DELAWARE DIVISION of REVENUEFORM 1100TEXT DELAWARE

What is the DELAWARE DIVISION OF REVENUE FORM 1100

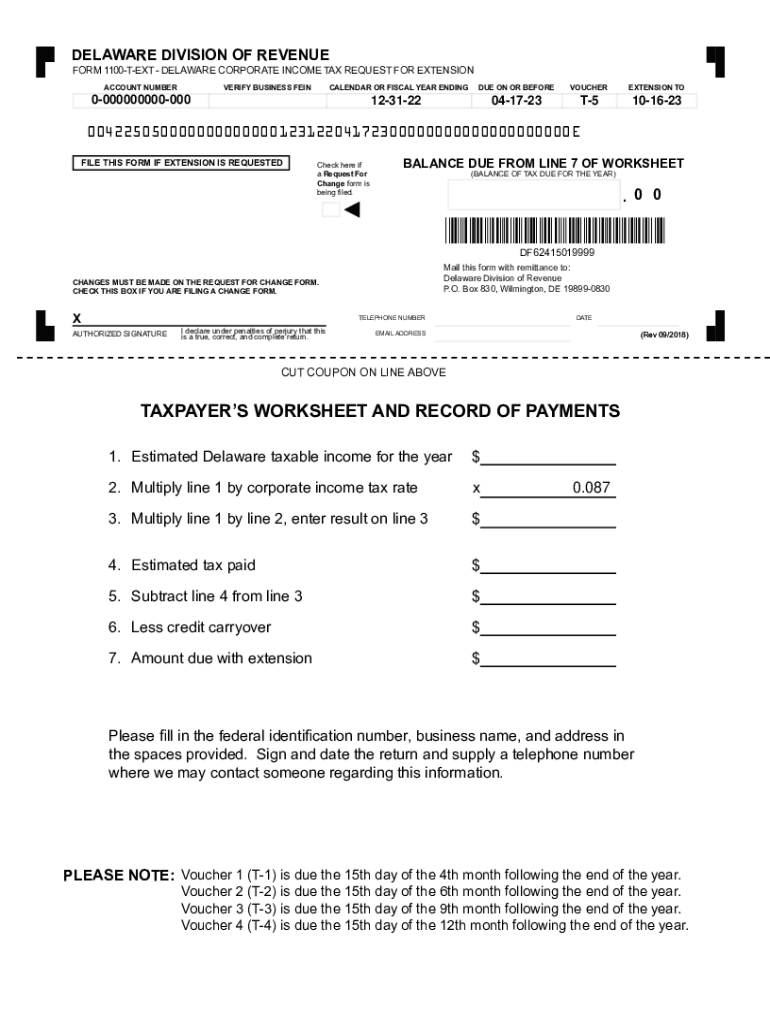

The DELAWARE DIVISION OF REVENUE FORM 1100 is a tax form used by businesses operating in Delaware to report their income and calculate their corporate income tax. This form is essential for corporations, limited liability companies, and partnerships that are subject to Delaware's corporate tax laws. By accurately completing this form, businesses ensure compliance with state tax regulations and contribute to the funding of public services within Delaware.

How to use the DELAWARE DIVISION OF REVENUE FORM 1100

Using the DELAWARE DIVISION OF REVENUE FORM 1100 involves several steps. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with accurate financial data, ensuring that all calculations are correct. It is important to review the completed form for any errors before submission. Businesses can file the form electronically or submit a paper version, depending on their preference and compliance requirements.

Steps to complete the DELAWARE DIVISION OF REVENUE FORM 1100

Completing the DELAWARE DIVISION OF REVENUE FORM 1100 requires a systematic approach:

- Gather financial records, including revenue, expenses, and deductions.

- Enter business information, including the name, address, and federal employer identification number.

- Calculate total income and allowable deductions to determine taxable income.

- Apply the appropriate tax rate to calculate the total tax owed.

- Review the form for accuracy and completeness before submission.

Required Documents for the DELAWARE DIVISION OF REVENUE FORM 1100

To successfully complete the DELAWARE DIVISION OF REVENUE FORM 1100, businesses must provide several supporting documents:

- Income statements detailing revenue earned during the tax year.

- Expense reports that outline all business-related costs.

- Previous tax returns for reference and comparison.

- Any additional documentation required for specific deductions or credits claimed.

Filing Deadlines for the DELAWARE DIVISION OF REVENUE FORM 1100

Filing deadlines for the DELAWARE DIVISION OF REVENUE FORM 1100 are crucial for compliance. Generally, the form must be submitted by the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the due date is typically April 15. It is advisable to confirm specific deadlines each year, as they may vary based on state regulations or changes in tax law.

Penalties for Non-Compliance with the DELAWARE DIVISION OF REVENUE FORM 1100

Failure to file the DELAWARE DIVISION OF REVENUE FORM 1100 on time can result in significant penalties. Businesses may incur late fees, which can accumulate over time, increasing the overall tax liability. Additionally, non-compliance can lead to interest charges on any unpaid taxes. It is important for businesses to stay informed about their filing obligations to avoid these financial repercussions.

Quick guide on how to complete delaware division of revenueform 1100text delaware

Effortlessly Prepare DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE on Any Device

Digital document management has gained signNow traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE on any device through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE with ease

- Locate DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the delaware division of revenueform 1100text delaware

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE?

The DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE is a crucial tax form that Delaware businesses need to complete for corporate income tax purposes. It provides essential information to the state for accurate tax assessment. By utilizing airSlate SignNow, you can electronically sign and send this form efficiently, ensuring compliance with state requirements.

-

How can airSlate SignNow help with the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE?

airSlate SignNow simplifies the submission process for the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE by allowing users to prepare, send, and eSign the document promptly. This streamlines the workflow, minimizes errors, and accelerates the submission to the Delaware Division of Revenue. With our solution, you'll save time and ensure accurate filing.

-

Is there a cost associated with using airSlate SignNow for the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE?

Yes, airSlate SignNow offers competitive pricing plans tailored to fit different business needs. By investing in our platform, you gain access to essential tools for managing the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE and other documents. Consider our plans as a cost-effective solution to enhance your document management process.

-

What features does airSlate SignNow provide for the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE?

airSlate SignNow offers features such as templates for the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE, automated workflows, and real-time tracking of document status. These features help ensure that all required fields are completed correctly and allow for easy collaboration with your team. Our intuitive interface makes managing these documents hassle-free.

-

Can I integrate airSlate SignNow with other software for the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE. You can connect it with CRM systems, cloud storage, and more to create a unified document management experience. This integration saves you time and maximizes efficiency.

-

What are the benefits of eSigning the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE?

eSigning the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE offers numerous benefits, including increased security, speed, and accessibility. With airSlate SignNow, you can sign documents from anywhere, reducing the need for physical paperwork. This not only enhances convenience but also ensures timely submissions to meet compliance requirements.

-

How secure is the airSlate SignNow platform for the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE?

The security of your documents is our top priority at airSlate SignNow. We employ state-of-the-art encryption protocols and adhere to rigorous compliance standards to safeguard the DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE and other sensitive documents. You can trust our platform for secure and reliable document management.

Get more for DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE

- Anew health care services notice of privacy practices form

- How to fill out aia08 forms

- Usda 1890 national scholars program application form

- Usda rural development iowa performance report usda performance report

- Aps claims 613886372 form

- Ccr voting ballot sunrisevalleythoa com form

- Wallowa whitman national forest home form

- Initial license application for a health care form

Find out other DELAWARE DIVISION OF REVENUEFORM 1100TEXT DELAWARE

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure