Pit X Amended State of Nm Form 2015

What is the Pit X Amended State Of Nm Form

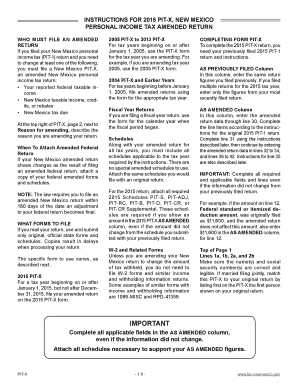

The Pit X Amended State Of Nm Form is a tax document used in New Mexico for individuals and businesses to amend previously filed personal income tax returns. This form allows taxpayers to correct errors or make changes to their tax information, ensuring compliance with state tax regulations. It is essential for taxpayers who need to rectify discrepancies in their reported income, deductions, or credits after their initial submission.

How to use the Pit X Amended State Of Nm Form

Using the Pit X Amended State Of Nm Form involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained from the New Mexico Taxation and Revenue Department. Next, carefully fill out the form, providing accurate information regarding the changes you wish to make. It is crucial to include all relevant details, such as your original tax return information and the specific amendments. Once completed, you can submit the form electronically or via mail, depending on your preference.

Steps to complete the Pit X Amended State Of Nm Form

Completing the Pit X Amended State Of Nm Form requires careful attention to detail. Follow these steps for successful completion:

- Download the form from the New Mexico Taxation and Revenue Department website.

- Review your original tax return to identify the errors or changes needed.

- Fill in your personal information at the top of the form.

- Indicate the tax year you are amending.

- Provide the corrected figures alongside the original amounts.

- Sign and date the form to validate your submission.

- Submit the completed form according to the specified submission methods.

Key elements of the Pit X Amended State Of Nm Form

The Pit X Amended State Of Nm Form includes several key elements that are essential for proper completion. These elements typically consist of:

- Taxpayer Information: Your name, address, and Social Security number.

- Original Return Details: Information from your initial tax return, including filing status and income.

- Amended Information: The corrected amounts for income, deductions, and credits.

- Reason for Amendment: A brief explanation of why you are making changes.

Form Submission Methods

The Pit X Amended State Of Nm Form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to:

- File Online: Use the New Mexico Taxation and Revenue Department's online portal for electronic submission.

- Mail the Form: Send the completed form to the designated address provided on the form.

- In-Person Submission: Visit a local office of the New Mexico Taxation and Revenue Department for direct submission.

Penalties for Non-Compliance

Failure to submit the Pit X Amended State Of Nm Form or inaccuracies in the submitted information can lead to penalties. The New Mexico Taxation and Revenue Department may impose fines or interest on any unpaid taxes resulting from the amendments. It is crucial to ensure that all information is accurate and submitted on time to avoid potential penalties.

Quick guide on how to complete 2015 pit x amended state of nm form

Your assistance manual on how to prepare your Pit X Amended State Of Nm Form

If you’re curious about how to finalize and submit your Pit X Amended State Of Nm Form, here are a few concise guidelines on how to simplify tax processing.

To begin, you just need to create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an exceptionally intuitive and robust document platform that enables you to edit, produce, and finalize your tax documents effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and revisit to modify details as needed. Streamline your tax oversight with advanced PDF editing, eSigning, and convenient sharing options.

Follow the instructions below to finalize your Pit X Amended State Of Nm Form swiftly:

- Create your account and start working on PDFs in just a few minutes.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Pit X Amended State Of Nm Form in our editor.

- Complete the mandatory fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your valid eSignature (if necessary).

- Examine your document and fix any errors.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper filing can lead to additional errors and delay refunds. Naturally, before electronically filing your taxes, ensure to check the IRS website for submission regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct 2015 pit x amended state of nm form

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the 2015 pit x amended state of nm form

How to generate an eSignature for your 2015 Pit X Amended State Of Nm Form online

How to make an electronic signature for the 2015 Pit X Amended State Of Nm Form in Chrome

How to create an eSignature for putting it on the 2015 Pit X Amended State Of Nm Form in Gmail

How to make an eSignature for the 2015 Pit X Amended State Of Nm Form from your mobile device

How to generate an electronic signature for the 2015 Pit X Amended State Of Nm Form on iOS devices

How to generate an electronic signature for the 2015 Pit X Amended State Of Nm Form on Android OS

People also ask

-

What is the Pit X Amended State Of Nm Form?

The Pit X Amended State Of Nm Form is a legal document used to amend previously submitted information to the New Mexico state authorities. It allows businesses to correct or update information that may have changed. Utilizing airSlate SignNow simplifies the eSigning process for this form, ensuring compliance and accuracy.

-

How can airSlate SignNow help me with the Pit X Amended State Of Nm Form?

airSlate SignNow provides a user-friendly platform to easily eSign and manage the Pit X Amended State Of Nm Form. Our solution simplifies document workflows, allowing you to send forms for signature quickly and track their status in real time. This makes the amendment process efficient and streamlined.

-

Is there a cost associated with using airSlate SignNow for the Pit X Amended State Of Nm Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You'll find affordable options that allow unlimited signing of documents, including the Pit X Amended State Of Nm Form. Investing in our solution not only saves time but also enhances compliance and reduces administrative burdens.

-

What features does airSlate SignNow offer for the Pit X Amended State Of Nm Form?

airSlate SignNow includes features such as reusable templates, advanced eSignature options, and document tracking specifically tailored for forms like the Pit X Amended State Of Nm Form. The platform also provides secure cloud storage and integration with other applications, making document management seamless.

-

Can I integrate airSlate SignNow with other applications for the Pit X Amended State Of Nm Form?

Absolutely! airSlate SignNow easily integrates with various applications to enhance your workflow, including CRM software, cloud storage services, and productivity tools. This means you can manage the Pit X Amended State Of Nm Form alongside your other business processes effortlessly.

-

How do I get started with airSlate SignNow for the Pit X Amended State Of Nm Form?

Getting started with airSlate SignNow is simple. You can sign up for a free trial, which allows you to explore all the features tailored for processing the Pit X Amended State Of Nm Form. Once you’ve signed up, you can easily create, send, and track your documents in just a few clicks.

-

What are the benefits of using airSlate SignNow for the Pit X Amended State Of Nm Form?

Using airSlate SignNow for the Pit X Amended State Of Nm Form offers numerous benefits, including faster turnaround times for signatures, reduced paper usage, and the ability to track document status. Additionally, our platform offers enhanced security and compliance, giving you peace of mind while managing sensitive information.

Get more for Pit X Amended State Of Nm Form

Find out other Pit X Amended State Of Nm Form

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document