Sales and Use Tax Construction Contract Exemption Certificate Form

Understanding the Sales And Use Tax Construction Contract Exemption Certificate

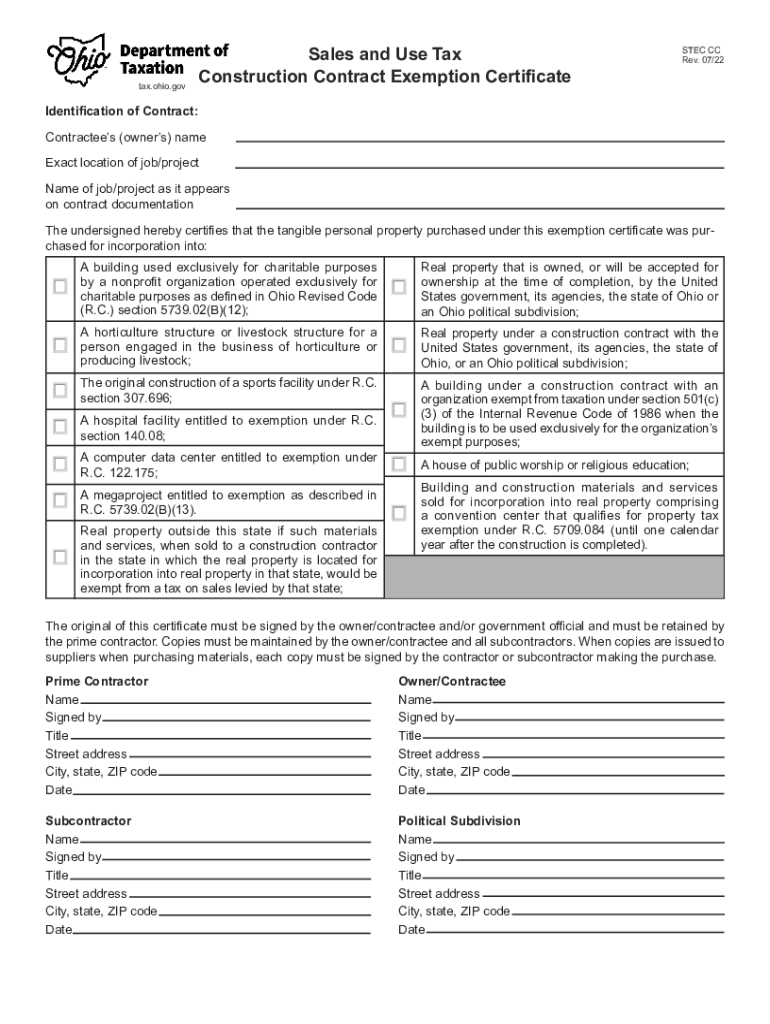

The Sales And Use Tax Construction Contract Exemption Certificate is a crucial document for businesses involved in construction projects. This certificate allows contractors to purchase materials and supplies without paying sales tax, provided that these items are intended for use in a specific construction project. By utilizing this exemption, contractors can reduce their overall project costs, making it an essential tool for financial management in the construction industry.

How to Utilize the Sales And Use Tax Construction Contract Exemption Certificate

To effectively use the Sales And Use Tax Construction Contract Exemption Certificate, contractors must present it to suppliers when purchasing materials. This certificate serves as proof that the items are intended for tax-exempt use in a construction project. It is important to ensure that the certificate is filled out accurately, including the project details and the contractor's information, to avoid any issues with suppliers or tax authorities.

Obtaining the Sales And Use Tax Construction Contract Exemption Certificate

Contractors can obtain the Sales And Use Tax Construction Contract Exemption Certificate through their state’s department of taxation or revenue. The process typically involves filling out an application form that may require information about the business, including its tax identification number and details about the construction projects. Some states may also offer the certificate online, streamlining the application process for contractors.

Steps to Complete the Sales And Use Tax Construction Contract Exemption Certificate

Completing the Sales And Use Tax Construction Contract Exemption Certificate involves several key steps:

- Gather necessary information, including the contractor's business name, address, and tax identification number.

- Provide details about the specific construction project, including its location and nature.

- Clearly state the types of materials and supplies that will be purchased under this exemption.

- Sign and date the certificate to validate its authenticity.

Legal Considerations for the Sales And Use Tax Construction Contract Exemption Certificate

Using the Sales And Use Tax Construction Contract Exemption Certificate legally requires adherence to state regulations. Contractors must ensure that the materials purchased are genuinely intended for use in exempt projects. Misuse of the certificate can lead to penalties, including back taxes owed and potential fines. It is advisable for contractors to keep thorough records of all transactions related to the exemption to support compliance during audits.

Key Elements of the Sales And Use Tax Construction Contract Exemption Certificate

Several key elements must be included in the Sales And Use Tax Construction Contract Exemption Certificate to ensure its validity:

- The contractor’s name and contact information.

- The project’s address and description.

- A detailed list of materials being purchased tax-exempt.

- The signature of the contractor or authorized representative.

Examples of Using the Sales And Use Tax Construction Contract Exemption Certificate

Practical examples of using the Sales And Use Tax Construction Contract Exemption Certificate include a contractor purchasing lumber, concrete, and fixtures for a residential building project. By presenting the exemption certificate at the point of sale, the contractor avoids paying sales tax on these materials, leading to significant cost savings. Another example is a commercial contractor acquiring materials for a renovation project, again using the certificate to maintain budget efficiency.

Quick guide on how to complete sales and use tax construction contract exemption certificate

Effortlessly Prepare Sales And Use Tax Construction Contract Exemption Certificate on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Sales And Use Tax Construction Contract Exemption Certificate across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign Sales And Use Tax Construction Contract Exemption Certificate with Ease

- Obtain Sales And Use Tax Construction Contract Exemption Certificate and then click Get Form to initiate the process.

- Make use of the tools we offer to fill out your document.

- Select relevant sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that task.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your adjustments.

- Select your preferred method for sharing your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or mistakes that require new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Sales And Use Tax Construction Contract Exemption Certificate and maintain outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax construction contract exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is stec cc and how does it work with airSlate SignNow?

Stec cc is a state-of-the-art electronic signature solution that streamlines the signing process for documents. With airSlate SignNow, users can easily integrate stec cc to enhance document management, ensuring secure and legal signatures in just a few clicks.

-

What are the pricing options for airSlate SignNow that include stec cc?

AirSlate SignNow offers various pricing tiers that include access to stec cc features. Depending on your business needs, you can choose from plans that provide different levels of functionality, ensuring a cost-effective solution for those who require electronic signatures and document collaboration.

-

What key features does airSlate SignNow offer with stec cc?

With stec cc, airSlate SignNow provides a variety of features including customizable templates, automated workflows, and real-time tracking of document status. These features not only enhance productivity but also ensure compliance and security throughout the signing process.

-

How can stec cc benefit my business when using airSlate SignNow?

Implementing stec cc with airSlate SignNow can signNowly reduce the time spent on manual document handling. By automating the signing process, you can improve efficiency, enhance customer satisfaction, and accelerate turnaround times for critical business agreements.

-

Is it easy to integrate stec cc with other tools using airSlate SignNow?

Yes, stec cc integration with airSlate SignNow is straightforward and compatible with numerous popular applications. You can easily connect to CRM systems, cloud storage, and collaboration platforms, ensuring that your business processes remain seamless and efficient.

-

What kind of customer support is available for stec cc users of airSlate SignNow?

AirSlate SignNow provides comprehensive customer support for users of stec cc, including live chat, email assistance, and an extensive knowledge base. This ensures that you receive prompt help and guidance to make the most of your electronic signature solutions.

-

How secure is stec cc in airSlate SignNow?

Security is a top priority for airSlate SignNow and stec cc is designed with multiple layers of protection. Features such as secure data encryption, user authentication, and compliance with e-signature regulations ensure that your documents are safe and confidential.

Get more for Sales And Use Tax Construction Contract Exemption Certificate

- Cash float form 576861138

- Oxford hip score calculator 584658810 form

- Residential tenancies act 1987 sect 29residential tenancies act 1987 legislation wa gov auresidential tenancies act 1987 form

- Choicelend loan application form home loan experts

- Bible college sa form

- Rates by direct debit form city of penrith

- Junior bp workbook girl guides victoria guidesvic org form

- Brownesdairy caffeinatestaging com auwp contentorder form name date address account no product code qty

Find out other Sales And Use Tax Construction Contract Exemption Certificate

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement