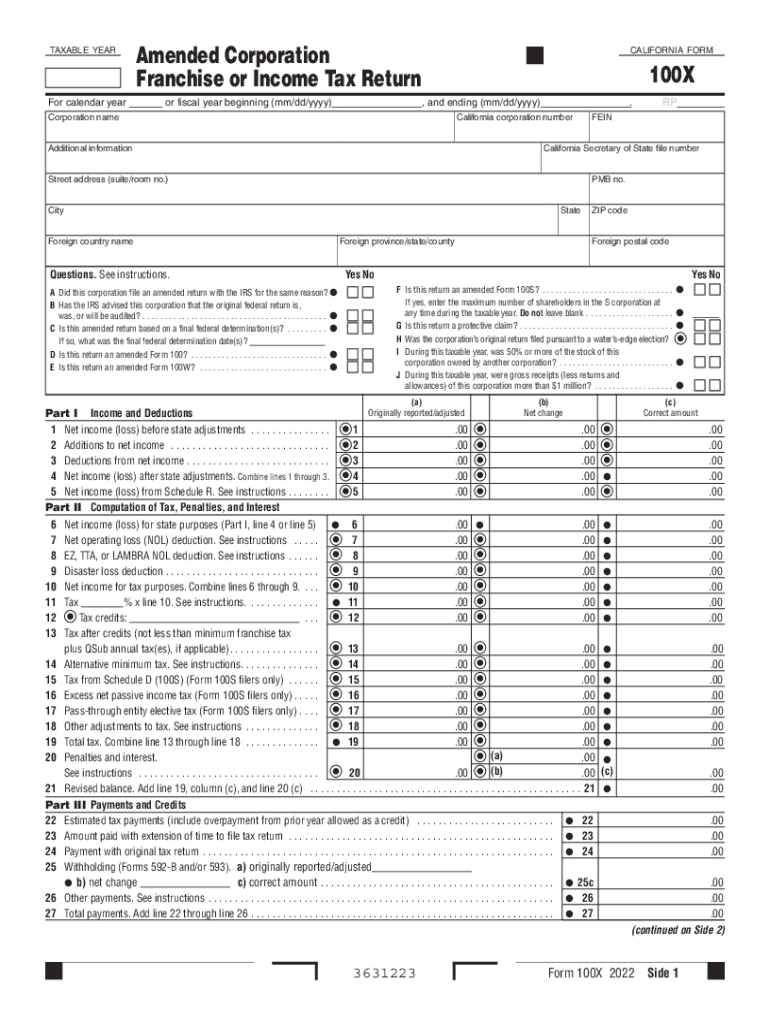

Form 100x Amended Corporation Franchise or Income Tax Return

What is the Form 100x Amended Corporation Franchise Or Income Tax Return

The Form 100x is an amended version of the California Corporation Franchise or Income Tax Return. It is specifically designed for corporations that need to correct or modify previously filed tax returns. This form allows businesses to report changes in income, deductions, or credits that affect their tax liability. By using Form 100x, corporations can ensure that their tax filings accurately reflect their financial situation, which is essential for compliance with California tax laws.

How to use the Form 100x Amended Corporation Franchise Or Income Tax Return

To effectively use the Form 100x, corporations must first gather all relevant financial documents and information from the original return. This includes income statements, deduction records, and any supporting documentation for the changes being made. Once the necessary information is compiled, the corporation can fill out the form, ensuring that all sections are completed accurately. It is crucial to provide a clear explanation of the amendments being made in the designated section to facilitate processing by the California tax authorities.

Steps to complete the Form 100x Amended Corporation Franchise Or Income Tax Return

Completing the Form 100x involves several key steps:

- Obtain the latest version of Form 100x from the California Franchise Tax Board website.

- Review the original tax return to identify the specific areas that need amendments.

- Fill out the form, ensuring that all required fields are completed, including the corporation's name, address, and tax identification number.

- Clearly indicate the changes being made and provide necessary explanations in the appropriate sections.

- Attach any supporting documents that substantiate the changes, such as revised financial statements or additional schedules.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Form 100x Amended Corporation Franchise Or Income Tax Return

The Form 100x is legally recognized by the California Franchise Tax Board as the official method for corporations to amend their tax returns. It is important for corporations to use this form to correct any inaccuracies in their previous filings to avoid potential penalties or legal issues. Filing an amended return shows good faith and compliance with tax regulations, which can be beneficial in case of audits or inquiries by tax authorities.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Form 100x. Generally, the amended return must be filed within six months of the original return's due date. This timeline ensures that any corrections are made promptly and that the corporation remains compliant with tax regulations. It is advisable to check for any specific updates or changes to deadlines that may be announced by the California Franchise Tax Board.

Required Documents

When preparing to file the Form 100x, corporations should gather several essential documents, including:

- The original tax return that is being amended.

- Financial statements that reflect the changes being made.

- Supporting documentation for any deductions or credits claimed.

- Records of any correspondence with the California Franchise Tax Board related to the original return.

Quick guide on how to complete form 100x amended corporation franchise or income tax return

Effortlessly prepare Form 100x Amended Corporation Franchise Or Income Tax Return on any device

Managing documents online has gained popularity among companies and individuals alike. It offers a perfect sustainable substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Form 100x Amended Corporation Franchise Or Income Tax Return on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Form 100x Amended Corporation Franchise Or Income Tax Return with ease

- Locate Form 100x Amended Corporation Franchise Or Income Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose your preferred way to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searching, or mistakes that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and electronically sign Form 100x Amended Corporation Franchise Or Income Tax Return to maintain excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 100x amended corporation franchise or income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 100x pricing for airSlate SignNow?

The 2022 100x pricing model for airSlate SignNow offers flexible plans designed to fit various business needs. Our pricing options ensure that you only pay for what you require, with scalable solutions that grow alongside your business. Explore our tiered plans to determine which best suits your 2022 100x objectives.

-

What features does airSlate SignNow offer under the 2022 100x plan?

The airSlate SignNow 2022 100x plan includes comprehensive features such as document templates, in-person signing, and real-time tracking. Additionally, powerful integrations with top applications streamline your workflow. This ensures you can manage your eSigning needs effortlessly while boosting your team's productivity.

-

How can airSlate SignNow benefit my business in 2022?

In 2022, transitioning to airSlate SignNow can signNowly enhance operational efficiency. With its cost-effective solution, your team can send, sign, and manage documents digitally, saving time and reducing overhead costs. This agility enables your business to stay competitive in today's fast-paced environment.

-

Is airSlate SignNow compliant with legal standards in 2022?

Yes, airSlate SignNow adheres to legal standards for electronic signatures established in 2022. Our platform complies with E-SIGN and UETA laws, which means your signed documents are legally binding and secure. Trust in airSlate SignNow to manage your electronic signatures with full compliance.

-

What integrations does airSlate SignNow support in 2022?

The 2022 100x offerings from airSlate SignNow support a wide range of integrations with popular applications such as Salesforce, Google Drive, and Dropbox. This extensive connectivity allows you to streamline your document workflow and enhances collaboration across teams. Maximize efficiency with seamless integration in 2022.

-

Can I customize my documents with airSlate SignNow in 2022?

Absolutely! The airSlate SignNow platform allows for extensive customization of your documents in 2022. You can create templates, adjust fields, and incorporate branding elements to ensure your documents reflect your business's identity, making the signing process more personalized and effective.

-

How does airSlate SignNow ensure security in 2022?

In 2022, airSlate SignNow prioritizes security by implementing robust encryption protocols and secure cloud storage. Your documents are protected at every stage of the signing process, providing peace of mind regarding data privacy. Trust our platform for a secure eSigning experience without compromise.

Get more for Form 100x Amended Corporation Franchise Or Income Tax Return

- Kane quit claim deed form

- Internal mobility applicant interview form

- 92458 rent schedule low rent housing sc state housing form

- Premis preliminary report emspic form

- Apartment inventory form

- 16 team seeded bracket form

- Certificate of origin canada peru free trade agreement cbsa gc form

- Ifta 100 2014 form

Find out other Form 100x Amended Corporation Franchise Or Income Tax Return

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract