Irs Td F 90 22 1 2012-2026

What is the IRS TD F 90-22.1?

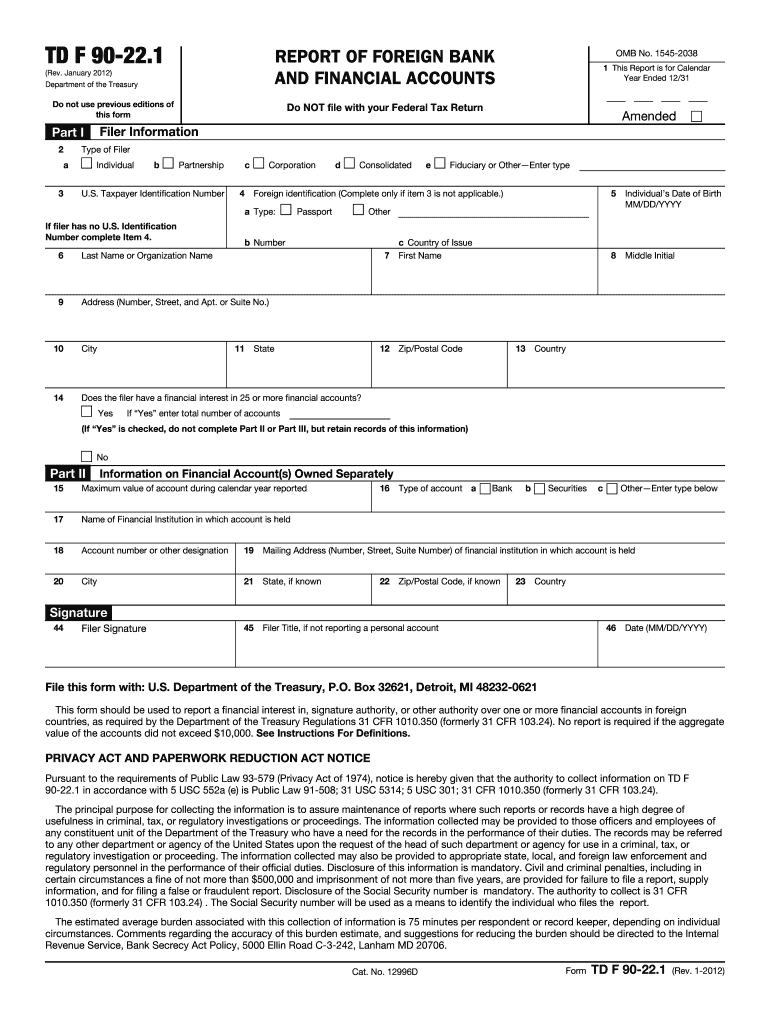

The IRS TD F 90-22.1, commonly known as the Report of Foreign Bank and Financial Accounts (FBAR), is a form required by the Financial Crimes Enforcement Network (FinCEN). It is used by U.S. citizens, residents, and entities to report foreign bank accounts and financial accounts exceeding a certain threshold. This form is essential for compliance with U.S. laws aimed at preventing money laundering and tax evasion. The requirement to file this form applies to anyone who has a financial interest in or signature authority over foreign accounts that cumulatively exceed $10,000 at any time during the calendar year.

Steps to Complete the IRS TD F 90-22.1

Completing the IRS TD F 90-22.1 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding your foreign accounts, including account numbers, financial institution names, and addresses. Next, determine if your accounts meet the reporting threshold. If they do, complete the form by entering the required details accurately. It's important to double-check all entries for completeness and correctness. Finally, submit the form electronically through the BSA E-Filing System, as paper submissions are no longer accepted.

Filing Deadlines / Important Dates

The deadline for filing the IRS TD F 90-22.1 is April 15 of the following year, with an automatic extension available until October 15. It is crucial to adhere to these deadlines to avoid penalties. If you miss the deadline, you may face fines and other legal repercussions. Understanding these timelines helps ensure that you remain compliant with U.S. regulations regarding foreign financial accounts.

Legal Use of the IRS TD F 90-22.1

The legal use of the IRS TD F 90-22.1 is primarily to disclose foreign bank accounts to the U.S. government. Failure to report these accounts can lead to severe penalties, including fines that can reach up to 50% of the account balance. The form serves as a tool for the government to monitor and prevent tax evasion and money laundering activities. Therefore, it is essential to file this form accurately and on time to comply with U.S. laws.

Penalties for Non-Compliance

Non-compliance with the IRS TD F 90-22.1 can result in significant penalties. Civil penalties may be imposed for failing to file the form or for filing it late, with fines ranging from $10,000 to $100,000, depending on the circumstances. In cases of willful neglect, penalties can be even more severe, potentially reaching up to 50% of the account balance. Understanding these penalties underscores the importance of timely and accurate reporting.

Required Documents

To complete the IRS TD F 90-22.1, you will need several documents. These include bank statements from foreign accounts, documentation of the account holder's identity, and any relevant financial records that demonstrate account ownership. Having these documents on hand will streamline the filing process and help ensure that all information reported is accurate and complete.

Who Issues the Form?

The IRS TD F 90-22.1 is issued by the Financial Crimes Enforcement Network (FinCEN), which operates under the U.S. Department of the Treasury. FinCEN is responsible for administering the Bank Secrecy Act, which mandates the reporting of foreign bank accounts. Understanding the authority behind the form helps clarify its importance and the need for compliance.

Quick guide on how to complete form bank account 2012 2019

Discover the easiest method to complete and endorse your Irs Td F 90 22 1

Are you still spending time drafting your official paperwork on physical copies instead of managing it online? airSlate SignNow offers a superior approach to finalize and approve your Irs Td F 90 22 1 and comparable documents for public services. Our advanced e-signature solution equips you with all the tools necessary to handle documents swiftly and in compliance with legal standards - robust PDF manipulation, organization, safeguarding, endorsement, and sharing features are all accessible within a user-friendly interface.

Only a few actions are needed to complete and endorse your Irs Td F 90 22 1:

- Incorporate the editable template into the editor by utilizing the Get Form button.

- Assess the information you need to input in your Irs Td F 90 22 1.

- Move through the fields using the Next option to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to fill in the fields with your information.

- Modify the content using Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Mask sections that are no longer relevant.

- Click on Sign to create a legally recognized electronic signature with your preferred method.

- Include the Date beside your signature and conclude your task with the Done button.

Preserve your finalized Irs Td F 90 22 1 in the Documents folder of your profile, download it, or transfer it to your selected cloud storage. Our service also provides versatile form sharing options. There’s no need to print your forms when you want to submit them to the respective public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form bank account 2012 2019

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the Axis Bank account closure form?

How To Fill Axis Bank Account Closure FormTo close your axis bank account, first you have to download the bank account closure form then submit it to your bank branch.Click the link and download the form:http://bit.ly/accntclosurepdfAfter downloading the account closure form, you have to fill up exactly as I have show below with detail. Kindly go through the filled form below and after filling the form, take all the kit like credit card, debit card, passbook and etc and submit it to your bank with the filled form.Source: How To Fill Axis Bank Account Closure Form

-

How do I fill out the Allahabad Bank account opening form?

Follow the step by step process for filling up the Allahabad Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Allahabad Bank Account Opening Minimum Balance:The minimum amount required to open a savings account is as follows: The minimum balance to open an account in rural and sub-urban branches isRs.500The minimum balance to open an account in all other branches isRs.1,000For issue of cheque book, an additional Rs.100 is to be paid in rural and sub-urban branches.Allahabad Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)Step 1:Continue Reading…

-

Do I need a bank account to fill out the MHT CET application form?

To apply, you need to pay through online mode. This doesn't necessarily need you to have a bank account. You can ask anyone kind-hearted who is having a bank account to pay and handover the hard cash to that person.Hope this helps.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

Can I use my father's bank account for filling up the JEE Mains 2019 application form?

Of course, I and almost all my friends and seniors used their father's bank account for JEE Mains 2019There's no rule for using only your personal bank account, most of the students don't have their own bank account.So use any of your parents' bank account for filling the JEE form .

Create this form in 5 minutes!

How to create an eSignature for the form bank account 2012 2019

How to make an electronic signature for your Form Bank Account 2012 2019 in the online mode

How to make an electronic signature for your Form Bank Account 2012 2019 in Chrome

How to create an eSignature for signing the Form Bank Account 2012 2019 in Gmail

How to generate an electronic signature for the Form Bank Account 2012 2019 from your smartphone

How to create an eSignature for the Form Bank Account 2012 2019 on iOS devices

How to generate an electronic signature for the Form Bank Account 2012 2019 on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to td?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents digitally. The platform enhances workflow efficiency by streamlining the signing process, making 'td' a crucial part of managing documentation effectively. It serves as an essential tool for organizations looking to automate their processes related to 'td.'

-

How much does airSlate SignNow cost for users focused on td?

Pricing for airSlate SignNow is designed to be budget-friendly while providing excellent value for its features. Customers can choose from various plans that cater to different business needs, all aimed at simplifying 'td.' Contact our sales team for detailed pricing that suits your requirements.

-

What features does airSlate SignNow offer for effective td management?

airSlate SignNow includes features like customizable templates, real-time notifications, and advanced security measures that enhance 'td' management. These tools help users achieve better compliance and tracking, ensuring your documents are always secure during the signing process.

-

How can airSlate SignNow benefit my business’s td operations?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document handling, which is crucial for improving 'td' operations. The platform allows for faster turnaround times on contracts and agreements, ultimately leading to increased productivity and enhanced client satisfaction.

-

What integrations does airSlate SignNow support for managing td?

airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and Dropbox, making it easier to manage 'td.' These integrations allow users to import documents directly and streamline workflows, ensuring that all 'td' processes are cohesive and efficient.

-

Is airSlate SignNow suitable for small businesses focusing on td?

Yes, airSlate SignNow is an excellent choice for small businesses looking to simplify their 'td' processes. Its user-friendly interface and affordable pricing make it accessible and easy for small teams to adopt, allowing them to manage documents without complicated setups.

-

How does the security of airSlate SignNow protect my td information?

Security is a top priority at airSlate SignNow, with features like encryption and compliance with international standards protecting your 'td' information. The platform ensures that all data is secured during transmission and at rest, giving users confidence in the integrity of their documents.

Get more for Irs Td F 90 22 1

Find out other Irs Td F 90 22 1

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now