Quarter # Form 941ME 99 *2106200* Maine Revenue 2022

Understanding the Quarter # Form 941ME 99 *2106200* Maine Revenue

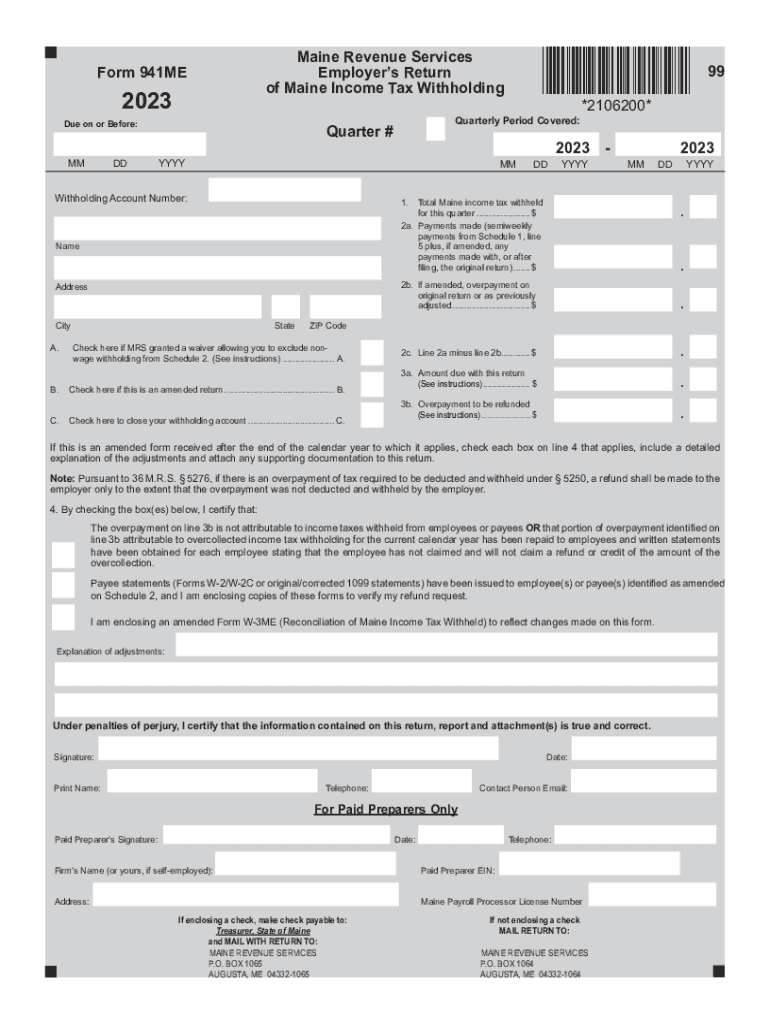

The Quarter # Form 941ME 99 *2106200* is a specific tax form used by employers in Maine to report wages paid and taxes withheld. This form is essential for compliance with state income tax regulations. It is designed to help employers accurately report their payroll information to the Maine Revenue Services, ensuring that all income tax obligations are met. Understanding this form is crucial for maintaining good standing with state tax authorities.

Steps to Complete the Quarter # Form 941ME 99 *2106200* Maine Revenue

Completing the Quarter # Form 941ME 99 *2106200* involves several key steps:

- Gather necessary information, including employer details, employee wages, and tax withheld.

- Fill out the form accurately, ensuring all sections are completed, including total wages and withholding amounts.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when submitting the Quarter # Form 941ME 99 *2106200*. Typically, the form is due on the last day of the month following the end of the quarter. For example, forms for the first quarter, ending March 31, are due by April 30. It is essential to stay informed about these deadlines to avoid late fees and penalties.

Form Submission Methods

The Quarter # Form 941ME 99 *2106200* can be submitted through various methods:

- Online submission via the Maine Revenue Services website.

- Mailing a paper copy to the appropriate state tax office.

- In-person delivery at designated tax offices, if preferred.

Penalties for Non-Compliance

Failure to file the Quarter # Form 941ME 99 *2106200* on time or inaccuracies in reporting can lead to significant penalties. These may include fines based on the amount of tax owed and interest on unpaid taxes. Employers should ensure timely and accurate submissions to avoid these financial repercussions.

Eligibility Criteria for Filing

To file the Quarter # Form 941ME 99 *2106200*, employers must meet specific eligibility criteria. This includes having employees who earn wages subject to Maine income tax withholding. Additionally, businesses must be registered with the Maine Revenue Services and have a valid employer identification number (EIN). Understanding these criteria is essential for compliance and proper tax reporting.

Quick guide on how to complete quarter form 941me 99 2106200 maine revenue

Finish Quarter # Form 941ME 99 *2106200* Maine Revenue effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as a superb environmentally friendly option to traditional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Manage Quarter # Form 941ME 99 *2106200* Maine Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Quarter # Form 941ME 99 *2106200* Maine Revenue without any hassle

- Locate Quarter # Form 941ME 99 *2106200* Maine Revenue and click Get Form to begin.

- Employ the tools we offer to finish your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to store your changes.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your preference. Modify and eSign Quarter # Form 941ME 99 *2106200* Maine Revenue to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct quarter form 941me 99 2106200 maine revenue

Create this form in 5 minutes!

How to create an eSignature for the quarter form 941me 99 2106200 maine revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing for managing Maine income tax documents?

airSlate SignNow offers competitive pricing plans that are tailored to meet the needs of businesses managing Maine income tax documents. You can choose from various subscription options that provide a cost-effective solution without sacrificing features. Our plans ensure that you get all necessary tools for efficient document handling.

-

How does airSlate SignNow help streamline Maine income tax filing?

With airSlate SignNow, you can easily send and eSign documents crucial for your Maine income tax filing. The platform simplifies the process by allowing users to sign documents electronically, reducing paperwork and speeding up submissions. This streamlining can save time and enhance overall productivity during tax season.

-

What features does airSlate SignNow provide for handling Maine income tax?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure cloud storage specifically designed to assist with Maine income tax. Users can collaborate on forms, add fields for signatures, and even automate repetitive tasks. These features make managing tax-related documents easier and more efficient.

-

Can airSlate SignNow integrate with other software used for Maine income tax?

Yes, airSlate SignNow is designed to integrate seamlessly with various accounting and tax software, making it ideal for managing Maine income tax. This integration enables users to sync data between platforms and enhances collaboration among teams. It ensures that you can work within your preferred environment while staying compliant.

-

Is airSlate SignNow suitable for both individuals and businesses filing Maine income tax?

Absolutely! airSlate SignNow caters to both individuals and businesses when it comes to managing Maine income tax documents. Whether you're a freelancer or a corporation, our platform provides tailored solutions to ensure everyone can efficiently eSign and send their tax documents with ease.

-

What are the benefits of using airSlate SignNow for Maine income tax e-signatures?

The primary benefit of using airSlate SignNow for Maine income tax e-signatures is its simplicity and efficiency. Users can sign tax forms from any device at any time, ensuring all parties can complete necessary paperwork promptly. Additionally, the platform enhances security, ensuring that your sensitive financial information is protected.

-

How can airSlate SignNow enhance the security of my Maine income tax documents?

airSlate SignNow employs advanced security protocols, including encryption and secure cloud storage to safeguard your Maine income tax documents. This ensures that all private information remains confidential and compliant with industry regulations. You can trust that your sensitive tax documents are in safe hands.

Get more for Quarter # Form 941ME 99 *2106200* Maine Revenue

- Usgs form 9 3010 sm 403 2 figure 1 open market simplified acquisition memorandum usgs

- Up to date please contact your agency or service to update your tsp address of record before you apply for the loan form

- Permit applications amp forms city of arlington

- Fixed asset form project name project location d

- Registry of motor vehicles id cards photo form

- Application for electrical permit application for an electrical permit for proposed work on residential and commercial form

- Flood permit application form

- City of daytona beach shores mechanical permit application form

Find out other Quarter # Form 941ME 99 *2106200* Maine Revenue

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free