About Form W 12, IRS Paid Preparer Tax Identification

Understanding the IRS Paid Preparer Tax Identification Number (PTIN)

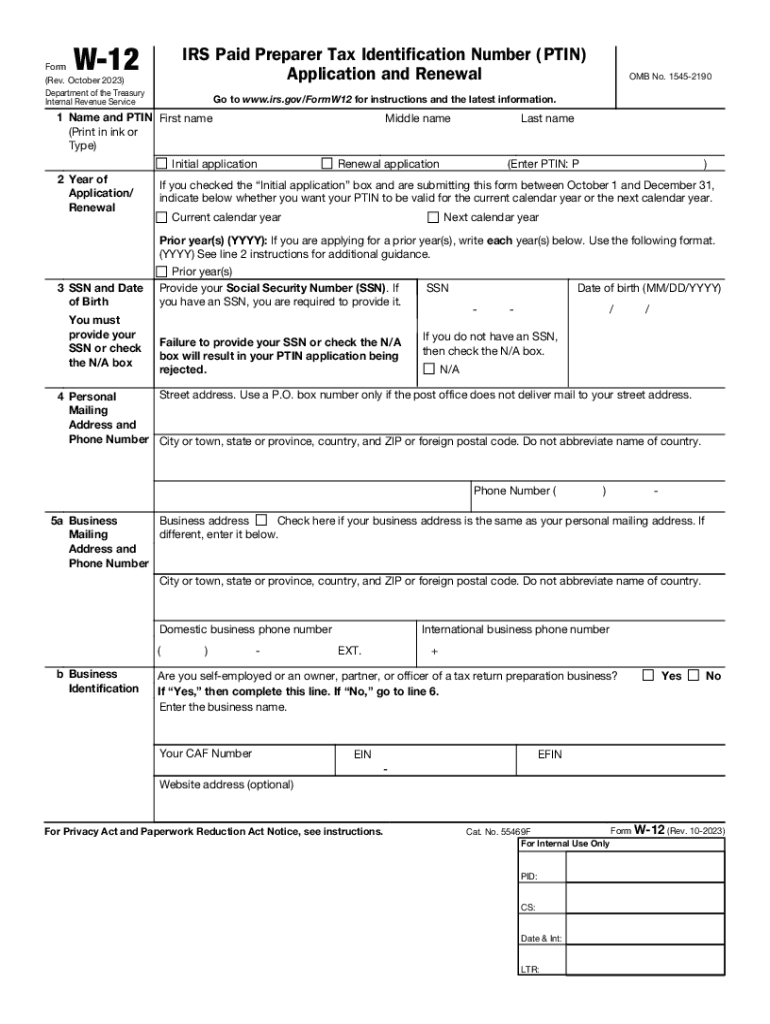

The IRS Paid Preparer Tax Identification Number (PTIN) is a unique identifier assigned to tax preparers who are paid to prepare or assist in preparing federal tax returns. This number is essential for compliance with IRS regulations. All paid tax preparers must have a PTIN to legally prepare tax returns for compensation. The PTIN helps the IRS track tax preparers and ensure accountability in the tax preparation industry.

Steps to Renew Your PTIN

Renewing your PTIN is a straightforward process. Follow these steps to ensure your PTIN remains active:

- Visit the IRS PTIN renewal page on the IRS website.

- Log in to your PTIN account using your existing credentials.

- Review your personal and business information for accuracy.

- Complete any required fields and submit your renewal application.

- Pay the renewal fee, if applicable, using an accepted payment method.

- Receive confirmation of your PTIN renewal via email.

Required Documents for PTIN Renewal

When renewing your PTIN, you may need to provide specific information, which can include:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Your business information, including the name and address of your practice.

- Any changes in your professional qualifications or certifications.

Having these documents ready can streamline the renewal process and prevent delays.

Important Filing Deadlines for PTIN Renewal

Staying aware of filing deadlines is crucial for maintaining your PTIN. The IRS typically requires tax preparers to renew their PTINs annually. It is advisable to renew your PTIN before the start of the tax season to ensure you are ready to assist clients without interruption. The renewal period generally opens in October and closes in December each year.

Penalties for Non-Compliance with PTIN Requirements

Failure to renew your PTIN or to obtain one can result in significant penalties from the IRS. Tax preparers without a valid PTIN may face fines and could be barred from preparing tax returns for compensation. Additionally, clients may experience delays in processing their tax returns, which can lead to further complications.

Eligibility Criteria for Obtaining a PTIN

To obtain a PTIN, applicants must meet certain eligibility criteria. These include:

- Being a paid tax preparer who prepares or assists in preparing federal tax returns.

- Having a valid SSN or ITIN.

- Not being disqualified from preparing tax returns due to prior violations of IRS regulations.

Meeting these criteria is essential for ensuring compliance and maintaining the integrity of the tax preparation process.

Quick guide on how to complete about form w 12 irs paid preparer tax identification

Effortlessly Prepare About Form W 12, IRS Paid Preparer Tax Identification on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage About Form W 12, IRS Paid Preparer Tax Identification on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to Modify and eSign About Form W 12, IRS Paid Preparer Tax Identification with Ease

- Obtain About Form W 12, IRS Paid Preparer Tax Identification and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you’d like to send your form: via email, SMS, invitation link, or download it to your computer.

No more lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign About Form W 12, IRS Paid Preparer Tax Identification to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form w 12 irs paid preparer tax identification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PTIN renewal and why is it important?

PTIN renewal refers to the process of renewing your Preparer Tax Identification Number, which is crucial for tax professionals. It ensures that you remain compliant with IRS regulations, allowing you to legally prepare tax returns. Missing the renewal deadline may result in penalties and affect your ability to serve clients.

-

How does airSlate SignNow assist with PTIN renewal?

airSlate SignNow offers a streamlined solution for managing PTIN renewal documents. With robust eSignature capabilities, you can quickly gather necessary signatures and submit required forms. This simplifies the renewal process, making it efficient and hassle-free.

-

What are the costs associated with PTIN renewal through airSlate SignNow?

Using airSlate SignNow for PTIN renewal is a cost-effective choice, especially when compared to traditional methods. The pricing is competitive, and you can choose a plan that fits your business needs. Investing in this solution can save you time and improve your overall workflow.

-

Are there any special features for PTIN renewal with airSlate SignNow?

Yes, airSlate SignNow offers features specifically designed to simplify the PTIN renewal process. These include customizable templates, automated reminders for deadlines, and secure storage of your documents. Such features enhance the efficiency and reliability of your PTIN renewal management.

-

Can I track the status of my PTIN renewal with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking of your PTIN renewal documents. You can monitor when documents have been sent, viewed, and signed, ensuring you are always up-to-date. This transparency helps you manage your renewal process more effectively.

-

Is airSlate SignNow compliant with IRS regulations for PTIN renewal?

Yes, airSlate SignNow complies with all relevant IRS regulations for PTIN renewal. The platform ensures that your documents are handled securely and in accordance with the law. You can rely on airSlate SignNow to help you maintain compliance throughout the renewal process.

-

What integrations does airSlate SignNow offer for PTIN renewal?

airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making PTIN renewal even easier. These integrations allow you to import data directly from your existing tools, streamlining your workflow. This interoperability enhances your productivity during the renewal process.

Get more for About Form W 12, IRS Paid Preparer Tax Identification

Find out other About Form W 12, IRS Paid Preparer Tax Identification

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template