I 041 Wisconsin Form W RA, Required Attachments for Electronic Filing Form W RA 2022

What is the I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA

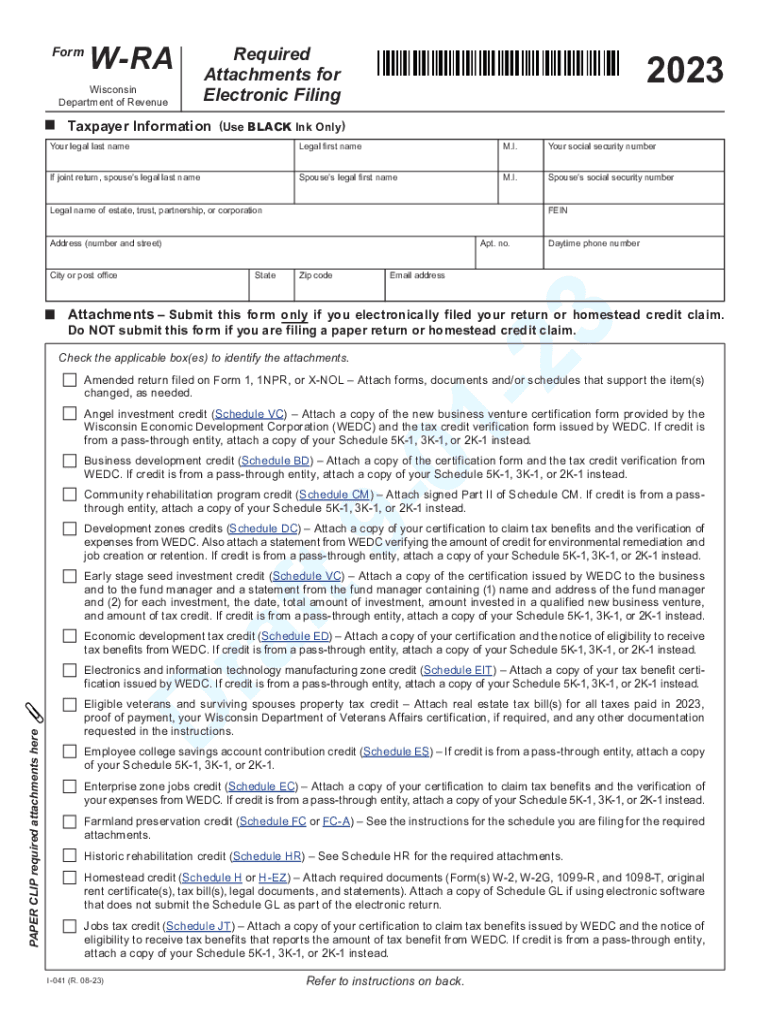

The I 041 Wisconsin Form W RA is a specific tax form used by residents of Wisconsin for reporting certain income and tax information to the state. This form is essential for individuals and businesses who need to comply with Wisconsin tax regulations. The "W RA" designation indicates that it is related to the reporting of withholding tax and may require additional documentation to support the information provided. Understanding this form is crucial for ensuring accurate tax filings and avoiding potential penalties.

How to use the I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA

Using the I 041 Wisconsin Form W RA involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including W-2 forms, 1099 forms, and any other relevant income documentation. Next, complete the form by entering your personal details, income information, and any applicable deductions. It is important to review the form for accuracy before submission. When filing electronically, ensure that you attach all required documents as specified by the Wisconsin Department of Revenue to avoid delays or issues with processing.

Steps to complete the I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA

Completing the I 041 Wisconsin Form W RA requires careful attention to detail. Follow these steps:

- Gather necessary documents, including W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income accurately on the form.

- Include any deductions or credits you are eligible for.

- Review the form for completeness and accuracy.

- Attach any required documents as specified by the form instructions.

- Submit the form electronically or via mail, based on your preference.

Required Documents

When filing the I 041 Wisconsin Form W RA, certain documents must be included to support your submission. These typically include:

- W-2 forms from employers showing wages and withholding.

- 1099 forms for any freelance or contract work.

- Proof of any deductions or credits claimed.

- Any additional documentation requested by the Wisconsin Department of Revenue.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the I 041 Wisconsin Form W RA. Generally, the form must be submitted by April 15 of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates ensures compliance and helps avoid penalties for late submissions.

Who Issues the Form

The I 041 Wisconsin Form W RA is issued by the Wisconsin Department of Revenue. This state agency oversees tax collection and compliance, providing the necessary forms and guidelines for residents to fulfill their tax obligations. For any updates or changes to the form or filing procedures, it is advisable to consult the official Wisconsin Department of Revenue website or contact them directly.

Quick guide on how to complete i 041 wisconsin form w ra required attachments for electronic filing form w ra

Effortlessly Prepare I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA on Any Device

Digital document organization has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly without delays. Manage I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA seamlessly

- Obtain I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, either by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiring document searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Alter and eSign I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct i 041 wisconsin form w ra required attachments for electronic filing form w ra

Create this form in 5 minutes!

How to create an eSignature for the i 041 wisconsin form w ra required attachments for electronic filing form w ra

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA?

The I 041 Wisconsin Form W RA is a document required for electronic filing in Wisconsin. It ensures that all necessary information regarding tax refunds is accurately submitted. Using airSlate SignNow to manage this form means you can efficiently eSign and send documents needed for filing.

-

What are the benefits of using airSlate SignNow for the I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA?

Using airSlate SignNow for the I 041 Wisconsin Form W RA simplifies the signing and submission process. It allows you to streamline workflows, reduce errors, and speed up document processing. Additionally, the platform provides enhanced security and compliance for your sensitive information.

-

Can I integrate airSlate SignNow with my existing accounting software for the I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA?

Yes, airSlate SignNow offers integrations with various accounting and tax software. This facilitates the seamless transfer of data necessary for completing the I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA. You can optimize your workflow without having to switch between multiple platforms.

-

How does airSlate SignNow ensure the security of the I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA?

airSlate SignNow employs advanced security measures such as encryption and multi-factor authentication. These protocols help protect sensitive information contained in the I 041 Wisconsin Form W RA during transmission and storage. Your documents remain secure and accessible only to authorized users.

-

What is the pricing structure for using airSlate SignNow to file the I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA?

airSlate SignNow offers various pricing plans designed to fit different business needs. You can choose a plan that provides the necessary features for managing the I 041 Wisconsin Form W RA effectively. A cost-effective solution is available to ensure you can handle your electronic filing with ease.

-

Is customer support available for issues related to the I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA?

Absolutely! airSlate SignNow provides exceptional customer support to assist you with queries regarding the I 041 Wisconsin Form W RA. Whether you need help with eSigning or understanding filing requirements, our support team is here to help you navigate your needs.

-

How can airSlate SignNow help me manage the required attachments for the I 041 Wisconsin Form W RA?

airSlate SignNow simplifies the process of managing required attachments by allowing users to upload and associate documents directly with the I 041 Wisconsin Form W RA. This ensures that all necessary materials are in one place, reducing the chances of missing important attachments during electronic filing.

Get more for I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA

- Certificates award form

- Forms ampamp online filing mine safety and health administration

- Tax organizer org0 mkshelbycpa com form

- City of talladega business license form

- Srr lwp 00001 rev 18 savannah river site liquid waste planning process pbadupws nrc form

- Attestation of ownership form myrexis inc

- Omb approval no 1870 0503 form

- Instructions to builders for completing certificates of participation form

Find out other I 041 Wisconsin Form W RA, Required Attachments For Electronic Filing Form W RA

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form