Tax Year Form MET1 MET1 2020

What is the Tax Year Form MET-1?

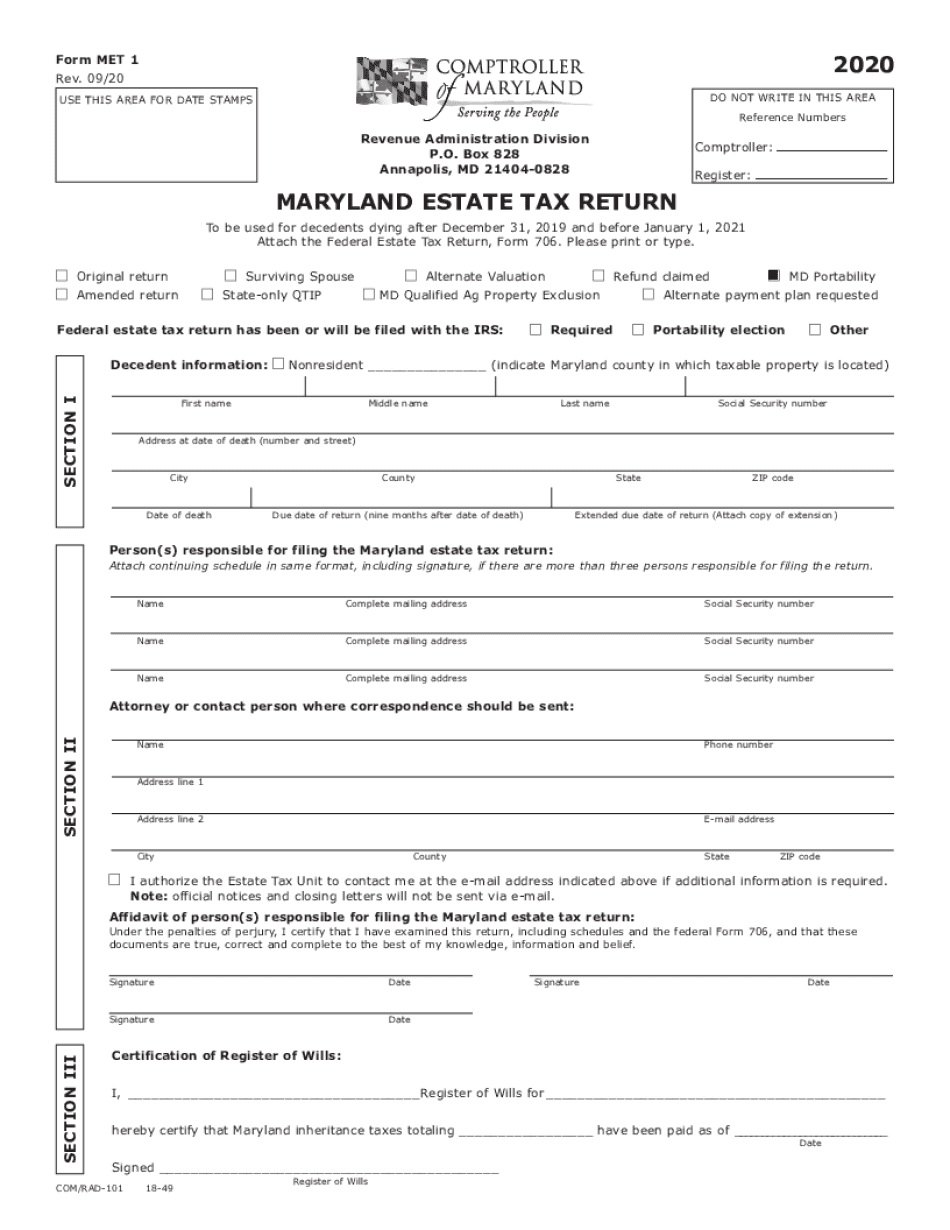

The Maryland MET-1 form is a critical document used for reporting estate taxes in the state of Maryland. Specifically, it is designed for estates that exceed the exemption threshold set by Maryland law. The form must be completed accurately to ensure compliance with state tax regulations. The MET-1 form is essential for calculating the estate tax liability and must be filed within nine months of the decedent's date of death. Understanding the purpose and requirements of the MET-1 form is vital for executors and administrators managing an estate.

Steps to Complete the Tax Year Form MET-1

Completing the Maryland MET-1 form involves several important steps to ensure accuracy and compliance. First, gather all necessary information regarding the decedent's assets, liabilities, and any prior tax filings. Next, fill out the form carefully, providing details about the estate's value and deductions. It is crucial to include all required schedules and attachments, such as the Maryland Form 500E, if applicable. After completing the form, review it thoroughly for any errors or omissions before submitting it to the Maryland Comptroller's office.

Legal Use of the Tax Year Form MET-1

The MET-1 form is legally binding when filled out and submitted according to Maryland state laws. It must be signed by the executor or administrator of the estate, affirming that the information provided is accurate and complete. The form must also comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) if submitted electronically. Ensuring that the form is legally valid is essential to avoid potential penalties or disputes regarding the estate tax liability.

Filing Deadlines / Important Dates

Timely filing of the MET-1 form is crucial to avoid penalties. The form must be submitted within nine months of the decedent's date of death. If additional time is needed, an extension can be requested, but it is important to file the request before the original deadline. Missing the deadline can result in interest and penalties, which can significantly increase the estate's tax burden. Keeping track of these important dates helps ensure compliance and smooth processing of the estate tax return.

Required Documents

When filing the MET-1 form, several supporting documents are required to substantiate the information provided. These may include the decedent's death certificate, a complete inventory of the estate's assets, and any relevant financial statements. Additionally, if there are deductions claimed, documentation supporting those deductions must be included. Ensuring that all required documents are prepared and submitted with the MET-1 form can help facilitate a smoother review process by the Maryland Comptroller's office.

Form Submission Methods

The Maryland MET-1 form can be submitted through various methods, including online, by mail, or in person. For electronic submissions, using a compliant eSignature solution can streamline the process and ensure legal validity. If submitting by mail, ensure that the form is sent to the correct address and that it is postmarked by the filing deadline. In-person submissions can be made at designated state offices, which may provide immediate confirmation of receipt. Choosing the appropriate submission method can help avoid delays in processing the estate tax return.

Quick guide on how to complete tax year 2020 form met1 met1

Complete Tax Year Form MET1 MET1 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without hassle. Manage Tax Year Form MET1 MET1 on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to modify and electronically sign Tax Year Form MET1 MET1 without any difficulty

- Find Tax Year Form MET1 MET1 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Tax Year Form MET1 MET1 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year 2020 form met1 met1

Create this form in 5 minutes!

How to create an eSignature for the tax year 2020 form met1 met1

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Maryland Met 1 in relation to airSlate SignNow?

Maryland Met 1 is a term associated with airSlate SignNow's compliance with Maryland's electronic signature laws. This allows businesses operating in Maryland to utilize legally binding electronic signatures through a trusted platform, ensuring that all signed documents meet state requirements.

-

How does airSlate SignNow ensure secure eSigning in Maryland?

airSlate SignNow utilizes top-notch encryption and security protocols to protect your documents when you eSign in Maryland. With features like two-factor authentication and comprehensive audit trails, users can be confident that their signed documents are secure and compliant with Maryland Met 1 standards.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Users can select from monthly or annual subscription options, and all plans include access to features that comply with Maryland Met 1, ensuring an effective electronic signature solution.

-

Can I integrate airSlate SignNow with existing software?

Yes, airSlate SignNow offers seamless integrations with a variety of business applications, such as CRM systems, cloud storage services, and more. This allows users in Maryland to streamline their workflow while ensuring compliance with Maryland Met 1 for signed documents.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes intuitive features like document templates, custom branding, and real-time tracking of document status. These capabilities help businesses in Maryland manage their documents efficiently while adhering to Maryland Met 1 requirements.

-

Is airSlate SignNow user-friendly for beginners?

Yes, airSlate SignNow is designed with simplicity in mind, making it user-friendly for individuals and businesses new to electronic signatures. The easy-to-navigate interface and helpful resources ensure that anyone in Maryland can start eSigning documents in no time, meeting Maryland Met 1 standards.

-

What benefits does airSlate SignNow provide for Maryland businesses?

airSlate SignNow helps Maryland businesses save time and money by streamlining their document signing processes. By utilizing electronic signatures compliant with Maryland Met 1, companies can enhance productivity, reduce paper usage, and ensure legal compliance.

Get more for Tax Year Form MET1 MET1

- Living trust for husband and wife with no children washington form

- Living trust for individual who is single divorced or widow or widower with no children washington form

- Living trust for individual who is single divorced or widow or widower with children washington form

- Living trust for husband and wife with one child washington form

- Living trust for husband and wife with minor and or adult children washington form

- Amendment to living trust washington form

- Living trust property record washington form

- Washington trust 497429985 form

Find out other Tax Year Form MET1 MET1

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter