Form MTA 305 Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return Revised 723 2023-2026

What is the Form MTA 305?

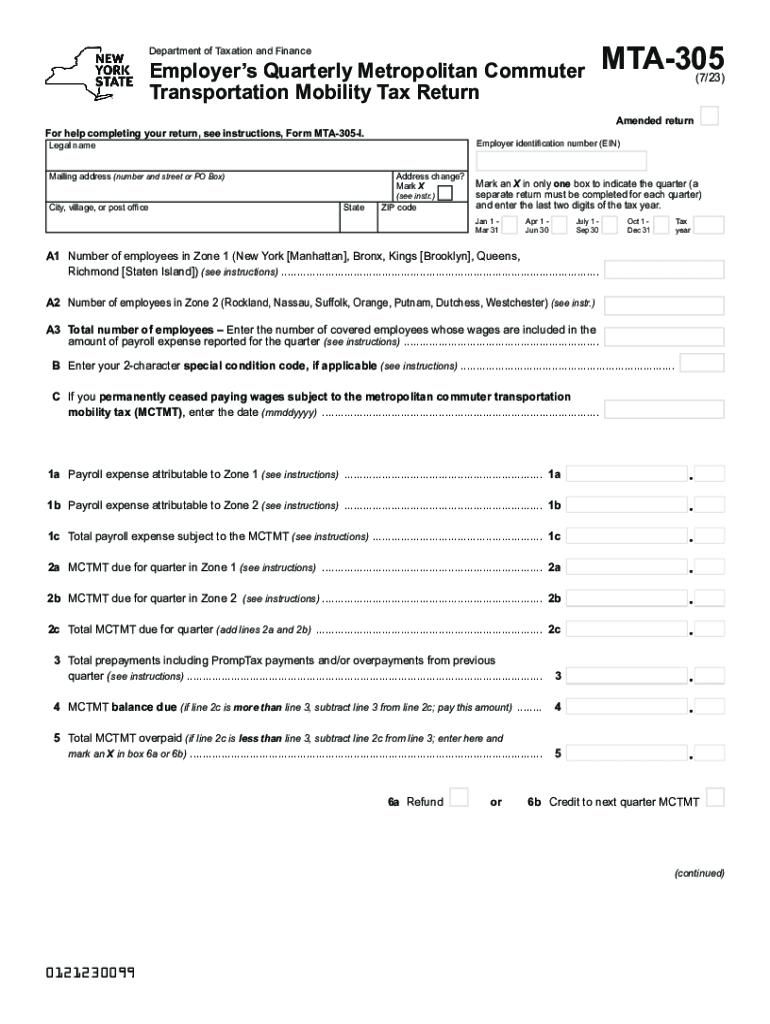

The MTA 305 is the Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return. This form is essential for employers operating within the Metropolitan Transportation Authority (MTA) region, which includes New York City and surrounding areas. It is used to report and pay the Metropolitan Commuter Transportation Mobility Tax (MCTMT), which funds public transportation services in the region. The MTA 305 form is revised periodically, with the latest version being the Revised 723, ensuring compliance with current tax regulations.

Steps to Complete the Form MTA 305

Completing the MTA 305 form involves several key steps:

- Gather Necessary Information: Collect details about your business, including the employer identification number (EIN), total payroll, and the number of employees.

- Determine Tax Liability: Calculate the MCTMT based on your payroll figures and the applicable tax rate.

- Fill Out the Form: Carefully enter the required information in each section of the form, ensuring accuracy to avoid penalties.

- Review and Sign: Double-check all entries for correctness and sign the form to validate your submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the filing deadline.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the MTA 305 form to avoid late fees and penalties. The form is due quarterly, with specific deadlines for each quarter:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

How to Obtain the Form MTA 305

The MTA 305 form can be obtained through several means:

- Official Website: Download the latest version of the MTA 305 form directly from the MTA's official website.

- Tax Professionals: Consult with tax advisors or accountants who can provide you with the form and assist with its completion.

- Local Offices: Visit local government offices or MTA service centers where physical copies of the form may be available.

Key Elements of the Form MTA 305

The MTA 305 form includes several critical sections that employers must complete:

- Employer Information: This section requires the employer's name, address, and EIN.

- Payroll Information: Employers must report total payroll and the number of employees for the reporting period.

- Tax Calculation: This section involves calculating the MCTMT based on the reported payroll figures.

- Signature and Certification: The form must be signed by an authorized representative of the business, certifying the accuracy of the information provided.

Legal Use of the Form MTA 305

The MTA 305 form serves a legal purpose as it is required by law for employers in the MTA region to report and pay the MCTMT. Failure to file this form can result in penalties and interest on unpaid taxes. It is crucial for employers to understand their obligations under New York State tax law and ensure timely compliance to avoid legal repercussions.

Quick guide on how to complete form mta 305 employers quarterly metropolitan commuter transportation mobility tax return revised 723

Complete Form MTA 305 Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return Revised 723 with ease on any device

Online document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Form MTA 305 Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return Revised 723 on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric procedure today.

The simplest method to alter and electronically sign Form MTA 305 Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return Revised 723 effortlessly

- Find Form MTA 305 Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return Revised 723 and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form MTA 305 Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return Revised 723 to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mta 305 employers quarterly metropolitan commuter transportation mobility tax return revised 723

Create this form in 5 minutes!

How to create an eSignature for the form mta 305 employers quarterly metropolitan commuter transportation mobility tax return revised 723

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 305 tax form and who needs to file it?

The 305 tax form is essential for specific businesses and individuals who need to report income and expenses related to certain activities. It is crucial for complying with federal tax regulations and ensuring accurate reporting. If your business falls under the relevant categories, filing the 305 tax form is mandatory.

-

How does airSlate SignNow simplify the process of signing the 305 tax form?

airSlate SignNow streamlines the signing process for the 305 tax form by allowing users to send and eSign documents electronically. This not only speeds up the process but also minimizes the risk of errors commonly associated with paper forms. With airSlate SignNow, you can manage your documents all in one place effortlessly.

-

What are the pricing options for using airSlate SignNow to manage the 305 tax form?

airSlate SignNow offers various pricing plans suitable for different business needs, making it a cost-effective solution for handling the 305 tax form. You can choose from basic to advanced plans based on your requirements, ensuring you only pay for what you need while benefiting from its signature features.

-

Can I integrate airSlate SignNow with other tools to assist in filing the 305 tax form?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for managing the 305 tax form. Whether you use CRM software, accounting tools, or cloud storage solutions, airSlate SignNow can connect with these systems to improve efficiency. This integration ensures that you can manage all necessary tasks from a single platform.

-

What features does airSlate SignNow offer for users preparing the 305 tax form?

Users can access several powerful features in airSlate SignNow, such as document templates, automatic reminders, and in-app chat support when preparing the 305 tax form. These tools make it easier to ensure that your forms are filled out correctly and submitted on time. Additionally, you can track your documents' status in real-time.

-

Is airSlate SignNow compliant with legal standards for signing the 305 tax form?

Absolutely, airSlate SignNow complies with legal standards, making it a safe choice for electronically signing the 305 tax form. The platform uses industry-standard encryption and authentication measures to safeguard your documents. This ensures that your signed forms are legally binding and secure.

-

What are the benefits of using airSlate SignNow for the 305 tax form over traditional methods?

Using airSlate SignNow for the 305 tax form offers numerous benefits over traditional methods, including time savings, enhanced security, and reduced paper consumption. The electronic signing process is faster and more reliable than mailing physical documents. Moreover, you can access your signed forms anytime and anywhere, greatly enhancing your productivity.

Get more for Form MTA 305 Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return Revised 723

- Highline christian church youth group permission and release highlinechristian form

- Order of the eastern star petition for membership form

- Rodeo sponsorship form

- Oswego hospital lifeline application oswego health oswegohealth form

- Directory of mental hygiene related service partners form

- Patient pain drawing form

- Sports event contract template form

- Sports photography contract template form

Find out other Form MTA 305 Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return Revised 723

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation