Form 3582 Fill Out & Sign Online

Understanding Form 3582 for FTB Payments

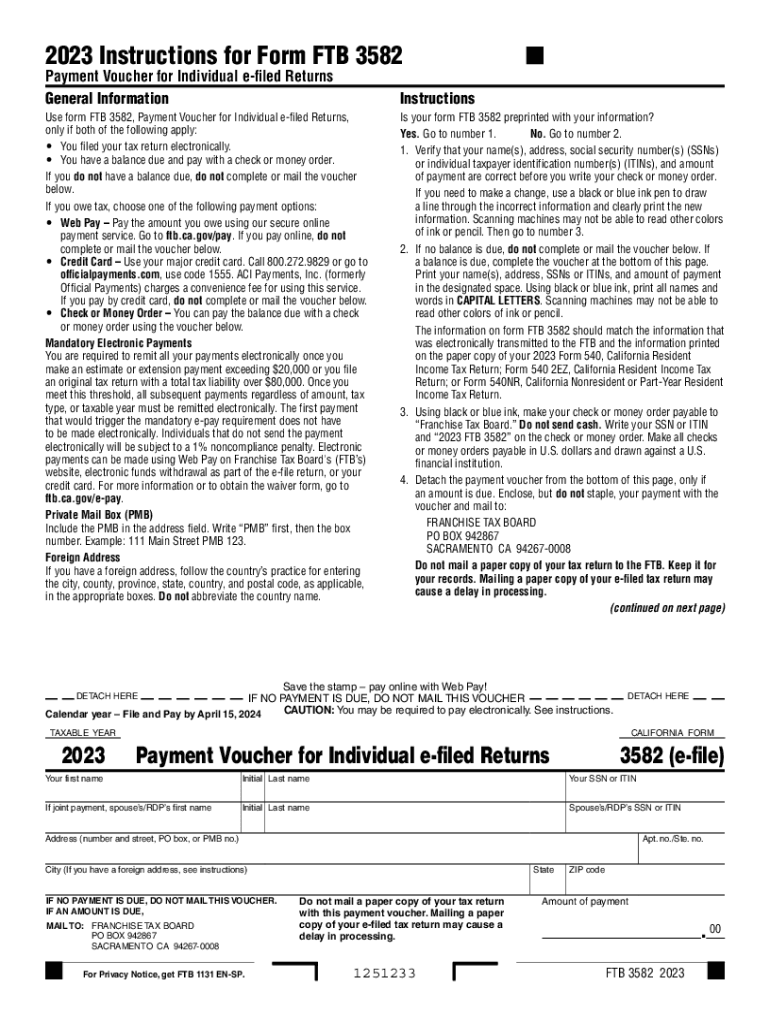

The Form 3582 is a crucial document for California taxpayers who need to make payments to the Franchise Tax Board (FTB). This form serves as a payment voucher, allowing individuals and businesses to submit their tax payments efficiently. It is particularly relevant for those who owe taxes or are making estimated payments. Understanding the purpose and requirements of this form is essential for ensuring compliance with California tax regulations.

Steps to Complete Form 3582

Completing Form 3582 involves several straightforward steps. First, gather all necessary information, including your taxpayer identification number and the amount due. Next, accurately fill out the form with your personal details, including your name and address. Ensure that you double-check the payment amount to avoid any discrepancies. Once completed, you can choose to submit the form electronically or by mail, depending on your preference.

Filing Deadlines for Form 3582

It is important to be aware of the filing deadlines associated with Form 3582. Typically, the form must be submitted by the tax payment due date to avoid penalties and interest. For estimated tax payments, the deadlines usually align with quarterly due dates. Being mindful of these dates ensures that you remain in good standing with the FTB and avoid any unnecessary fees.

Submitting Form 3582: Online and Mail Options

Form 3582 can be submitted through various methods, providing flexibility for taxpayers. For those who prefer digital solutions, the FTB offers an online submission option that allows for quick processing. Alternatively, if you choose to submit by mail, ensure that you send the form to the correct address provided by the FTB. Regardless of the method chosen, retaining a copy of the submitted form for your records is advisable.

Key Elements of Form 3582

Understanding the key elements of Form 3582 is vital for accurate completion. The form includes sections for your personal information, payment amount, and any relevant tax periods. It is essential to fill out each section correctly to avoid processing delays. Additionally, the form may require you to indicate the type of payment being made, whether it is for estimated taxes or a balance due.

Legal Use of Form 3582

Form 3582 must be used in accordance with California tax laws. This means that taxpayers should only use the form for its intended purpose, which is to submit payments to the FTB. Misuse of the form can lead to legal consequences, including penalties. Therefore, it is crucial to ensure that all information provided is accurate and complies with state tax regulations.

Examples of Using Form 3582

Various scenarios illustrate the use of Form 3582. For instance, a self-employed individual may use this form to make estimated tax payments throughout the year. Similarly, a business entity might use it to pay any outstanding tax liabilities. These examples highlight the form's versatility and importance in maintaining compliance with California tax obligations.

Quick guide on how to complete form 3582 fill out ampamp sign online

Complete Form 3582 Fill Out & Sign Online effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and without delays. Manage Form 3582 Fill Out & Sign Online across any platform with airSlate SignNow Android or iOS applications and simplify any document-related operations today.

How to edit and eSign Form 3582 Fill Out & Sign Online with ease

- Obtain Form 3582 Fill Out & Sign Online and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Alter and eSign Form 3582 Fill Out & Sign Online and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3582 fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3582 California 2023?

Form 3582 California 2023 is a document used for specific legal and regulatory purposes in California. It serves as an essential paperwork for various transactions and submissions. Understanding how to properly fill out Form 3582 California 2023 can streamline processes and ensure compliance with state regulations.

-

How can airSlate SignNow help with Form 3582 California 2023?

airSlate SignNow simplifies the process of completing and submitting Form 3582 California 2023 by providing an intuitive platform for eSigning documents. Users can easily upload the form, fill it out, and share it securely for signatures. This not only enhances efficiency but also helps maintain accurate records.

-

Is there a cost associated with using airSlate SignNow for Form 3582 California 2023?

Yes, there is a subscription cost associated with using airSlate SignNow; however, it is a cost-effective solution overall. Plans vary based on features and volume requirements, making it easy for businesses of all sizes to find an option that works for them. This investment can lead to signNow time savings when working with Form 3582 California 2023.

-

What features does airSlate SignNow offer for managing Form 3582 California 2023?

airSlate SignNow offers a host of features for managing Form 3582 California 2023, including custom templates, automated workflows, and real-time tracking. These tools enhance user experience by ensuring that all stakeholders can access and review documents efficiently. The platform also provides security features to protect sensitive information.

-

Can I integrate airSlate SignNow with other applications for Form 3582 California 2023?

Absolutely! airSlate SignNow provides integration options with various applications, allowing users to streamline their workflow when dealing with Form 3582 California 2023. This means you can connect it to CRM software, cloud storage, and other tools that enhance document management efficiency.

-

How secure is airSlate SignNow when handling Form 3582 California 2023?

airSlate SignNow prioritizes security, using advanced encryption and compliance features to protect your data when handling Form 3582 California 2023. Your information is secure throughout the document lifecycle, from creation and signing to storage and retrieval. This ensures compliance with legal standards and protects sensitive content.

-

Do I need technical skills to use airSlate SignNow for Form 3582 California 2023?

No, you do not need technical skills to use airSlate SignNow for Form 3582 California 2023. The platform is designed to be user-friendly, allowing individuals without a technical background to navigate and utilize its features easily. This makes it accessible for everyone who needs to manage important forms.

Get more for Form 3582 Fill Out & Sign Online

- Multistate riders and addenda form 3131 word fannie mae

- Paychex fsa medical reimbursement form 2015 2019

- Annuity beneficiary change request stedmarkpartners form

- Form 1077 2009 2019

- Mac form 2009

- Cms 838 2003 2019 form

- Precertification template 2016 2019 form

- Riverbend authorization form v2 draft 050616xlsx

Find out other Form 3582 Fill Out & Sign Online

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement