Tax Year Form MET1 MET1 2021

Understanding the Maryland 1 Tax Return Form

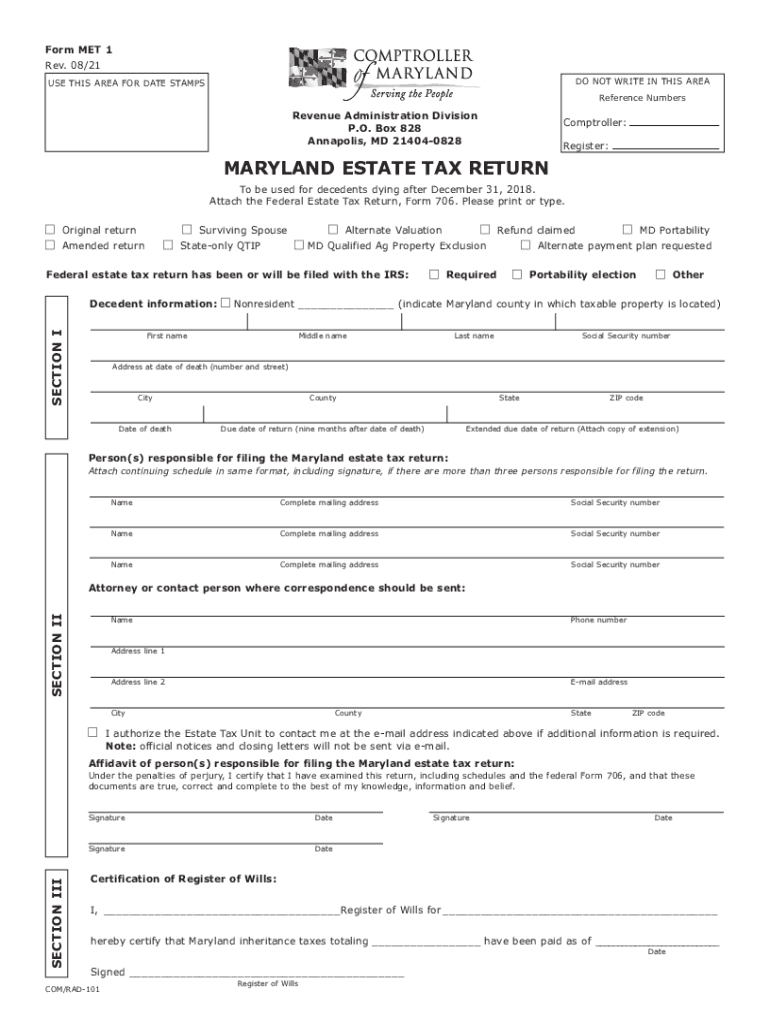

The Maryland 1 tax return form, also known as the MET-1, is essential for individuals and entities subject to the Maryland estate tax. This form is used to report the value of the estate and calculate the tax owed. The tax year for the MET-1 typically corresponds to the calendar year in which the decedent passed away. Understanding the nuances of this form is crucial for compliance with state tax laws.

Steps to Complete the Maryland 1 Tax Return Form

Completing the Maryland 1 tax return form involves several key steps:

- Gather necessary documentation, including the death certificate and asset valuations.

- Fill out the form accurately, ensuring all information is complete and correct.

- Calculate the total value of the estate and the corresponding tax liability.

- Review the form for accuracy before submission.

Each step is vital to ensure that the form is processed without delays or complications.

Obtaining the Maryland 1 Tax Return Form

The Maryland 1 tax return form can be obtained from the Maryland State Comptroller's website or through local tax offices. It is available in both digital and paper formats, allowing users to choose the method that best suits their needs. For those preferring to fill out the form electronically, accessing it online can streamline the process significantly.

Legal Use of the Maryland 1 Tax Return Form

The Maryland 1 tax return form must be completed and submitted according to state regulations to be considered legally binding. This includes adhering to deadlines and ensuring that all required signatures are present. Electronic signatures are acceptable, provided they comply with the relevant eSignature laws, which ensure the integrity and authenticity of the document.

Filing Deadlines for the Maryland 1 Tax Return Form

Timely filing of the Maryland 1 tax return form is crucial to avoid penalties. The form is typically due nine months after the date of death of the decedent. If additional time is needed, an extension may be requested, but it is important to understand that this does not extend the payment deadline for any taxes owed.

Required Documents for the Maryland 1 Tax Return Form

When completing the Maryland 1 tax return form, several documents are required to support the information provided. These may include:

- The decedent's death certificate

- Asset valuations, including appraisals for real estate and personal property

- Documentation of debts and liabilities

- Any prior tax returns if applicable

Having these documents ready will facilitate a smoother filing process.

Quick guide on how to complete tax year 2021 form met1 met1

Prepare Tax Year Form MET1 MET1 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without hassles. Manage Tax Year Form MET1 MET1 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and eSign Tax Year Form MET1 MET1 without any hassle

- Search for Tax Year Form MET1 MET1 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with a few clicks from any device you choose. Edit and eSign Tax Year Form MET1 MET1 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year 2021 form met1 met1

Create this form in 5 minutes!

How to create an eSignature for the tax year 2021 form met1 met1

The way to generate an e-signature for your PDF document online

The way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Maryland 1 tax return form?

The Maryland 1 tax return form is the official document used by individuals to file their state income tax returns in Maryland. It allows taxpayers to report their income, claim deductions, and calculate their tax obligations. Completing the Maryland 1 tax return form accurately is essential to ensure compliance with state tax laws.

-

How can I complete the Maryland 1 tax return form using airSlate SignNow?

You can complete the Maryland 1 tax return form using airSlate SignNow by uploading your tax documents and using our eSignature features. This easy-to-use platform allows you to fill out and sign the form digitally. It's a cost-effective solution that streamlines your filing process.

-

Are there any costs associated with using airSlate SignNow for the Maryland 1 tax return form?

Yes, there are costs associated with using airSlate SignNow, but they are designed to be budget-friendly. Pricing varies based on the features you need, including document signing and form management for the Maryland 1 tax return form. Visit our website for detailed pricing options.

-

What features does airSlate SignNow offer for handling the Maryland 1 tax return form?

airSlate SignNow offers several features for handling the Maryland 1 tax return form, such as eSigning, document sharing, and secure cloud storage. Our platform is user-friendly and designed to simplify the process of managing your tax documents. You can also track the progress of your forms in real-time.

-

Can I integrate airSlate SignNow with other tax software for the Maryland 1 tax return form?

Yes, airSlate SignNow can be integrated with various tax software solutions to enhance your experience with the Maryland 1 tax return form. These integrations allow for seamless data transfer and improved organization of your tax documents, ensuring a more efficient filing process.

-

What are the benefits of using airSlate SignNow for the Maryland 1 tax return form?

Using airSlate SignNow for the Maryland 1 tax return form offers numerous benefits, including efficiency and convenience. You can complete, sign, and send your tax documents from anywhere, reducing the time spent on tax filing. Additionally, our secure platform ensures your information is protected throughout the process.

-

Is airSlate SignNow suitable for individual and business use for the Maryland 1 tax return form?

Absolutely! airSlate SignNow is designed for both individual and business use, making it an excellent choice for filing the Maryland 1 tax return form. Our platform can accommodate various needs, whether you're filing personally or managing tax documents for your business.

Get more for Tax Year Form MET1 MET1

- Guaranty attachment to lease for guarantor or cosigner delaware form

- Amendment to lease or rental agreement delaware form

- Warning notice due to complaint from neighbors delaware form

- Lease subordination agreement delaware form

- Apartment rules and regulations delaware form

- Agreed cancellation of lease delaware form

- Affidavit of mailing delaware form

- Amendment of residential lease delaware form

Find out other Tax Year Form MET1 MET1

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile