DR 908 Florida Insurance Premium Taxes and Fees Return 2022

What is the DR 908 Florida Insurance Premium Taxes And Fees Return

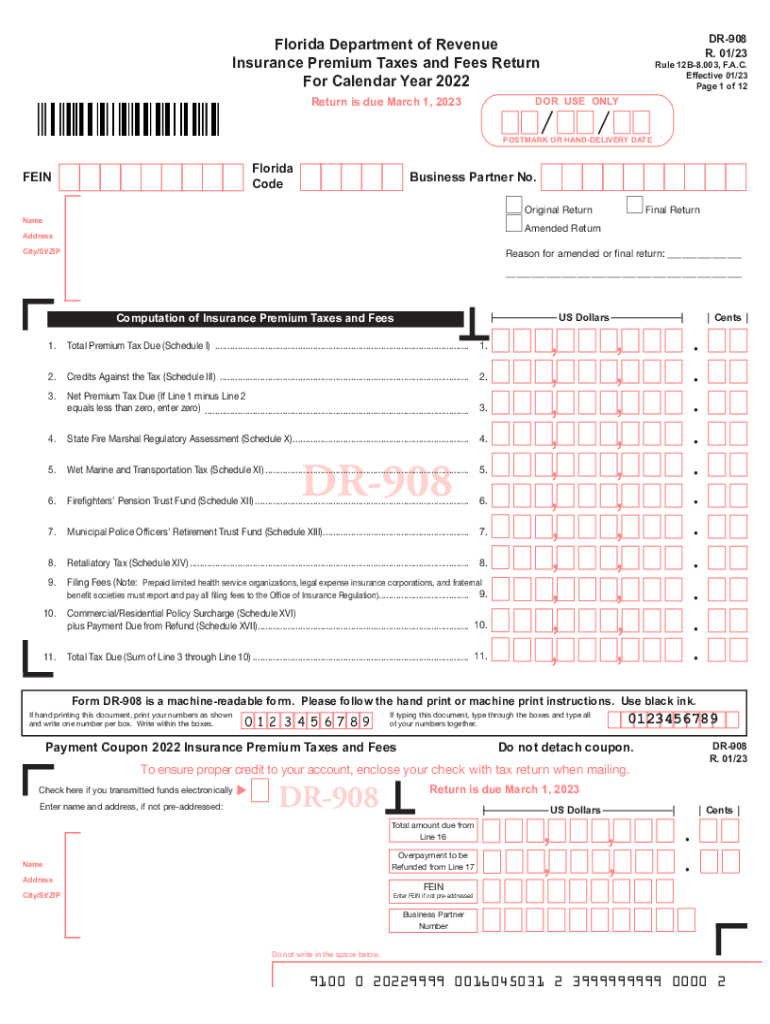

The DR 908 Florida Insurance Premium Taxes And Fees Return is a tax form that insurance companies in Florida must complete to report and pay premium taxes and fees associated with their operations. This form is essential for ensuring compliance with state tax regulations and is used to calculate the amount of tax owed based on the premiums collected by the insurer. It encompasses various types of insurance, including life, health, and property insurance, and is a critical component of the financial reporting for insurance entities operating within the state.

How to use the DR 908 Florida Insurance Premium Taxes And Fees Return

Using the DR 908 involves several steps. First, insurance companies must gather relevant financial data, including total premiums collected during the reporting period. Next, they should carefully fill out the form, ensuring that all required information is accurately reported. The completed form must then be submitted to the Florida Department of Revenue by the specified deadline. Companies should retain a copy of the submitted form for their records and ensure that all calculations are verified to avoid discrepancies.

Steps to complete the DR 908 Florida Insurance Premium Taxes And Fees Return

Completing the DR 908 requires a systematic approach:

- Collect all necessary financial documents, including records of premiums collected.

- Access the DR 908 form from the Florida Department of Revenue's website.

- Fill in the required sections, including company information and premium totals.

- Calculate the total premium tax due based on the provided guidelines.

- Review the completed form for accuracy before submission.

- Submit the form by mail or electronically, as per the guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the DR 908 are crucial for compliance. Insurance companies must submit the form by the last day of the month following the end of each quarter. For example, the deadlines are typically April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. Companies should mark these dates on their calendars to avoid late penalties and ensure timely compliance with state regulations.

Penalties for Non-Compliance

Failure to file the DR 908 on time or incorrect reporting can result in significant penalties. The Florida Department of Revenue imposes fines for late submissions, which can accumulate over time. Additionally, inaccuracies in the reported premiums may lead to further assessments and potential audits. It is essential for insurers to adhere to all filing requirements and deadlines to avoid these financial repercussions.

Who Issues the Form

The DR 908 Florida Insurance Premium Taxes And Fees Return is issued by the Florida Department of Revenue. This department is responsible for the administration of tax laws in Florida, including the collection of insurance premium taxes. The department provides guidelines and resources to assist insurance companies in completing the form accurately and in compliance with state regulations.

Quick guide on how to complete dr 908 florida insurance premium taxes and fees return

Complete DR 908 Florida Insurance Premium Taxes And Fees Return effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage DR 908 Florida Insurance Premium Taxes And Fees Return on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign DR 908 Florida Insurance Premium Taxes And Fees Return without hassle

- Find DR 908 Florida Insurance Premium Taxes And Fees Return and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal value as a traditional handwritten signature.

- Review all information carefully and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign DR 908 Florida Insurance Premium Taxes And Fees Return while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 908 florida insurance premium taxes and fees return

Create this form in 5 minutes!

How to create an eSignature for the dr 908 florida insurance premium taxes and fees return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DR 908 Florida Insurance Premium Taxes And Fees Return?

The DR 908 Florida Insurance Premium Taxes And Fees Return is a document required by the Florida Department of Revenue for insurance companies to report their premium taxes and fees. Completing this form accurately is crucial for compliance with state tax regulations. Using airSlate SignNow simplifies this process by allowing businesses to easily fill out, eSign, and submit the return online.

-

How can airSlate SignNow help with the DR 908 Florida Insurance Premium Taxes And Fees Return?

airSlate SignNow offers a streamlined solution for managing the DR 908 Florida Insurance Premium Taxes And Fees Return. With features like document templates and electronic signatures, it reduces the time and effort needed for preparation and submission. This ensures that your return is filed correctly and on time, helping you avoid penalties.

-

What features does airSlate SignNow offer for managing insurance tax documents?

airSlate SignNow includes features such as customizable templates, team collaboration tools, and secure electronic signatures, all of which can enhance your workflow when handling the DR 908 Florida Insurance Premium Taxes And Fees Return. These features not only improve efficiency but also ensure the security and integrity of your documents during the filing process.

-

Is airSlate SignNow cost-effective for filing the DR 908 Florida Insurance Premium Taxes And Fees Return?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By reducing manual processes and paper usage, it can lead to signNow savings over time. This makes it an economical choice for efficiently managing the DR 908 Florida Insurance Premium Taxes And Fees Return.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, enhancing your workflow when preparing the DR 908 Florida Insurance Premium Taxes And Fees Return. This allows you to import data directly into your return, minimizing errors and saving you valuable time.

-

What are the benefits of eSigning the DR 908 Florida Insurance Premium Taxes And Fees Return?

eSigning the DR 908 Florida Insurance Premium Taxes And Fees Return can streamline your filing process and ensure greater accuracy. It eliminates the need for paper documents and allows for instant submission, which can save you time and reduce the risk of losing important paperwork. Additionally, eSigned documents are legally binding and secure.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents, including the DR 908 Florida Insurance Premium Taxes And Fees Return. The platform employs advanced encryption and data protection measures to ensure that your information remains confidential and secure throughout the entire signing process.

Get more for DR 908 Florida Insurance Premium Taxes And Fees Return

- Archive orgdetailsb 001000357rebif rebidose beta 1a download borrow form

- Authorization release of medical records information

- Requisition form upmc molecular genomic pathology lab

- George e wahlen department of veterans affairs medical form

- State of alabamadomestic limited liability compan form

- Residential applications form

- Evacuation planning form for family child care emergencydisaster

- Retiree health care account rhca assets at merrill form

Find out other DR 908 Florida Insurance Premium Taxes And Fees Return

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed