CERT 106, Claim for Refund of Use Tax Paid on Motor 2022

What is the CERT 106, Claim For Refund Of Use Tax Paid On Motor

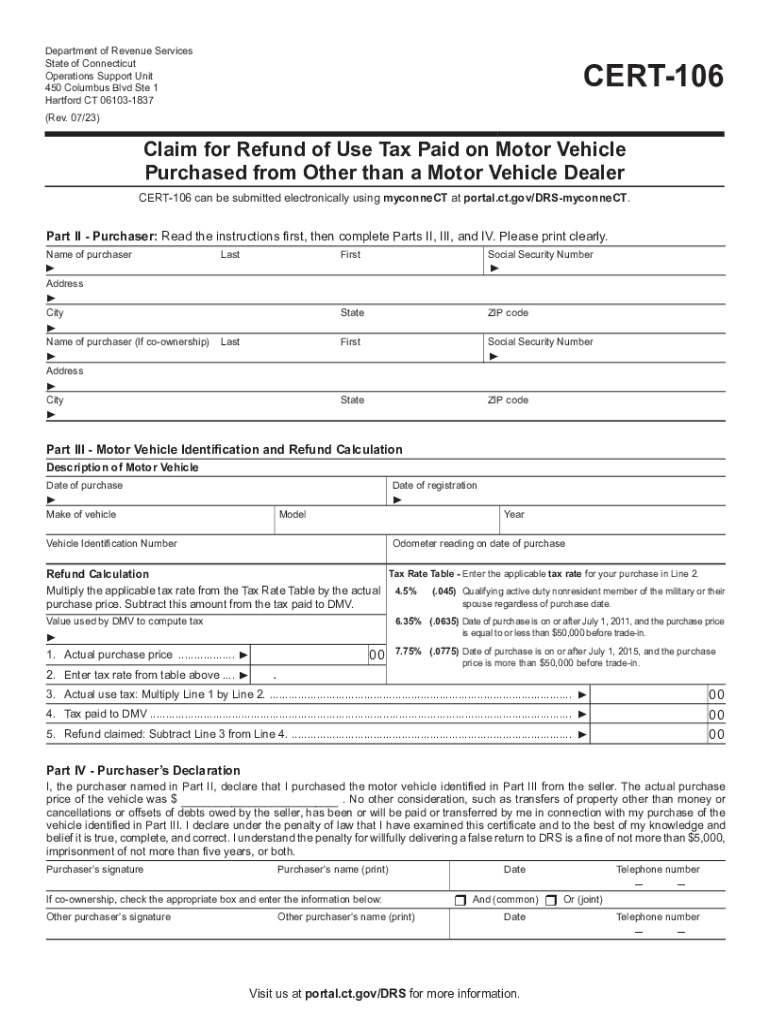

The CERT 106 form, officially known as the Claim For Refund Of Use Tax Paid On Motor Vehicles, is a document used in Connecticut to request a refund for use tax that has been paid on motor vehicles. This form is essential for taxpayers who have overpaid or erroneously paid use tax on their vehicle purchases. The use tax is generally applicable when a vehicle is purchased outside of Connecticut and brought into the state for use. By completing this form, individuals can reclaim the excess tax they have paid.

How to use the CERT 106, Claim For Refund Of Use Tax Paid On Motor

To effectively use the CERT 106, taxpayers should first ensure they meet the eligibility criteria for a refund. This includes having proof of the original tax payment and documentation that supports the claim. Once eligibility is confirmed, the form can be filled out with necessary details such as the vehicle's information, the amount of tax paid, and the reason for the refund request. After completing the form, it can be submitted to the Connecticut Department of Revenue Services for processing.

Steps to complete the CERT 106, Claim For Refund Of Use Tax Paid On Motor

Completing the CERT 106 involves several key steps:

- Gather all necessary documentation, including proof of tax payment and vehicle purchase details.

- Download the CERT 106 form from the Connecticut Department of Revenue Services website.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documents that validate your claim.

- Submit the completed form to the appropriate address provided on the form.

Required Documents

When submitting the CERT 106, certain documents are required to support your claim. These typically include:

- Proof of payment of the use tax, such as receipts or tax returns.

- Documentation of the vehicle purchase, including the bill of sale or purchase agreement.

- Any additional forms or documents that the Connecticut Department of Revenue Services may specify.

Eligibility Criteria

Eligibility for filing the CERT 106 includes several criteria that must be met:

- The claimant must have paid use tax on a motor vehicle.

- The vehicle must be registered in Connecticut.

- The claim must be submitted within the specified timeframe set by the state.

Form Submission Methods

The CERT 106 can be submitted through various methods, allowing taxpayers flexibility in how they choose to file:

- By mail: Send the completed form and supporting documents to the address specified on the form.

- In person: Deliver the form directly to a local office of the Connecticut Department of Revenue Services.

- Online: Check if there are options for electronic submission on the state’s revenue services website.

Quick guide on how to complete cert 106 claim for refund of use tax paid on motor

Complete CERT 106, Claim For Refund Of Use Tax Paid On Motor effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage CERT 106, Claim For Refund Of Use Tax Paid On Motor on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign CERT 106, Claim For Refund Of Use Tax Paid On Motor seamlessly

- Obtain CERT 106, Claim For Refund Of Use Tax Paid On Motor and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow has specially designed for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Modify and eSign CERT 106, Claim For Refund Of Use Tax Paid On Motor and promote excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cert 106 claim for refund of use tax paid on motor

Create this form in 5 minutes!

How to create an eSignature for the cert 106 claim for refund of use tax paid on motor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct drs cert 106 and how does it work?

The ct drs cert 106 is an essential document for certain business transactions in Connecticut. With airSlate SignNow, you can easily send, eSign, and manage your ct drs cert 106 online, streamlining the process for all parties involved.

-

How can airSlate SignNow help me manage the ct drs cert 106?

airSlate SignNow provides a simple platform to create, send, and sign your ct drs cert 106 documents. This ensures that your documents are securely signed and accessible anytime, making your document management more efficient.

-

Is there a free trial for airSlate SignNow to use with ct drs cert 106?

Yes, airSlate SignNow offers a free trial, allowing users to explore its features, including those related to the ct drs cert 106. You can experience the platform without any financial commitment before deciding to subscribe.

-

What are the pricing options for using airSlate SignNow with ct drs cert 106?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Users can choose a plan that best fits their needs, allowing for efficient handling of documents like the ct drs cert 106 at a cost-effective rate.

-

Can I integrate airSlate SignNow with other applications to manage the ct drs cert 106?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your document workflow. This includes tools that help you create and manage the ct drs cert 106, making the process even more streamlined.

-

What are the benefits of using airSlate SignNow for the ct drs cert 106?

Using airSlate SignNow for the ct drs cert 106 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. It simplifies the signing process, enabling faster transaction completion.

-

How secure is airSlate SignNow when handling the ct drs cert 106?

airSlate SignNow prioritizes document security, ensuring that your ct drs cert 106 and other sensitive information are protected. The platform uses advanced encryption and complies with industry standards to give you peace of mind.

Get more for CERT 106, Claim For Refund Of Use Tax Paid On Motor

- Njcog form

- Radio auction donation form wrnj radio inc

- L 102df rev form

- Chubb insurance company mining industry application pdf fillable form

- California direct deposit form

- Heap program los angeles form

- Plant quarantine inspector california form

- Pomona prod govaccess org home showpublishedcity of pomona neighborhood services department notice of form

Find out other CERT 106, Claim For Refund Of Use Tax Paid On Motor

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free