Instructions for Form it 2105 Estimated Income Tax Payment Voucher for Individuals New York State, New York City, Yonkers MCTMT

Understanding the Instructions for Form IT-2105

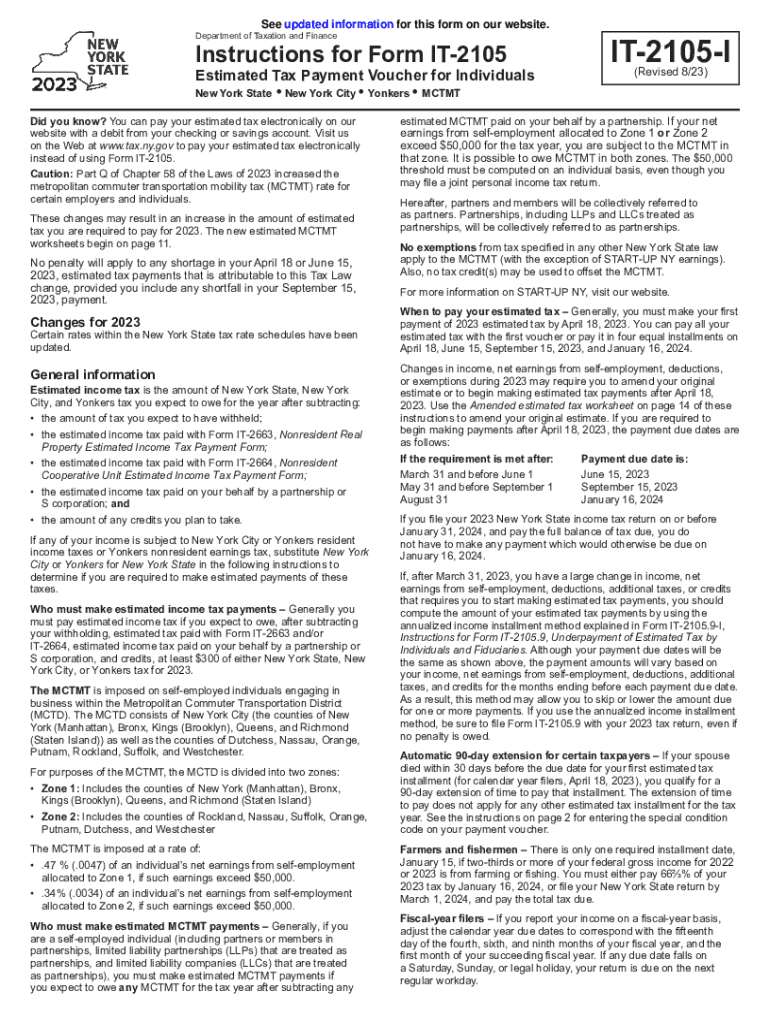

The Instructions for Form IT-2105 provide guidance for individuals making estimated income tax payments in New York State, New York City, and Yonkers. This form is essential for taxpayers who expect to owe tax of one thousand dollars or more when filing their annual tax return. The instructions outline the eligibility criteria, payment methods, and specific calculations required to determine the estimated tax liability.

How to Use the Instructions for Form IT-2105

To effectively use the Instructions for Form IT-2105, individuals should first review their expected income for the year. Based on this income, taxpayers can estimate their tax liability using the provided worksheets. The instructions detail how to fill out the payment voucher accurately, ensuring that all necessary information is included. This includes personal identification details, payment amounts, and the applicable tax year.

Steps to Complete the Instructions for Form IT-2105

Completing the Instructions for Form IT-2105 involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated income for the current tax year.

- Use the worksheets included in the instructions to determine your estimated tax liability.

- Fill out the IT-2105 voucher with your personal information and calculated payment amount.

- Submit the completed voucher along with your payment by the specified deadline.

Key Elements of the Instructions for Form IT-2105

Important elements of the Instructions for Form IT-2105 include:

- Eligibility criteria for making estimated payments.

- Detailed worksheets for calculating estimated tax liability.

- Information on payment methods, including online and mail options.

- Important deadlines for submitting payments to avoid penalties.

Filing Deadlines and Important Dates

Filing deadlines for the IT-2105 are crucial to avoid penalties. Estimated payments are typically due on specific dates throughout the year, including April 15, June 15, September 15, and January 15 of the following year. Taxpayers should mark these dates on their calendars to ensure timely submissions.

Form Submission Methods

Taxpayers can submit the IT-2105 voucher through various methods. The form can be mailed to the designated address provided in the instructions, or payments can be made online through the New York State Department of Taxation and Finance website. In-person payments may also be possible at local tax offices, depending on the jurisdiction.

Quick guide on how to complete instructions for form it 2105 estimated income tax payment voucher for individuals new york state new york city yonkers mctmt

Complete Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and electronically sign Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT effortlessly

- Obtain Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and electronically sign Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT and ensure superb communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 2105 estimated income tax payment voucher for individuals new york state new york city yonkers mctmt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax Revised 823?

The Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax Revised 823 provides guidelines for individuals to calculate and submit their estimated income tax payments. It ensures compliance with state tax regulations and helps avoid penalties.

-

How can airSlate SignNow assist with the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher?

airSlate SignNow streamlines the process of completing the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax Revised 823 by allowing users to fill out and eSign the form electronically. This eliminates the need for paper forms and simplifies submission.

-

Is using airSlate SignNow for the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher cost-effective?

Yes, airSlate SignNow is a cost-effective solution designed to empower businesses and individuals to handle their tax documents efficiently. Utilizing airSlate SignNow for the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax Revised 823 can save time and reduce costs associated with traditional paper-based processes.

-

What features does airSlate SignNow offer to help with tax documents?

airSlate SignNow features an intuitive interface, secure eSigning capabilities, and templates specifically designed for tax forms like the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax Revised 823. This ensures that users can easily navigate tax season with confidence.

-

Are there integration options available with airSlate SignNow for tax preparation software?

Absolutely! airSlate SignNow offers integration options with various tax preparation software, enhancing the efficiency of managing the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax Revised 823. This allows users to seamlessly incorporate their tax documentation workflows.

-

How secure is airSlate SignNow for handling tax forms?

Security is a top priority at airSlate SignNow. Our platform implements industry-standard encryption and compliance measures, ensuring the safe handling of sensitive information related to the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax Revised 823, thus protecting users' data.

-

Can I access the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher through mobile devices with airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing users to access the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax Revised 823 from any device. This flexibility ensures you can manage your tax documents anytime, anywhere.

Get more for Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT

- Stop payment notice form

- Quitclaim deed from corporation to husband and wife california form

- Grant deed from corporation to husband and wife california form

- California mechanics liens form

- Cancel contract 497298182 form

- California notice owner form

- Stop payment notice 497298184 form

- California lien construction form

Find out other Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT