NJ 2210 Underpayment of Estimated Tax by Individuals, Estates, or Trusts Form

What is the NJ 2210 Underpayment of Estimated Tax by Individuals, Estates, or Trusts

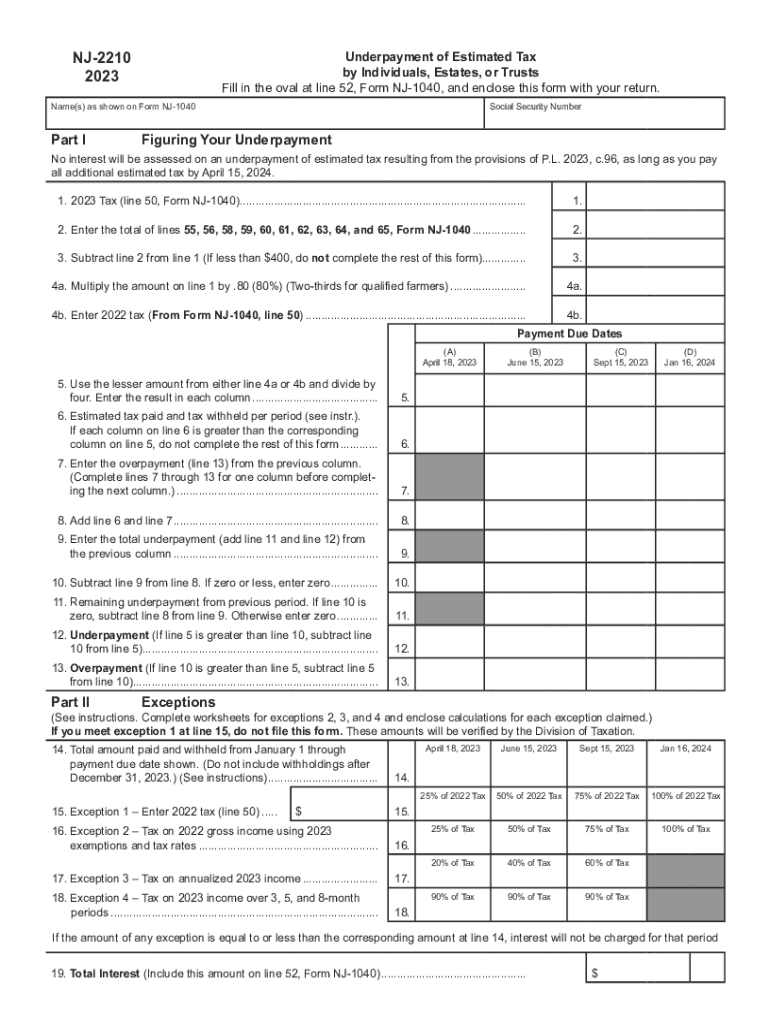

The NJ 2210 form is designed for individuals, estates, and trusts in New Jersey to report underpayment of estimated tax. This form helps taxpayers calculate whether they owe a penalty for not paying enough tax throughout the year. The underpayment occurs when the total tax paid through withholding and estimated payments is less than the required amount. Understanding this form is essential for maintaining compliance with New Jersey tax laws and avoiding unnecessary penalties.

Steps to Complete the NJ 2210 Underpayment of Estimated Tax by Individuals, Estates, or Trusts

Completing the NJ 2210 involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year, including any credits or deductions.

- Determine your total payments made through withholding and estimated payments.

- Compare your total payments to your total tax liability to assess if you have underpaid.

- Complete the NJ 2210 form by following the instructions provided for each section.

- Submit the form by the specified deadline to avoid penalties.

Key Elements of the NJ 2210 Underpayment of Estimated Tax by Individuals, Estates, or Trusts

Several key elements are essential when dealing with the NJ 2210 form:

- Payment Thresholds: Understand the income thresholds that trigger potential underpayment penalties.

- Calculation Methods: Familiarize yourself with the different methods for calculating estimated tax payments.

- Penalties: Be aware of the penalties for underpayment, which can vary based on the amount owed and the duration of the underpayment.

- Filing Requirements: Know the filing requirements and deadlines to ensure timely submission.

Filing Deadlines / Important Dates

Filing deadlines for the NJ 2210 are crucial for compliance. Typically, estimated tax payments are due quarterly, with specific deadlines throughout the year. It is important to mark these dates on your calendar to avoid penalties:

- First Quarter: April 15

- Second Quarter: June 15

- Third Quarter: September 15

- Fourth Quarter: January 15 of the following year

Penalties for Non-Compliance

Failure to comply with the NJ 2210 requirements can result in significant penalties. These penalties are calculated based on the amount of underpayment and the duration of the underpayment period. Taxpayers may face interest charges on unpaid amounts, which can accumulate quickly. Understanding these penalties can motivate timely compliance and accurate payment of estimated taxes.

Eligibility Criteria

To be eligible to use the NJ 2210 form, taxpayers must meet specific criteria. Generally, individuals, estates, and trusts that have a tax liability and make estimated payments are required to assess their underpayment. Additionally, those who expect to owe a certain amount in taxes after withholding must consider filing this form to avoid penalties. Reviewing eligibility criteria ensures that taxpayers understand their obligations under New Jersey tax law.

Quick guide on how to complete nj 2210 underpayment of estimated tax by individuals estates or trusts

Prepare NJ 2210 Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Handle NJ 2210 Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign NJ 2210 Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts effortlessly

- Find NJ 2210 Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign NJ 2210 Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj 2210 underpayment of estimated tax by individuals estates or trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NJ NJ 2210 form, and how can airSlate SignNow help with it?

The NJ NJ 2210 form is used to calculate underpayment of estimated tax for New Jersey residents. With airSlate SignNow, users can easily eSign and send their NJ NJ 2210 documents securely and efficiently, ensuring compliance with state tax regulations.

-

What are the pricing plans for using airSlate SignNow to manage NJ NJ 2210 documents?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. The plans provide cost-effective solutions for managing NJ NJ 2210 forms, ensuring businesses can efficiently handle their tax documents without overspending.

-

Can I integrate airSlate SignNow with other software to manage NJ NJ 2210 documents?

Yes, airSlate SignNow supports a wide range of integrations with popular software, making it easy to manage NJ NJ 2210 documents alongside your existing workflows. This seamless integration enhances productivity and streamlines the document process.

-

What features does airSlate SignNow offer for handling NJ NJ 2210 documents?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking for NJ NJ 2210 documents. These features enhance the eSigning process, making it simpler and more efficient for users.

-

Is airSlate SignNow a secure platform for submitting NJ NJ 2210 documents?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to protect your NJ NJ 2210 documents. Advanced encryption and authentication measures ensure that your sensitive tax information remains confidential.

-

How quickly can I get my NJ NJ 2210 documents signed with airSlate SignNow?

With airSlate SignNow, you can have your NJ NJ 2210 documents signed within minutes. The platform's intuitive interface allows you to send documents for eSignature quickly, facilitating faster tax submissions and compliance.

-

Can airSlate SignNow help track the status of my NJ NJ 2210 forms?

Yes, airSlate SignNow includes real-time tracking features that allow you to monitor the status of your NJ NJ 2210 forms. You will receive notifications when your documents are viewed and signed, keeping you updated throughout the process.

Get more for NJ 2210 Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts

- Inbjudan infr anskan om schengenvisering form

- Quarterly hazardous waste report generation and on form

- 447 nc pdf south carolina department of motor vehicles form

- Employee registration pdf form

- Application to amend avc extra contributions railways pension form

- Certification of trust thrivent mutual funds mf24143 download this form to authorize ownership of mutual fund account by a trust

- Form ct drs ct 941x fill online printable fillable

- Total power exchange contract template form

Find out other NJ 2210 Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors