Form LL 1 Wage Claim Texas Workforce Commission 2014

What is the Form LL 1 Wage Claim Texas Workforce Commission

The Form LL 1 Wage Claim is a document utilized by employees in Texas to formally request unpaid wages from their employers. This form is filed with the Texas Workforce Commission (TWC) and serves as a legal mechanism for workers to assert their rights regarding unpaid labor. It is essential for employees who believe they have not received compensation for work performed, including overtime, bonuses, or other wages owed. The TWC processes these claims to ensure compliance with Texas labor laws and to facilitate the resolution of wage disputes.

How to use the Form LL 1 Wage Claim Texas Workforce Commission

Using the Form LL 1 Wage Claim involves several steps to ensure that your claim is properly filed and processed. First, download the form from the Texas Workforce Commission's website or obtain a physical copy. Next, fill out the form with accurate details, including your personal information, employer's information, and specifics about the wages owed. After completing the form, you can submit it either online, by mail, or in person at a TWC office. It is important to keep a copy of your submitted form for your records.

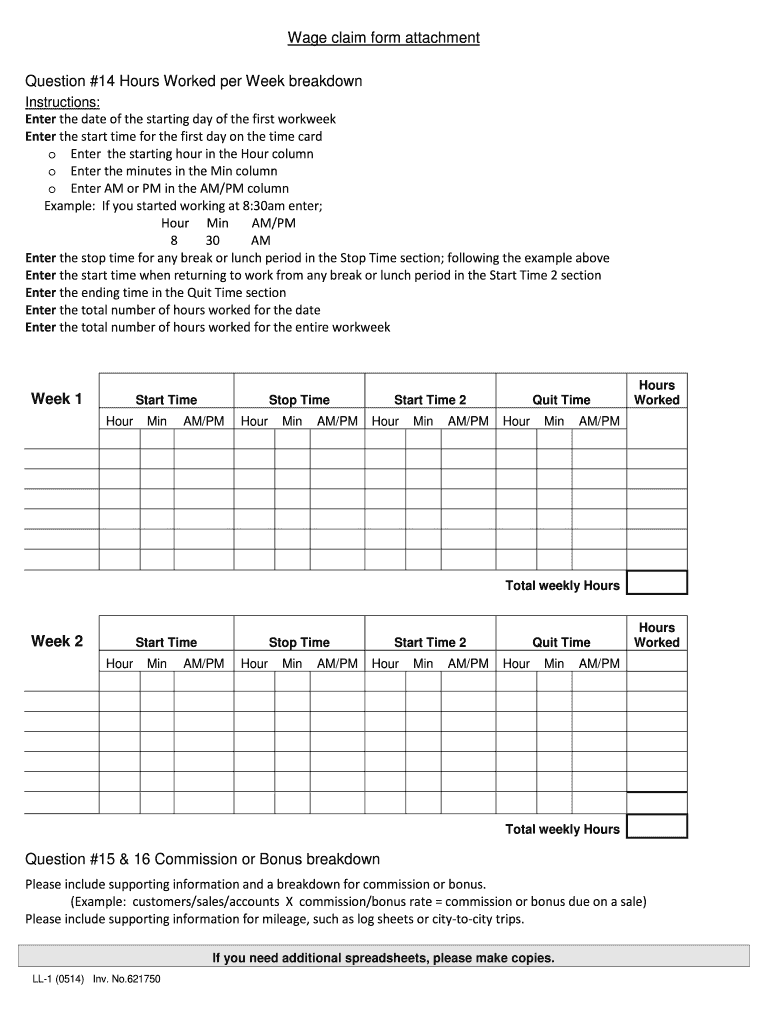

Steps to complete the Form LL 1 Wage Claim Texas Workforce Commission

Completing the Form LL 1 Wage Claim requires careful attention to detail. Start by providing your name, address, and contact information. Next, include your employer's name and address. Clearly state the nature of your claim, specifying the amount of unpaid wages and the time period during which the work was performed. Ensure all sections of the form are filled out completely and accurately. Once you have reviewed the form for any errors, sign and date it before submission. This thorough approach helps prevent delays in processing your claim.

Legal use of the Form LL 1 Wage Claim Texas Workforce Commission

The legal use of the Form LL 1 Wage Claim is grounded in Texas labor laws, which protect employees' rights to receive compensation for their work. By filing this form, employees initiate a formal process that allows the TWC to investigate their claims. It is crucial to understand that submitting this form does not guarantee payment, but it does provide a legal framework for addressing wage disputes. Employees are encouraged to keep records of their hours worked and any correspondence with their employer regarding unpaid wages, as this documentation can support their claims.

Eligibility Criteria

To be eligible to file the Form LL 1 Wage Claim, employees must have worked for an employer in Texas and have a legitimate claim for unpaid wages. This includes situations where an employee has not received payment for hours worked, overtime, commissions, or bonuses. Additionally, the claim must be filed within a specific timeframe, generally within 180 days from the date the wages were due. Employees must also ensure they are not covered by any other agreements or contracts that may impact their eligibility to file this claim.

Form Submission Methods (Online / Mail / In-Person)

The Form LL 1 Wage Claim can be submitted through various methods, providing flexibility for employees. For online submission, individuals can use the Texas Workforce Commission's website to fill out and submit the form electronically. Alternatively, employees may choose to print the completed form and mail it to the appropriate TWC office. For those who prefer face-to-face interaction, submitting the form in person at a local TWC office is also an option. Regardless of the method chosen, it is advisable to keep a copy of the submitted form for future reference.

Quick guide on how to complete form ll 1 wage claim texas workforce commission

Simplify Your HR Processes with Form LL 1 Wage Claim Texas Workforce Commission Template

Every HR expert recognizes the importance of keeping employee information organized and orderly. With airSlate SignNow, you gain access to an extensive collection of state-specific labor documents that greatly enhance the organization, management, and storage of all employment-related paperwork in one location. airSlate SignNow enables you to oversee Form LL 1 Wage Claim Texas Workforce Commission management from start to finish, with comprehensive editing and eSignature capabilities available whenever you need them. Increase your precision, document security, and eliminate minor manual errors in just a few clicks.

Steps to Modify and eSign Form LL 1 Wage Claim Texas Workforce Commission:

- Choose the appropriate state and look for the form you require.

- Access the form page and then click Get Form to begin working on it.

- Allow Form LL 1 Wage Claim Texas Workforce Commission to upload in our editor and follow the prompts highlighting required fields.

- Input your details or insert additional fillable fields into the document.

- Utilize our tools and features to adjust your form as needed: annotate, obscure sensitive information, and create an eSignature.

- Review your form for mistakes before proceeding with its submission.

- Click Done to save modifications and download your document.

- Alternatively, send your document directly to your recipients to collect signatures and information.

- Safely store completed forms within your airSlate SignNow account and access them whenever you wish.

Employing a versatile eSignature solution is essential when handling Form LL 1 Wage Claim Texas Workforce Commission. Make even the most intricate workflows as seamless as possible with airSlate SignNow. Start your free trial today to discover what you can achieve with your team.

Create this form in 5 minutes or less

Find and fill out the correct form ll 1 wage claim texas workforce commission

FAQs

-

I’ve been staying out of India for 2 years. I have an NRI/NRO account in India and my form showed TDS deduction of Rs. 1 lakh. Which form should I fill out to claim that?

The nature of your income on which TDS has been deducted will decide the type of ITR to be furnished by you for claiming refund of excess TDS. ITR for FY 2017–18 only can be filed now with a penalty of Rs. 5000/- till 31.12.2018 and Rs. 10,000/- from 01.01.2019 to 31.03.2019. So if your TDS relates to any previous year, then just forget the refund.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

-

I can't figure out if I should claim 1 dependent or 2 dependents on my W-4 tax form. When and how do you make changes to your W-4 tax form after having children?

OK, first off I’m going to say *IGNORE* the instructions on the updated W-4 form. It’s not worth anything. And yes, I’ve seen and followed the directions, which are wildly inaccurate and misleading.Here’s how exemptions and the W-4 work.As of last year, per the Tax Cuts and Job Act, you can NO LONGER, claim yourself as a dependent/exemption. You can, if you are married, no longer claim your spouse as a dependent/exemption.IF you have minor children (Age 19 and under) you *MAY* claim one exemption per child. IF you have a child, enrolled ‘full time in school’ who is age 24 or under, and that schooling is College, Trade School, Vo-Tech, etc and NOT primary education (IE High School education, GED classes, etc) you may claim an exemption for them.So simple example. Jack and Jane Darling are married. They have one child born June 1st.From January to June, Jack and Jane can *ONLY* claim ZERO EXEMPTIONS on their W-4. From June 1st, when the child is born, on wards, they can each claim ONE Exemption on their W-4.Hopefully that helps and simplifies it down. And yes, I’m a tax preparer as well. I spent all of last year warning various clients and I’m doing the same this year, along with explaining how many you can *legally* claim on your W-4.

-

I’ve been out of work for a month. I need to file a disability claim signed by 1 doctor. I have seen 4 doctors and spent 2 days in the hospital. How do I consolidate all records, so 1 of my doctors can review and sign my disability claim form?

You should have a primary care doctor who is your main point of contact for all of your health care. You can request that the other doctors that you have seen send their records to your primary care doctor. His office should help you with your disability claim.You are entitled to get copies of your own medical records from your doctors and the hospital. All you have to do is call and ask. They will have you sign a release and will then give you their records. There might be a charge for this. Once you have all of your own medical records, you can take them wherever you wish.I keep copies of all of my own medical records. If I go to a new doctor, I pull out the pertinent reports and take them with me. I am the only one who has copies of all of my medical reports.

Create this form in 5 minutes!

How to create an eSignature for the form ll 1 wage claim texas workforce commission

How to create an electronic signature for the Form Ll 1 Wage Claim Texas Workforce Commission online

How to generate an eSignature for your Form Ll 1 Wage Claim Texas Workforce Commission in Google Chrome

How to create an eSignature for putting it on the Form Ll 1 Wage Claim Texas Workforce Commission in Gmail

How to create an eSignature for the Form Ll 1 Wage Claim Texas Workforce Commission straight from your smart phone

How to make an electronic signature for the Form Ll 1 Wage Claim Texas Workforce Commission on iOS

How to create an eSignature for the Form Ll 1 Wage Claim Texas Workforce Commission on Android

People also ask

-

What is the 'Form LL 1 Wage Claim Texas Workforce Commission'?

The 'Form LL 1 Wage Claim Texas Workforce Commission' is a formal document used by employees to claim unpaid wages from their employers in Texas. This form initiates the wage claim process with the Texas Workforce Commission, ensuring that workers can seek the compensation they are owed effectively.

-

How can airSlate SignNow assist with the 'Form LL 1 Wage Claim Texas Workforce Commission'?

airSlate SignNow allows users to easily create, send, and eSign the 'Form LL 1 Wage Claim Texas Workforce Commission'. Our intuitive platform streamlines the process, making it faster and more efficient for individuals and businesses to handle wage disputes.

-

Is there a cost associated with using airSlate SignNow for the 'Form LL 1 Wage Claim Texas Workforce Commission'?

Yes, airSlate SignNow offers various pricing plans based on your business needs. These plans are cost-effective, ensuring that filing the 'Form LL 1 Wage Claim Texas Workforce Commission' remains an affordable solution for individuals and enterprises alike.

-

What features does airSlate SignNow offer for eSigning documents like the 'Form LL 1 Wage Claim Texas Workforce Commission'?

airSlate SignNow provides features such as secure electronic signatures, customizable templates, and tracking capabilities. These tools enhance the efficiency and reliability of submitting the 'Form LL 1 Wage Claim Texas Workforce Commission' seamlessly.

-

Can I integrate airSlate SignNow with other applications for handling the 'Form LL 1 Wage Claim Texas Workforce Commission'?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing users to synchronize data and streamline workflows while preparing the 'Form LL 1 Wage Claim Texas Workforce Commission'. This feature enhances productivity and reduces hassle.

-

What are the benefits of using airSlate SignNow to handle wage claim forms?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive documents like the 'Form LL 1 Wage Claim Texas Workforce Commission'. Our platform empowers businesses to focus on resolving claims rather than managing paperwork.

-

Is the 'Form LL 1 Wage Claim Texas Workforce Commission' legally recognized when eSigned through airSlate SignNow?

Yes, documents eSigned through airSlate SignNow, including the 'Form LL 1 Wage Claim Texas Workforce Commission', are legally recognized and comply with electronic signature laws. This ensures that your wage claim is valid and can be pursued by the Texas Workforce Commission.

Get more for Form LL 1 Wage Claim Texas Workforce Commission

- Classroom behavior tracking form ssms scps k12 fl

- Narrative sample data sheet form

- Submittal transmittal form

- Work comp for mass form

- Residential electric construction packet dayton power amp light form

- Payroll status change form urbandaleorg

- Central line consent form

- 34 printable canada customs invoice forms and templates

Find out other Form LL 1 Wage Claim Texas Workforce Commission

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online