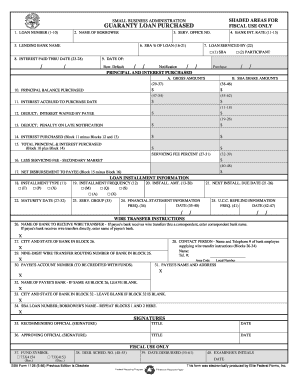

Guaranty Loan Purchased Small Business Administration Form

Understanding the Guaranty Loan Purchased by the Small Business Administration

The Guaranty Loan Purchased by the Small Business Administration (SBA) is a financial product designed to support small businesses in securing funding. This loan program is aimed at enhancing access to capital for entrepreneurs who may struggle to obtain traditional financing. The SBA guarantees a portion of the loan, which reduces the risk for lenders and encourages them to provide loans to small businesses. This program is particularly beneficial for businesses that may not have an extensive credit history or substantial collateral.

How to Obtain the Guaranty Loan Purchased by the Small Business Administration

To obtain the Guaranty Loan Purchased by the SBA, businesses must follow a structured application process. First, it is essential to identify an SBA-approved lender. This can typically be done through the SBA's website or local SBA offices. Once a lender is chosen, the business owner will need to prepare a business plan, financial statements, and any relevant documents that demonstrate the business's viability. The lender will review these materials and determine eligibility based on the SBA's guidelines.

Key Elements of the Guaranty Loan Purchased by the Small Business Administration

Several key elements characterize the Guaranty Loan Purchased by the SBA. These include:

- Loan Amount: The amount can vary based on the business's needs and the lender's assessment.

- Interest Rates: Typically lower than conventional loans, as the SBA guarantees a portion of the loan.

- Repayment Terms: Flexible repayment terms can range from a few years to several decades, depending on the loan type.

- Eligibility Requirements: Businesses must meet specific criteria, including size standards and operational history.

Steps to Complete the Guaranty Loan Purchased by the Small Business Administration

Completing the Guaranty Loan Purchased by the SBA involves several steps:

- Research: Understand the different types of SBA loans and determine which one fits your business needs.

- Prepare Documentation: Gather necessary documents such as tax returns, financial statements, and a business plan.

- Choose a Lender: Select an SBA-approved lender who can guide you through the application process.

- Submit Application: Complete and submit the loan application along with the required documentation.

- Await Approval: The lender will review your application and may request additional information before making a decision.

Legal Use of the Guaranty Loan Purchased by the Small Business Administration

The Guaranty Loan Purchased by the SBA must be used for legitimate business purposes. This can include purchasing inventory, equipment, or real estate, as well as covering operational expenses. Misuse of the funds can lead to penalties, including the potential for loan default. It is crucial for business owners to adhere to the guidelines set forth by the SBA to ensure compliance and maintain their eligibility for future funding.

Application Process and Approval Time for the Guaranty Loan Purchased by the Small Business Administration

The application process for the Guaranty Loan Purchased by the SBA can vary in length depending on several factors, including the lender's requirements and the completeness of the application. Generally, the process may take anywhere from a few weeks to several months. After submitting the application, the lender will conduct a thorough review, which may include background checks and financial assessments. It is advisable for applicants to stay in communication with their lender throughout this period to address any questions or concerns that may arise.

Quick guide on how to complete guaranty loan purchased small business administration

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any delays. Manage [SKS] seamlessly on any device using the airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

The easiest way to edit and electronically sign [SKS] effortlessly

- Locate [SKS] and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to preserve your updates.

- Choose how you prefer to send your form, whether via email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure exceptional communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Guaranty Loan Purchased Small Business Administration

Create this form in 5 minutes!

How to create an eSignature for the guaranty loan purchased small business administration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Guaranty Loan Purchased through the Small Business Administration?

A Guaranty Loan Purchased through the Small Business Administration is a financing option designed for small businesses that require funds but may not qualify for traditional loans. This type of loan is backed by the SBA, reducing risk for lenders and enabling businesses to access necessary capital for growth. Understanding how it works can help you navigate your funding options more effectively.

-

How does the airSlate SignNow platform facilitate documents related to Guaranty Loans?

The airSlate SignNow platform streamlines the process of sending and signing documents associated with Guaranty Loans Purchased through the Small Business Administration. By providing a user-friendly interface and secure electronic signatures, it helps businesses expedite the documentation process. This efficiency can signNowly enhance your loan application experience.

-

What are the benefits of using airSlate SignNow for my Guaranty Loan documents?

Using airSlate SignNow for your Guaranty Loan documents offers numerous benefits such as faster turnaround times, reduced paperwork, and enhanced security. Electronic signatures ensure compliance with legal requirements while saving time compared to traditional methods. Moreover, you can easily track your document status at any time.

-

Are there any costs associated with airSlate SignNow for Guaranty Loan transactions?

Yes, there are costs associated with using airSlate SignNow for Guaranty Loan transactions, but the platform is designed to be cost-effective. Pricing plans vary depending on the features you choose, including the number of users and additional integrations. Given the efficiency it brings, your investment can lead to signNow time and cost savings.

-

Can airSlate SignNow integrate with other platforms for managing Guaranty Loans?

Absolutely! airSlate SignNow offers various integrations with project management and financial software, enhancing your ability to manage Guaranty Loans Purchased through the Small Business Administration. These integrations can streamline your workflows and improve collaboration among your team, making it easier to handle loan documentation.

-

What features of airSlate SignNow help in the preparation of Guaranty Loan documents?

airSlate SignNow comes equipped with features such as document templates, custom workflows, and automated reminders that are ideal for preparing Guaranty Loan documents. These tools help ensure that you never miss a step in the application process. Additionally, the platform's audit trail feature provides a clear record of all actions taken on your documents.

-

How can electronic signatures benefit my Guaranty Loan application process?

Electronic signatures can greatly benefit your Guaranty Loan application process by eliminating the need for printing, signing, and scanning documents. This not only accelerates the timeframe for getting approvals but also keeps your documentation organized and easily accessible. Furthermore, electronic signatures are legally binding, ensuring compliance with SBA requirements.

Get more for Guaranty Loan Purchased Small Business Administration

Find out other Guaranty Loan Purchased Small Business Administration

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors