I 804 Form 804 Claim for Decedent's Wisconsin Income Tax Refund Fillable 2021

What is the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

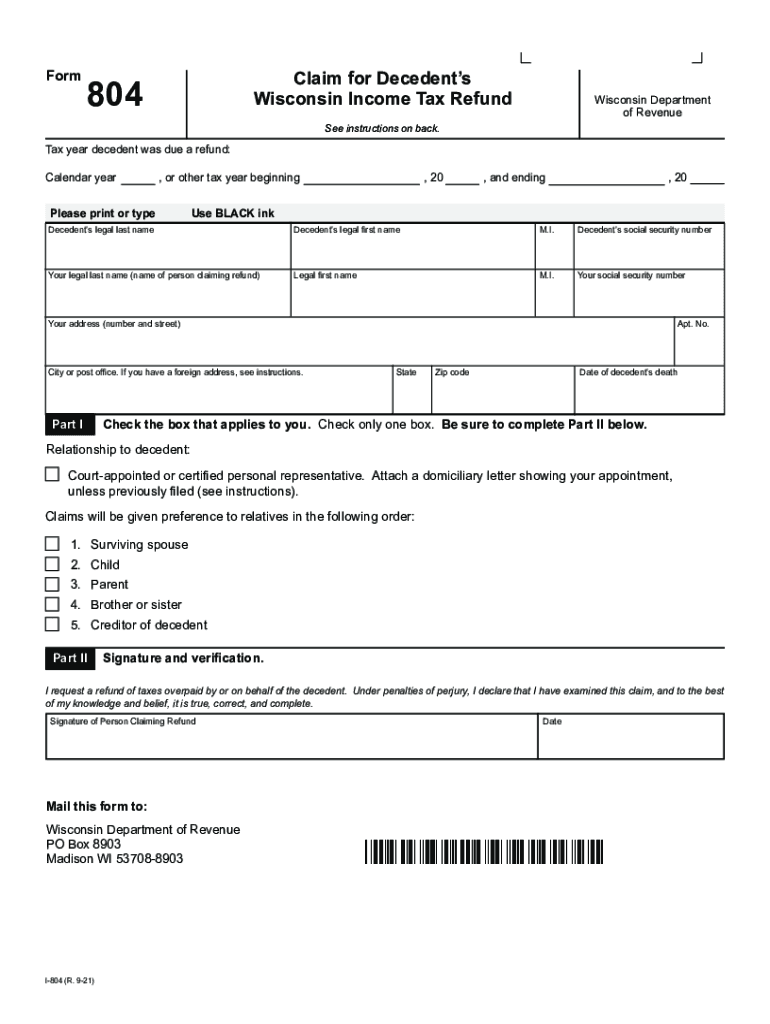

The I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund is a specific tax form utilized to request a refund of income tax that was owed to a decedent at the time of their passing. This form is essential for the estate of the deceased to reclaim any overpaid taxes from the state of Wisconsin. It serves as a formal request to the Wisconsin Department of Revenue, ensuring that the rightful beneficiaries can receive the funds due to the deceased individual.

How to use the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

Using the I 804 Form 804 is a straightforward process that involves filling out the form accurately and submitting it to the appropriate state authority. To begin, gather all necessary documentation related to the decedent's income tax history. This includes previous tax returns, any notices from the Wisconsin Department of Revenue, and proof of the decedent's passing. Once you have the required documents, complete the fillable form by entering the relevant information, ensuring that all details are correct and complete before submission.

Steps to complete the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

Completing the I 804 Form 804 involves several key steps:

- Gather necessary documents, including the decedent's tax returns and proof of death.

- Access the fillable form, either online or through a printed copy.

- Fill in the decedent's personal information, including name, Social Security number, and address.

- Provide details regarding the tax refund being claimed, including the tax year and amount.

- Include any additional information required by the Wisconsin Department of Revenue.

- Review the completed form for accuracy and completeness.

- Submit the form via mail or electronically, as per the guidelines provided by the state.

Required Documents

When submitting the I 804 Form 804, several documents are required to support the claim. These include:

- A copy of the decedent's death certificate.

- Previous tax returns for the years in question.

- Any correspondence from the Wisconsin Department of Revenue regarding the decedent's tax status.

- Proof of identity for the individual filing the claim, such as a government-issued ID.

Legal use of the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

The I 804 Form 804 is legally recognized for the purpose of claiming tax refunds owed to a decedent. It is important to ensure that the form is filled out accurately and submitted in accordance with state regulations. Misrepresentation or failure to provide required documentation can lead to delays in processing the claim or potential legal issues. Therefore, it is advisable to consult with a tax professional or legal advisor if there are any uncertainties regarding the process.

State-specific rules for the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

Wisconsin has specific rules governing the use of the I 804 Form 804. These rules include deadlines for submission, eligibility criteria for claiming refunds, and the type of documentation required. It is essential to familiarize yourself with these regulations to ensure compliance and avoid any complications. The Wisconsin Department of Revenue provides guidelines that outline these state-specific rules, which should be reviewed before submitting the form.

Quick guide on how to complete i 804 form 804 claim for decedents wisconsin income tax refund fillable

Effortlessly prepare I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Handle I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable effortlessly

- Find I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct i 804 form 804 claim for decedents wisconsin income tax refund fillable

Create this form in 5 minutes!

How to create an eSignature for the i 804 form 804 claim for decedents wisconsin income tax refund fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable?

The I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable is a document used to request a refund of state income tax for a deceased individual. This form makes it easy for executors and beneficiaries to claim funds owed to the decedent from the state. Utilizing this form streamlines the process and ensures all necessary information is submitted correctly.

-

How can I access the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable?

You can access the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable directly from our airSlate SignNow platform. We offer a user-friendly interface where you can fill out the form online, ensuring a hassle-free experience. Simply navigate to the required section, and you'll find the fillable version available for download.

-

What are the benefits of using the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable?

The I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable offers convenience and efficiency. By filling it out online, you eliminate the risk of errors commonly found in handwritten forms. Additionally, you can easily save, edit, and review the document before submission, ensuring that all details are accurate.

-

Is there a cost associated with filling out the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund?

Using airSlate SignNow to fill out the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund is cost-effective, and we offer various subscription plans. Pricing depends on the level of service you choose, with options suitable for individuals and businesses alike. Our platform aims to provide value while ensuring affordability for all users.

-

Can I integrate the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable with other applications?

Yes, the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable can be integrated with various applications available on the airSlate SignNow platform. Our solution is designed to connect seamlessly with popular tools like Google Drive, Dropbox, and more. This allows you to streamline your document management process and improve efficiency.

-

How secure is my information when using the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable?

Your information is highly secure when using the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable on airSlate SignNow. We implement industry-standard encryption and security protocols to protect your sensitive data. Additionally, our platform is compliant with regulations to ensure that your documents are handled safely and securely.

-

What features does the airSlate SignNow platform offer for the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable?

The airSlate SignNow platform provides features like e-signing, document tracking, and customizable templates for the I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable. Users can also set reminders and send documents for approval within the platform. These features enhance the overall experience and simplify the process of managing important documents.

Get more for I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

- Application for certificate of adequacy coa for reception facilities form a

- Pgampampe business rebate application rebate application form

- Construction valuation form san jose

- 5050 clark avenue lakewood ca 90712 form

- Plumbing bid and contract california megadox com form

- Collegiate livestock growers association jackpot show entry form

- Oas dhs in govdfbsaepermitsindiana department of homeland security fire and building form

- Shopatron master services agreement form

Find out other I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure