Tbor 1 Form 2013

What is the Tbor 1 Form

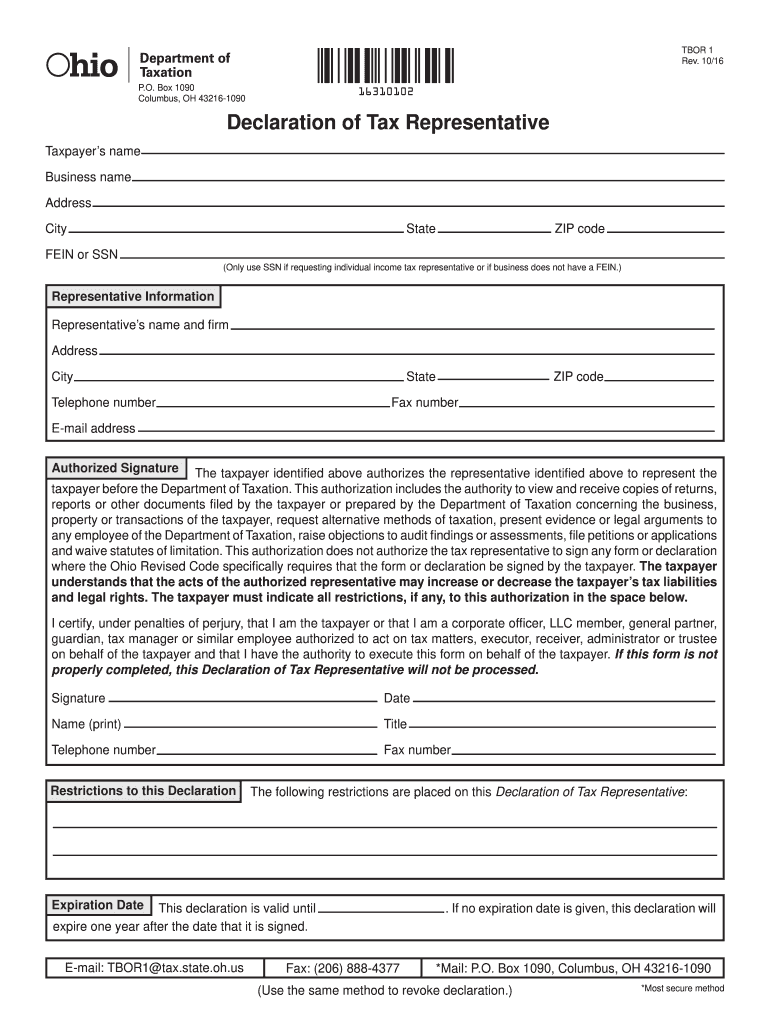

The Tbor 1 Form is a specific document used primarily for tax reporting purposes in the United States. It is designed to assist taxpayers in accurately reporting their income and financial activities to the Internal Revenue Service (IRS). This form includes various fields that require detailed information about the taxpayer's financial situation, ensuring compliance with federal tax regulations. Proper completion of the Tbor 1 Form is essential for avoiding penalties and ensuring that all tax obligations are met.

How to use the Tbor 1 Form

Using the Tbor 1 Form involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is advisable to review the form for any errors before submission. Once completed, the form can be signed electronically using a trusted eSignature platform, which streamlines the filing process and enhances security.

Steps to complete the Tbor 1 Form

Completing the Tbor 1 Form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, such as W-2s and 1099s.

- Access the Tbor 1 Form through a reliable source or platform.

- Fill in personal information, including name, address, and Social Security number.

- Report income and deductions accurately in the designated sections.

- Review the completed form for any discrepancies or missing information.

- Sign the form electronically to validate your submission.

- Submit the form either online or via mail, depending on your preference.

Legal use of the Tbor 1 Form

The Tbor 1 Form is legally recognized for tax reporting in the United States. It complies with IRS regulations, ensuring that all submitted information meets federal standards. By using this form, taxpayers can fulfill their legal obligations while benefiting from the convenience of electronic filing. It is important to ensure that the form is filled out correctly to avoid any legal issues or penalties associated with incorrect tax reporting.

Required Documents

To successfully complete the Tbor 1 Form, certain documents are necessary. These include:

- Proof of income, such as W-2 forms or 1099 statements.

- Previous tax returns for reference.

- Documentation of any deductions or credits being claimed.

- Identification information, including Social Security number.

Having these documents ready will facilitate a smoother completion process and ensure accurate reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Tbor 1 Form are crucial for taxpayers to observe. Typically, the form must be submitted by April 15 of each year. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines, especially in light of adjustments that may occur due to unforeseen events, such as natural disasters or changes in tax legislation.

Quick guide on how to complete tbor 1 2013 form

Your assistance manual on how to prepare your Tbor 1 Form

If you're interested in learning how to create and dispatch your Tbor 1 Form, here are some concise instructions on how to simplify tax submission.

Firstly, you only need to set up your airSlate SignNow account to transform your approach to handling documents online. airSlate SignNow is a straightforward and robust document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit to amend details as necessary. Optimize your tax management with advanced PDF editing, electronic signing, and intuitive sharing.

Follow the instructions below to complete your Tbor 1 Form in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax document; browse through versions and schedules.

- Select Get form to open your Tbor 1 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that paper filing can lead to return errors and delay refunds. Obviously, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct tbor 1 2013 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I e fill Income tax ITR-1 form in excel and generate xml in excel 2013?

First download the excel file.Then after all the relevant information is filled click on validate.After you click on validate XML file will be generated which is required to be uploaded.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do I relist my previous company that is unlisted from MCA for not filling out the e-return form 2013-14?

First of all you have to prepare all financials and get it audited from an Auditor (CA), and then approach National company law tribunal (NCLT) with petition for restoration of your company.It is pertinent to note that NCLT observe may things before making the company active, one of them is that whether company was making some operation during these periods or not, i.e you have to proof with supporting documents like VAT return/Service tax return/Income tax return that company was in operation.Company Registration

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the tbor 1 2013 form

How to create an electronic signature for your Tbor 1 2013 Form in the online mode

How to make an eSignature for your Tbor 1 2013 Form in Chrome

How to create an eSignature for putting it on the Tbor 1 2013 Form in Gmail

How to generate an electronic signature for the Tbor 1 2013 Form straight from your mobile device

How to generate an electronic signature for the Tbor 1 2013 Form on iOS devices

How to make an eSignature for the Tbor 1 2013 Form on Android devices

People also ask

-

What is the Tbor 1 Form and how can it be used with airSlate SignNow?

The Tbor 1 Form is a critical document for businesses, and airSlate SignNow allows you to easily eSign and manage it online. With our platform, you can streamline the completion of the Tbor 1 Form, ensuring that all necessary parties can sign quickly and securely, optimizing your workflow.

-

How much does airSlate SignNow cost for using the Tbor 1 Form?

airSlate SignNow offers competitive pricing plans tailored to your business needs, including options for accessing the Tbor 1 Form. You can choose from monthly or annual subscriptions, providing flexibility while ensuring you get the best value for sending and signing documents.

-

What features does airSlate SignNow offer for the Tbor 1 Form?

With airSlate SignNow, you can enjoy features such as customizable templates for the Tbor 1 Form, multiple signing options, and integration with various applications. These features enhance document management and ensure that the signing process is efficient and user-friendly.

-

Can I integrate airSlate SignNow with other software for the Tbor 1 Form?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, ensuring that your Tbor 1 Form workflow is smooth. Whether you're using CRM systems or cloud storage platforms, our integrations enhance your ability to manage documents and signatures efficiently.

-

What are the benefits of using airSlate SignNow for the Tbor 1 Form?

Using airSlate SignNow for the Tbor 1 Form offers numerous benefits, including time savings, enhanced security, and improved collaboration. Our platform allows for instant access to signed documents, reducing the hassle of manual processes and paperwork.

-

How secure is the Tbor 1 Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow, and we ensure that your Tbor 1 Form is protected through advanced encryption methods. Our platform complies with industry standards, safeguarding your sensitive information and providing peace of mind during the signing process.

-

Is it easy to get started with the Tbor 1 Form on airSlate SignNow?

Absolutely! Getting started with the Tbor 1 Form on airSlate SignNow is quick and straightforward. Our user-friendly interface and guided setup process make it easy for anyone to create, send, and eSign the Tbor 1 Form without prior experience.

Get more for Tbor 1 Form

- Guardians report form

- 11200 request for extension of time to earn eagle scout form

- Declaration of tax residence for entitiespart xix of the income tax act form

- The court requires that this form be printed on blue colored paper

- 2 beginning steps and overviews childrens law center form

- Have a dependent or minor children together or a spouse is pregnant form

- Reemployment plan examples form

- Certificate of residency erie community college form

Find out other Tbor 1 Form

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document