Form 8840 IRS Closer Connection Exception Statement

What is the Form 8840 IRS Closer Connection Exception Statement

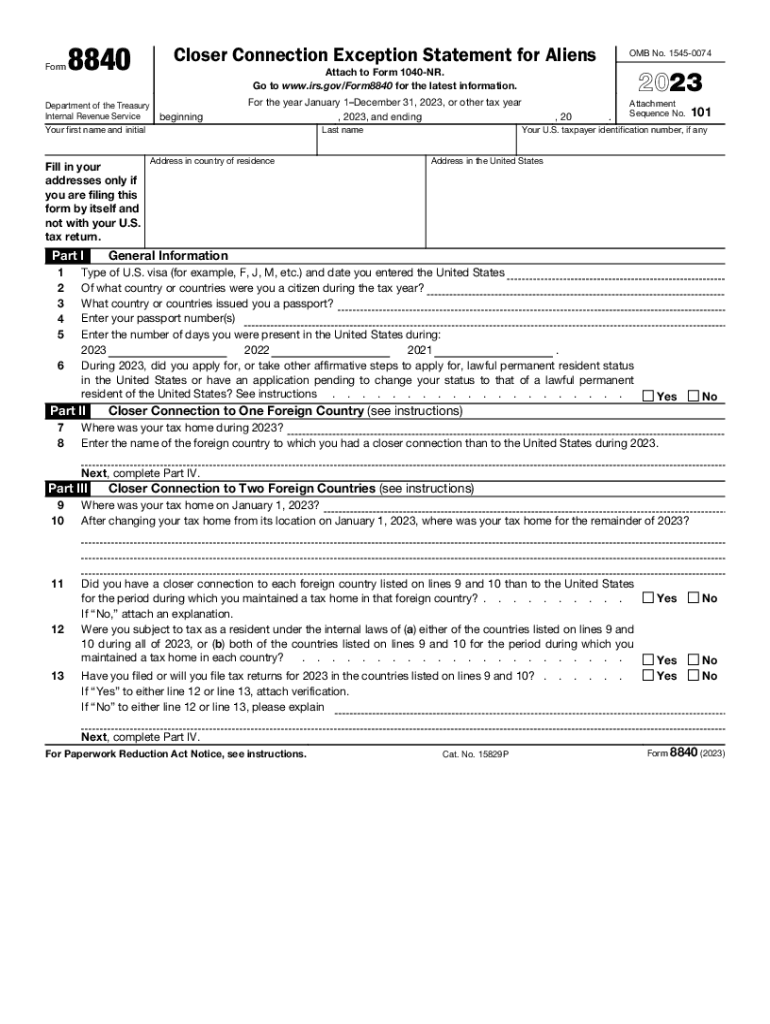

The Form 8840, also known as the Closer Connection Exception Statement for Aliens, is a document used by non-resident aliens to establish a closer connection to a foreign country than to the United States. This form is particularly relevant for individuals who spend significant time in the U.S. but wish to claim that they are not considered U.S. residents for tax purposes. By filing this form, individuals can potentially avoid being taxed on their worldwide income, as they can demonstrate that their primary home and economic ties are outside the U.S.

How to use the Form 8840 IRS Closer Connection Exception Statement

Using the Form 8840 involves a few straightforward steps. First, individuals must gather relevant information regarding their residency status and connections to both the U.S. and their home country. Next, they complete the form by providing details such as the number of days spent in the U.S. and information about their permanent home. After filling out the form, it should be submitted to the IRS as part of the annual tax return process. It is essential to ensure that the form is filed accurately to avoid any issues with compliance.

Steps to complete the Form 8840 IRS Closer Connection Exception Statement

Completing the Form 8840 requires careful attention to detail. The following steps outline the process:

- Gather necessary documents, including travel records and proof of residence in your home country.

- Fill out the personal information section, including your name, address, and taxpayer identification number.

- Provide information on your physical presence in the U.S. for the current year and the two preceding years.

- Detail your connections to your home country, such as family, business, and social ties.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To be eligible to file the Form 8840, individuals must meet specific criteria. Primarily, they should be non-resident aliens who have spent a considerable amount of time in the U.S. but do not intend to establish residency. Additionally, they must demonstrate that they have a closer connection to a foreign country. This includes having a permanent home, family, and economic interests outside the U.S. Understanding these criteria is vital for ensuring that the form is applicable to your situation.

Filing Deadlines / Important Dates

Filing the Form 8840 is subject to specific deadlines. Generally, the form must be submitted by the due date of the individual’s tax return, which is typically April 15 for most taxpayers. However, if an extension is filed for the tax return, the deadline for submitting Form 8840 may also be extended. It is important to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the Form 8840 when required can result in significant penalties. Non-compliance may lead to being classified as a U.S. resident for tax purposes, which can subject an individual to U.S. taxation on worldwide income. Additionally, the IRS may impose fines for late filing or inaccuracies in the submitted information. Understanding the implications of non-compliance is crucial for individuals considering filing this form.

Quick guide on how to complete form 8840 irs closer connection exception statement

Complete Form 8840 IRS Closer Connection Exception Statement seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and eSign your documents quickly without delays. Handle Form 8840 IRS Closer Connection Exception Statement on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Form 8840 IRS Closer Connection Exception Statement effortlessly

- Locate Form 8840 IRS Closer Connection Exception Statement and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or erase sensitive details with the tools that airSlate SignNow provides for that specific purpose.

- Create your eSignature using the Sign function, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 8840 IRS Closer Connection Exception Statement and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8840 irs closer connection exception statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features make airSlate SignNow a closer choice for eSignatures?

airSlate SignNow offers robust features such as customizable templates, in-person signing, and advanced security options. These features make it a closer choice for businesses looking to streamline their document workflows. With its user-friendly interface, you can effortlessly manage eSignatures and increase productivity.

-

How does pricing work with airSlate SignNow for businesses?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. You can choose from monthly or annual subscriptions that serve as a closer fit for any budget. Additionally, there are tiered options that provide more functionality as your business grows.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow easily integrates with a range of software applications to enhance your workflow. This makes it a closer match for companies using existing tools like CRM systems, cloud storage, and project management software. Connecting these applications allows for a seamless experience during the signing process.

-

What are the benefits of choosing airSlate SignNow for document management?

Choosing airSlate SignNow benefits businesses by providing faster turnaround times and improving efficiency in document management. It serves as a closer option for organizations aiming to reduce paper usage and operational costs while enhancing compliance and security. This results in a more professional image and smoother business operations.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to be a closer solution for small businesses seeking an efficient eSigning platform. Its cost-effective pricing and user-friendly features cater specifically to small teams, allowing you to scale your eSignature needs as your business grows.

-

What security measures does airSlate SignNow have in place?

airSlate SignNow takes document security seriously with advanced encryption and compliance with industry standards. This provides users with a closer assurance that their sensitive information is protected during signing and storage. As a result, businesses can confidently send and eSign documents without compromising security.

-

How does airSlate SignNow handle customer support?

airSlate SignNow offers exceptional customer support through multiple channels including email, chat, and phone. This ensures that users have access to help whenever they need it, making it a closer choice for businesses that value reliable assistance. The support team is knowledgeable and ready to address any queries or issues you may encounter.

Get more for Form 8840 IRS Closer Connection Exception Statement

- Resolution conference questionnaire return this form 7 days stclaircounty

- Sc1040 instructions 2017 form

- Calculation policy st blaise ce primary school achieving bb st blaise oxon sch form

- Surf sports coach of the year application form surflifesaving sportal com

- Practicum form application for sports training certification sotx

- Antrag auf beurkundung einer auslandsgeburt im geburtenregister form

- Adopt a stepchild or relative form

- Homecoming date non student permission form

Find out other Form 8840 IRS Closer Connection Exception Statement

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free