Ohio Tbor 2021

What is the Ohio Tbor?

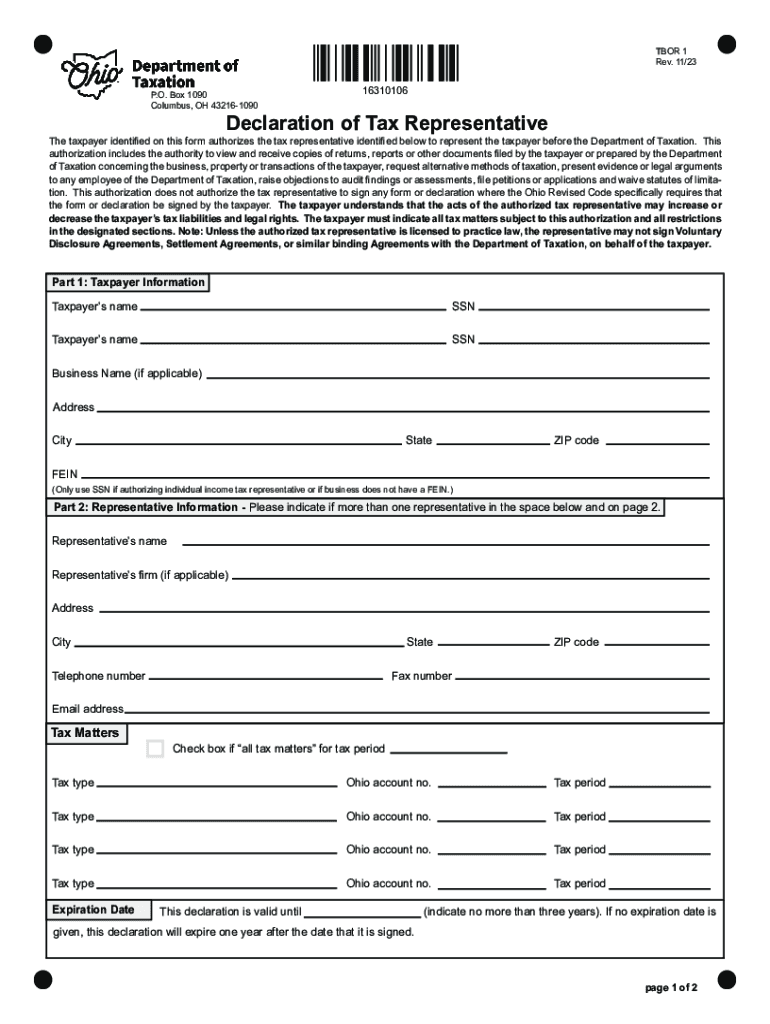

The Ohio Declaration of Representation, commonly referred to as the Tbor1, is a crucial form used to designate a representative for tax matters in Ohio. This form allows taxpayers to authorize an individual or entity to act on their behalf when dealing with the Ohio Department of Taxation. The Tbor1 is particularly relevant for those who may need assistance with tax preparation, filing, or communication with the tax department.

How to use the Ohio Tbor

Utilizing the Ohio Tbor involves several straightforward steps. First, the taxpayer must complete the form, providing necessary details such as their name, address, and Social Security number. Next, the representative's information must be included, which typically consists of their name, contact information, and any relevant identification numbers. Once filled out, the form should be submitted to the Ohio Department of Taxation to officially grant representation rights.

Steps to complete the Ohio Tbor

Completing the Ohio Tbor requires careful attention to detail. Begin by downloading the form from the Ohio Department of Taxation website. Fill in your personal information accurately, ensuring that all names and numbers match official documents. After entering the representative's details, sign and date the form. Finally, submit the Tbor1 either online, by mail, or in person at a local tax office, depending on your preference.

Legal use of the Ohio Tbor

The Ohio Tbor is legally recognized and provides a framework for taxpayers to appoint representatives for tax-related matters. This form ensures that the designated individual has the authority to discuss tax issues, receive confidential information, and represent the taxpayer in communications with the tax department. It is essential to understand that the authority granted through the Tbor1 is limited to tax matters and does not extend beyond this scope.

Required Documents

When submitting the Ohio Tbor, certain documents may be necessary to ensure the process goes smoothly. Typically, the taxpayer should include a copy of their identification, such as a driver's license or Social Security card, to verify their identity. If the representative is a business entity, documentation proving the entity's legitimacy may also be required. Always check the latest guidelines from the Ohio Department of Taxation for any additional requirements.

Filing Deadlines / Important Dates

It is crucial to be aware of deadlines associated with the Ohio Tbor to avoid any complications. Generally, the Tbor1 should be submitted before any tax filings to ensure the appointed representative can act on behalf of the taxpayer. Specific deadlines may vary based on the type of tax being filed, so it is advisable to consult the Ohio Department of Taxation for the most accurate and up-to-date information regarding filing dates.

Who Issues the Form

The Ohio Declaration of Representation, or Tbor1, is issued by the Ohio Department of Taxation. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. By providing this form, the department facilitates a streamlined process for taxpayers to appoint representatives, thereby enhancing communication and efficiency in tax matters.

Quick guide on how to complete ohio tbor

Effortlessly Prepare Ohio Tbor on Any Device

The management of online documents has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Ohio Tbor on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Ohio Tbor

- Retrieve Ohio Tbor and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal legitimacy as a standard wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to share your form—via email, SMS, invite link, or download it to your computer.

Dismiss the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you choose. Modify and electronically sign Ohio Tbor and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio tbor

Create this form in 5 minutes!

How to create an eSignature for the ohio tbor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Ohio Declaration of Representation?

An Ohio Declaration of Representation is a legal document that allows individuals to designate a representative for decision-making on their behalf. This declaration is particularly important in medical and legal situations. With airSlate SignNow, you can easily create and manage your Ohio Declaration of Representation electronically.

-

How does airSlate SignNow help with the Ohio Declaration of Representation?

airSlate SignNow provides a user-friendly platform to draft, send, and eSign your Ohio Declaration of Representation securely. Our software ensures that your document is legally binding and easily accessible whenever you need it. This streamlines the process, making it faster and more efficient.

-

Is there a cost associated with creating an Ohio Declaration of Representation on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to your needs, including a free trial. The cost of creating an Ohio Declaration of Representation may vary based on the subscription you choose. However, our service remains cost-effective compared to traditional methods.

-

What features does airSlate SignNow offer for managing documents like the Ohio Declaration of Representation?

airSlate SignNow includes features such as customizable templates, cloud storage, and real-time tracking for your Ohio Declaration of Representation. Additionally, eSigning functionalities and the ability to collaborate with others enhance the document management process. These tools simplify and expedite handling important legal documents.

-

Can I integrate airSlate SignNow with other tools for my Ohio Declaration of Representation?

Absolutely! airSlate SignNow supports integrations with various applications and software, allowing you to link your Ohio Declaration of Representation with tools you already use. This integration enhances your workflow and keeps all your documents organized and accessible in one place.

-

What are the benefits of using airSlate SignNow for my Ohio Declaration of Representation?

Using airSlate SignNow for your Ohio Declaration of Representation offers numerous benefits, including enhanced efficiency, security, and ease of access. Our platform allows for quick eSigning, reducing the time it takes to finalize important documents. Additionally, you can manage your declarations from any device, ensuring you always have what you need at your fingertips.

-

Is airSlate SignNow compliant with legal standards for Ohio Declaration of Representation?

Yes, airSlate SignNow is fully compliant with legal standards for documents, including the Ohio Declaration of Representation. We ensure that our eSignature solutions meet all necessary regulations, providing peace of mind that your documents are legally valid and secure. Our team is dedicated to maintaining high compliance standards.

Get more for Ohio Tbor

- Mailing letters mountaineer challenge academys post form

- Spes pta yearbook consent form required

- Technical service contract template form

- Technology consult contract template form

- Technology contract template form

- Technical support contract template form

- Technology service contract template form

- Teen contract template form

Find out other Ohio Tbor

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe