CT Form CT W3Connecticut Annual Reconciliation of 2022

What is the CT Form CT W3?

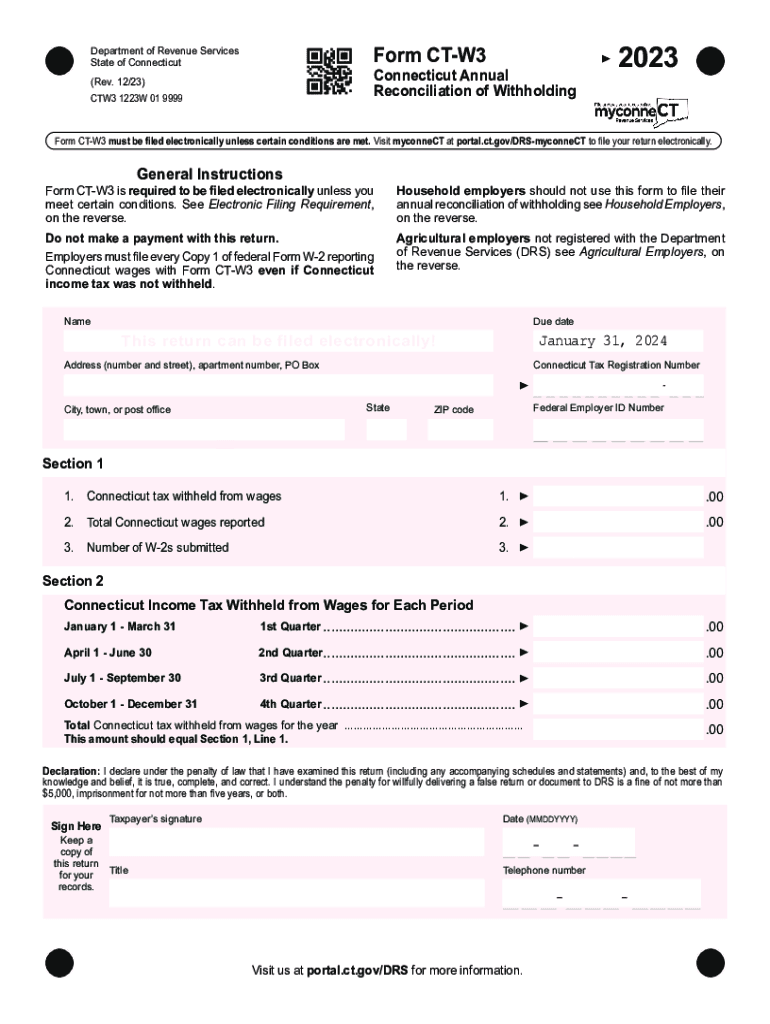

The CT Form CT W3 is the Connecticut Annual Reconciliation of Withholding form. This form is required for employers to report the total amount of Connecticut income tax withheld from employees during the calendar year. It serves as a summary of all W-2 forms issued by the employer, ensuring that the state has accurate records of withholding taxes collected. The form is essential for maintaining compliance with state tax regulations and helps facilitate the reconciliation process with the Connecticut Department of Revenue Services.

How to use the CT Form CT W3

To effectively use the CT Form CT W3, employers must first gather all relevant payroll information for the year, including the total wages paid and the total Connecticut income tax withheld. The form requires specific details such as the employer's identification number, business name, and address. After completing the form, it must be submitted along with the corresponding W-2 forms for each employee. This submission can be done electronically or via mail, depending on the employer's preference and compliance requirements.

Steps to complete the CT Form CT W3

Completing the CT Form CT W3 involves several key steps:

- Gather all W-2 forms issued to employees for the year.

- Calculate the total Connecticut income tax withheld from all employees.

- Fill out the CT W3 form with the required employer information and totals.

- Review the form for accuracy to avoid any discrepancies.

- Submit the form along with the W-2s to the Connecticut Department of Revenue Services.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines when filing the CT Form CT W3. The form is typically due by January 31 of the year following the tax year being reported. This deadline is crucial to ensure compliance and avoid potential penalties. Employers should also keep track of any changes in deadlines that may arise due to state regulations or updates from the Connecticut Department of Revenue Services.

Penalties for Non-Compliance

Failure to file the CT Form CT W3 on time or inaccuracies in the reported information can result in penalties. The Connecticut Department of Revenue Services may impose fines for late submissions or for failing to provide accurate withholding information. It is important for employers to understand these potential penalties and take necessary steps to ensure timely and accurate filing.

Who Issues the Form

The CT Form CT W3 is issued by the Connecticut Department of Revenue Services. This state agency is responsible for collecting taxes and ensuring compliance with tax laws. Employers can obtain the form directly from the department's website or through authorized tax preparation software that includes state tax forms.

Quick guide on how to complete ct form ct w3connecticut annual reconciliation of

Effortlessly Prepare CT Form CT W3Connecticut Annual Reconciliation Of on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents rapidly without delays. Manage CT Form CT W3Connecticut Annual Reconciliation Of on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to Modify and Electronically Sign CT Form CT W3Connecticut Annual Reconciliation Of with Ease

- Find CT Form CT W3Connecticut Annual Reconciliation Of and click on Get Form to commence.

- Use the tools we provide to complete your document.

- Emphasize relevant parts of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign CT Form CT W3Connecticut Annual Reconciliation Of to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct form ct w3connecticut annual reconciliation of

Create this form in 5 minutes!

How to create an eSignature for the ct form ct w3connecticut annual reconciliation of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ct w3, and why do I need it?

The form ct w3 is a state-specific tax form required for reporting wages paid in Connecticut. It is essential for businesses to submit this form to ensure compliance with state tax regulations. Using airSlate SignNow simplifies the completion and submission process of the form ct w3, making it easier to manage your tax obligations.

-

How can airSlate SignNow help me with completing the form ct w3?

airSlate SignNow provides an intuitive platform that allows users to fill out and eSign the form ct w3 seamlessly. With its easy-to-use features, businesses can ensure that all information is accurately captured, reducing the risk of errors. This efficiency saves time and simplifies tax filing.

-

Is there a cost associated with using airSlate SignNow for form ct w3?

Yes, airSlate SignNow offers flexible pricing plans to cater to different business needs. Users can choose from various subscription options, ensuring that you can find a plan that suits your budget while benefiting from hassle-free processing of the form ct w3.

-

Can I integrate airSlate SignNow with other software for processing the form ct w3?

Absolutely! airSlate SignNow integrates with various applications, allowing seamless data transfer to and from your existing systems. This integration capability enhances efficiency when managing payroll and tax forms like the form ct w3, ensuring that all relevant information is readily accessible.

-

What features does airSlate SignNow offer for managing the form ct w3?

airSlate SignNow boasts features such as eSignature, document templates, and automated workflow management for the form ct w3. These features enable businesses to streamline their document handling processes, reducing turnaround times and improving accuracy. From beginning to end, airSlate SignNow makes it easy to manage your documentation efficiently.

-

How secure is the information submitted through airSlate SignNow regarding the form ct w3?

Security is a top priority for airSlate SignNow. All documents, including the form ct w3, are encrypted and stored safely to protect sensitive information. This security infrastructure ensures that your data remains confidential and compliant with industry standards.

-

Can multiple users collaborate on the form ct w3 using airSlate SignNow?

Yes, airSlate SignNow facilitates collaboration among multiple users on the form ct w3. You can invite team members to review or fill out information, ensuring that the document is accurate and complete before submission. This feature supports better communication and teamwork.

Get more for CT Form CT W3Connecticut Annual Reconciliation Of

- Tournament liability form

- Small project stormwater pollution prevention plan swppp form

- State environmental review process serp checklist fortress wa form

- Sol driving school form

- Teacher nominationrating form

- Temporary food service facility permit application form

- Property owner authorization for tenant pay plan form wssc

- Mcps form 33545 january 2021request for change of

Find out other CT Form CT W3Connecticut Annual Reconciliation Of

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form