a local tax office.

Penalties for Non-Compliance

Failure to file the 502W tax form on time or accurately can result in significant penalties. The Virginia Department of Taxation may impose fines for late submissions, which can accumulate over time. Additionally, incorrect information may lead to further scrutiny and potential audits, increasing the risk of additional penalties. It is essential for pass-through entities to ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete tax return 702336032

Complete Tax Return effortlessly on every device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused task today.

The simplest method to edit and eSign Tax Return without any hassle

- Locate Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize key parts of your documents or censor sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misdirected files, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Tax Return and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return 702336032

Create this form in 5 minutes!

How to create an eSignature for the tax return 702336032

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 502w tax form and why is it important?

The 502w tax form is a crucial document for reporting certain types of income and expenses to the IRS. Understanding the 502w tax form ensures that businesses remain compliant and avoid potential penalties. Utilizing airSlate SignNow can streamline the eSigning process for such documents, making it easier to manage important tax-related paperwork.

-

How can airSlate SignNow help with filing the 502w tax?

airSlate SignNow simplifies the process of signing and sending the 502w tax form. With its user-friendly interface, you can quickly prepare your documents for eSignatures, ensuring they are completed and sent on time. This efficiency helps you focus more on your tax preparation rather than paperwork logistics.

-

Is there a cost associated with using airSlate SignNow for 502w tax documents?

Yes, there is a pricing structure for using airSlate SignNow that is designed to fit various business needs. The costs are competitive, providing a cost-effective solution for managing your 502w tax paperwork. You can choose from different plans based on the frequency of your document needs and the number of users.

-

What features does airSlate SignNow offer for managing the 502w tax form?

airSlate SignNow includes features such as document templates, automated workflows, and secure eSigning for the 502w tax form. These tools enhance efficiency and accuracy in your tax documentation process. Additionally, the platform ensures that your documents are stored securely and are easily accessible when needed.

-

Can the 502w tax form be integrated with other software using airSlate SignNow?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and document management software that are essential when dealing with the 502w tax form. These integrations allow for a unified workflow, making it easier to sync your financial data and simplify your tax preparation process.

-

How does eSigning the 502w tax form with airSlate SignNow work?

eSigning the 502w tax form with airSlate SignNow is straightforward. Once you upload your document, you can add signers, set signing orders, and send it out for signatures. The process is secure, and you will receive notifications once your document has been completed, keeping you updated on its status.

-

What are the benefits of using airSlate SignNow for tax forms like the 502w?

Using airSlate SignNow for tax forms like the 502w provides numerous benefits such as time savings, reduced paper use, and enhanced document security. The platform allows for quick access and easy sharing of your 502w tax form, reducing the stress of tax season. Overall, it promotes a more organized approach to handling tax documents.

Get more for Tax Return

- California transfer disclosure statement california civil code1102 et seq form

- Brokerage disclosure to buyer tenant relationship vaned form

- Real estate broker contracts and forms division of real estate

- Dual status disclosure real estate broker and mortgage form

- Brokerage disclosure community first commercial real form

- Colorado net tangible benefit form

- Lead based paint disclosures salespdf google drive form

- Bcertificationb of incumbency form

Find out other Tax Return

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF