Schedule CF Nd Form

What is the Schedule CF Nd

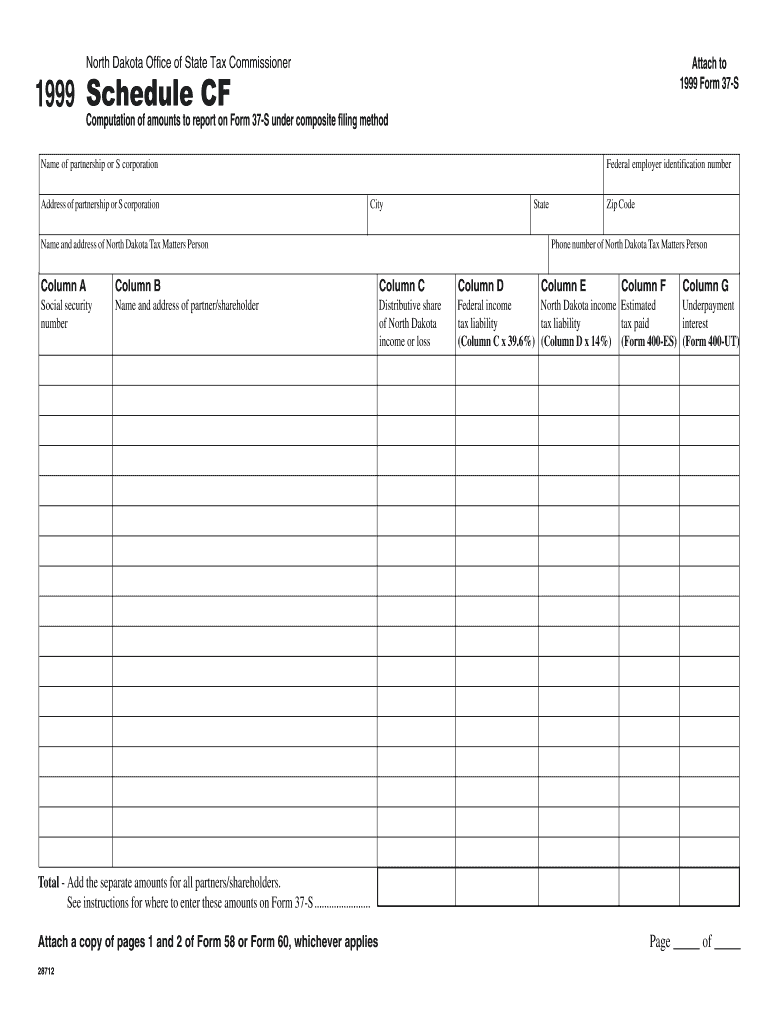

The Schedule CF Nd is a specific form used in the United States for reporting certain financial information related to tax obligations. This form is particularly relevant for individuals and businesses that need to disclose income, expenses, and other financial details to the Internal Revenue Service (IRS). It serves as a supplementary document that provides clarity and transparency in financial reporting, ensuring compliance with federal tax regulations.

How to use the Schedule CF Nd

Using the Schedule CF Nd involves several straightforward steps. First, gather all necessary financial documents, including income statements, expense receipts, and any other relevant financial records. Next, fill out the form accurately, ensuring that all sections are completed to reflect your financial situation. It is crucial to double-check the information for accuracy before submission. Finally, submit the completed form along with your main tax return, either electronically or via mail, depending on your preference.

Steps to complete the Schedule CF Nd

Completing the Schedule CF Nd requires careful attention to detail. Follow these steps for accurate completion:

- Begin by entering your personal information, including your name, Social Security number, and address.

- Report your income in the designated sections, ensuring you include all sources of revenue.

- Document any applicable deductions or expenses that pertain to your financial activities.

- Review all entries for accuracy and completeness before finalizing the form.

- Sign and date the form as required.

Legal use of the Schedule CF Nd

The Schedule CF Nd is legally recognized as part of the tax filing process in the United States. It is essential for taxpayers to understand that accurate completion and timely submission of this form are crucial for compliance with IRS regulations. Failure to use the form correctly can result in penalties or delays in processing tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule CF Nd align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 each year. If you require an extension, you may have until October 15 to submit your return and any accompanying forms, including the Schedule CF Nd. It is important to stay informed about any changes to these deadlines to avoid late penalties.

Required Documents

To complete the Schedule CF Nd, you will need several documents. These typically include:

- Income statements such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation that supports your financial claims.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule CF Nd, which must be followed to ensure compliance. Taxpayers should refer to the IRS instructions for the form, which detail how to report income, claim deductions, and provide necessary disclosures. Adhering to these guidelines helps prevent errors that could lead to audits or penalties.

Quick guide on how to complete schedule cf nd

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing out additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule CF Nd

Create this form in 5 minutes!

How to create an eSignature for the schedule cf nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule CF Nd process in airSlate SignNow?

The Schedule CF Nd process in airSlate SignNow allows businesses to efficiently manage and send documents for eSignature. This streamlined solution makes it easy to ensure compliance and enhance collaboration with stakeholders during the signing process.

-

How does airSlate SignNow handle document security in the Schedule CF Nd feature?

AirSlate SignNow prioritizes document security with advanced encryption and secure storage for the Schedule CF Nd feature. Our platform ensures that your sensitive documents are protected, giving you peace of mind as you manage your eSigning needs.

-

What pricing plans does airSlate SignNow offer for the Schedule CF Nd feature?

AirSlate SignNow offers flexible pricing plans tailored to meet different business needs for the Schedule CF Nd feature. From individual users to large organizations, we have affordable options that ensure all teams can benefit from our eSigning capabilities.

-

Can I integrate Schedule CF Nd with other applications?

Yes, airSlate SignNow supports seamless integrations with various applications, enhancing the utility of the Schedule CF Nd feature. You can connect with CRM systems, document management tools, and other essential business software to streamline your workflow.

-

What are the key benefits of using Schedule CF Nd with airSlate SignNow?

Using Schedule CF Nd with airSlate SignNow offers multiple benefits, including increased efficiency, reduced turnaround times for document signing, and improved accuracy. These advantages help businesses save time and resources while ensuring compliance.

-

How user-friendly is the Schedule CF Nd feature in airSlate SignNow?

The Schedule CF Nd feature in airSlate SignNow is designed with user experience in mind, making it accessible for everyone, regardless of technical expertise. Our intuitive interface simplifies the process of sending and eSigning documents, allowing quick adoption within teams.

-

Are there any mobile capabilities for Schedule CF Nd in airSlate SignNow?

Yes, airSlate SignNow offers robust mobile capabilities for the Schedule CF Nd feature, enabling users to manage and sign documents on the go. This flexibility ensures that your team can remain productive, regardless of their location.

Get more for Schedule CF Nd

Find out other Schedule CF Nd

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online