Tbor 1 Form 2018

What is the Tbor 1 Form

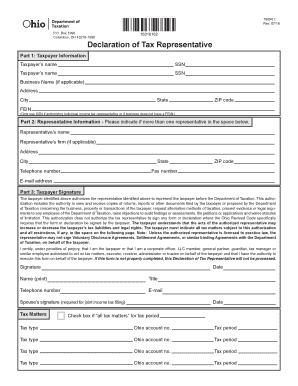

The Tbor 1 Form is a tax-related document used primarily for reporting specific financial information to state tax authorities. This form is essential for individuals and businesses to accurately declare their tax obligations. It includes sections for personal identification, income details, and applicable deductions or credits. Understanding the purpose of the Tbor 1 Form is crucial for ensuring compliance with state tax laws.

Steps to complete the Tbor 1 Form

Completing the Tbor 1 Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with your personal information, ensuring that all entries are accurate and up-to-date. Pay close attention to the income and deduction sections, as these will directly impact your tax liability. After completing the form, review it thoroughly for any errors before signing and submitting it.

How to obtain the Tbor 1 Form

The Tbor 1 Form can be obtained through various channels. Most state tax authority websites provide downloadable versions of the form in PDF format, allowing for easy access and printing. Additionally, physical copies may be available at local tax offices or public libraries. Ensure you are using the most recent version of the form to comply with current tax regulations.

Legal use of the Tbor 1 Form

The Tbor 1 Form must be used in accordance with state tax laws to maintain its legal validity. It is designed for specific reporting purposes, and any misuse or falsification of information can lead to penalties. Taxpayers should ensure that they are eligible to use this form and that they are reporting accurate information. Legal compliance is essential to avoid complications with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Tbor 1 Form vary by state but generally align with the federal tax filing schedule. It is important to be aware of these dates to avoid late fees or penalties. Many states require the form to be submitted by April 15, but some may have different deadlines. Checking with your state tax authority for specific dates is advisable to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Tbor 1 Form can typically be submitted through multiple methods, providing flexibility for taxpayers. Many states allow for online submissions through their tax authority websites, which can expedite processing times. Alternatively, the form can be mailed to the designated tax office or submitted in person at local offices. Each method has its own advantages, and taxpayers should choose the one that best fits their needs.

Key elements of the Tbor 1 Form

Key elements of the Tbor 1 Form include personal identification information, income sources, and applicable deductions. The form typically requires taxpayers to report wages, business income, and other earnings. Additionally, it may include sections for claiming credits or deductions, such as those for education or homeownership. Understanding these elements is vital for accurate completion and compliance with tax regulations.

Quick guide on how to complete tbor 1 2018 2019 form

Your assistance manual on how to prepare your Tbor 1 Form

If you want to learn how to generate and send your Tbor 1 Form, the following are a few straightforward guidelines to simplify your tax submission process.

To begin, you simply need to register your airSlate SignNow account to change how you manage paperwork online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and complete your income tax documents effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and return to adjust responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow these steps to complete your Tbor 1 Form in just a few minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Select Get form to open your Tbor 1 Form in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally valid eSignature (if necessary).

- Review your document and correct any mistakes.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically using airSlate SignNow. Please be aware that submitting on paper may increase return errors and delay reimbursements. Certainly, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct tbor 1 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

Create this form in 5 minutes!

How to create an eSignature for the tbor 1 2018 2019 form

How to create an eSignature for the Tbor 1 2018 2019 Form online

How to create an eSignature for your Tbor 1 2018 2019 Form in Google Chrome

How to generate an eSignature for signing the Tbor 1 2018 2019 Form in Gmail

How to make an eSignature for the Tbor 1 2018 2019 Form from your mobile device

How to make an electronic signature for the Tbor 1 2018 2019 Form on iOS devices

How to generate an eSignature for the Tbor 1 2018 2019 Form on Android devices

People also ask

-

What is the Tbor 1 Form and why is it important?

The Tbor 1 Form is a crucial document for businesses that ensures compliance with regulatory requirements. It simplifies the process of reporting and managing taxation matters, making it essential for accurate record-keeping. Understanding the Tbor 1 Form is vital for business owners to avoid penalties and streamline their operations.

-

How can airSlate SignNow help with the Tbor 1 Form?

airSlate SignNow provides an efficient platform to manage and electronically sign the Tbor 1 Form. By utilizing our features, you can securely send, receive, and store the Tbor 1 Form, ensuring all your documentation is compliant and easily accessible. This enhances workflow efficiency and reduces the risk of errors.

-

What are the main features of airSlate SignNow for handling the Tbor 1 Form?

With airSlate SignNow, you can enjoy features like real-time collaboration, template creation, and automated reminders specifically for the Tbor 1 Form. These functionalities help eliminate delays and ensure that all parties can complete the document efficiently. Additionally, our platform allows for secure cloud storage of all your signed forms.

-

Is airSlate SignNow cost-effective for managing the Tbor 1 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Tbor 1 Form compared to traditional paper-based methods. Our pricing plans are designed to accommodate businesses of all sizes, allowing you to save costs on printing and mailing. Investing in our solution will lead to long-term savings and increased productivity.

-

Can I integrate airSlate SignNow with other tools for processing the Tbor 1 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software like CRM systems and cloud storage platforms, enhancing your workflow for managing the Tbor 1 Form. These integrations allow you to automate processes and ensure that your Tbor 1 Form is consistently up-to-date with your business needs.

-

What security measures are in place for the Tbor 1 Form with airSlate SignNow?

airSlate SignNow prioritizes your data security, implementing robust measures to protect the Tbor 1 Form. Our platform uses encryption, two-factor authentication, and secure cloud storage to ensure that your sensitive documents are safe from unauthorized access. You can trust us to maintain the confidentiality of your business information.

-

How does airSlate SignNow streamline the eSigning of the Tbor 1 Form?

airSlate SignNow simplifies the eSigning process for the Tbor 1 Form by allowing multiple signers to complete the document in a streamlined manner. You can send the form directly to recipients via email, and they can sign it instantly without any downloads required. This saves time and enhances the user experience.

Get more for Tbor 1 Form

- Maryland lead paint disclosure form

- Printable legal form terminate parental rights

- Upitnik za poslodavce a1 form

- Central coast energy services heap application form

- Chapter 17 section 2 skillbuilder practice interpreting charts answers form

- Ct 248 form

- Law enforcement relocation verification form 384264183

Find out other Tbor 1 Form

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple