Board of Appeals EPetition Center Business Tax E Services Form

Understanding the Pennsylvania Rev 65 Form

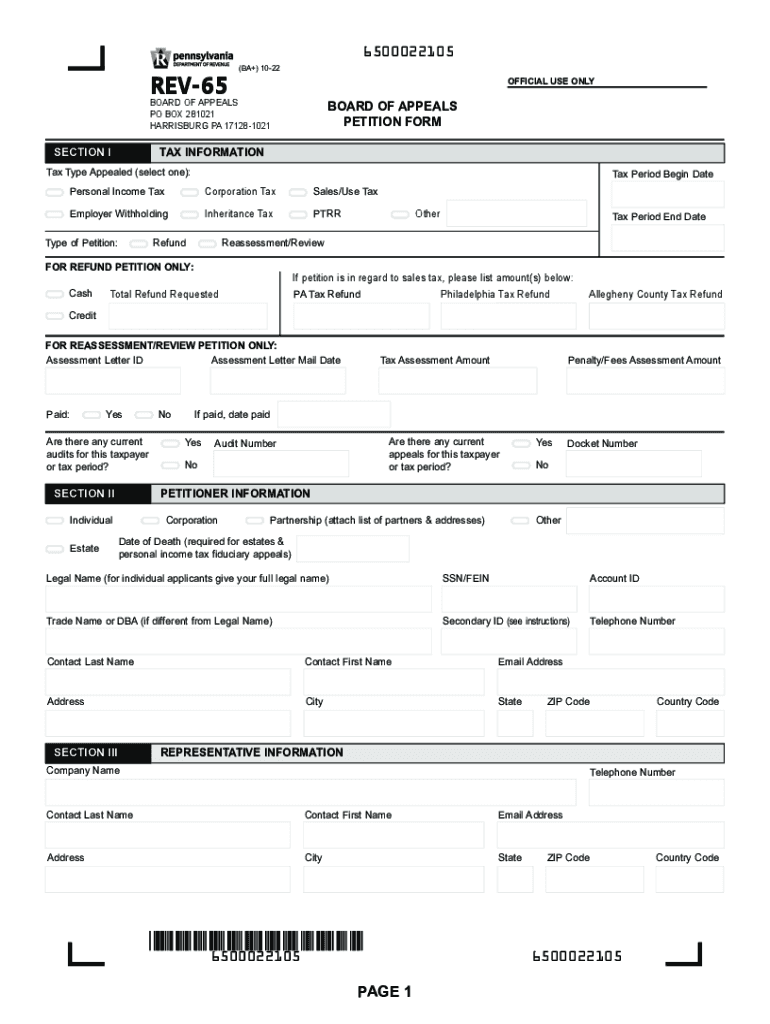

The Pennsylvania Rev 65 form is a crucial document for taxpayers seeking to appeal decisions made by the Pennsylvania Department of Revenue regarding tax assessments. This form is primarily used to file a petition with the Board of Appeals in Pennsylvania. It allows individuals and businesses to contest tax liabilities, refunds, or other related tax matters. Understanding the purpose and function of the Rev 65 is essential for anyone navigating the appeals process in Pennsylvania.

Steps to Complete the Pennsylvania Rev 65 Form

Filling out the Pennsylvania Rev 65 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your taxpayer identification number and details about the tax assessment you are appealing. Next, complete the form by providing your personal information, the specifics of the tax issue, and any supporting documentation that may strengthen your case. It is crucial to review the completed form for errors before submission, as inaccuracies can lead to delays or rejections.

Required Documents for the Rev 65 Submission

When submitting the Pennsylvania Rev 65 form, certain documents must accompany your petition to support your claims. These may include copies of tax returns, notices of assessment, and any correspondence with the Pennsylvania Department of Revenue. Additionally, any relevant financial records that can substantiate your appeal should be included. Ensuring that all required documents are submitted will enhance the likelihood of a successful appeal.

Form Submission Methods for the Rev 65

The Pennsylvania Rev 65 form can be submitted through various methods, providing flexibility for taxpayers. You can file the form online through the Board of Appeals ePetition Center, which offers a streamlined process for electronic submissions. Alternatively, you may choose to mail the completed form and supporting documents to the appropriate address provided by the Pennsylvania Department of Revenue. In-person submissions are also an option, allowing for direct interaction with department representatives.

Eligibility Criteria for Filing the Rev 65

To file the Pennsylvania Rev 65 form, taxpayers must meet specific eligibility criteria. Generally, you must be an individual or business that has received a notice of assessment or determination from the Pennsylvania Department of Revenue. Additionally, you must file your appeal within the designated timeframe, typically within 90 days of receiving the notice. Understanding these criteria is vital to ensuring that your appeal is valid and timely.

Legal Use of the Pennsylvania Rev 65 Form

The legal framework surrounding the Pennsylvania Rev 65 form is established by state tax laws and regulations. This form serves as a formal request for review and is protected under administrative law. Filing the Rev 65 correctly ensures that taxpayers can exercise their right to appeal tax decisions legally. It is important to adhere to all legal requirements and guidelines when completing and submitting the form to avoid complications in the appeals process.

Quick guide on how to complete board of appeals epetition center business tax e services

Complete Board Of Appeals EPetition Center Business Tax E Services seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any holdups. Manage Board Of Appeals EPetition Center Business Tax E Services on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Board Of Appeals EPetition Center Business Tax E Services effortlessly

- Obtain Board Of Appeals EPetition Center Business Tax E Services and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Board Of Appeals EPetition Center Business Tax E Services and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the board of appeals epetition center business tax e services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pennsylvania REV 65 form?

The Pennsylvania REV 65 form is a document used by non-profit organizations in Pennsylvania to request exemption from sales tax. Understanding its use is crucial for organizations looking to benefit from tax exemptions. airSlate SignNow offers a seamless way to eSign and manage this document efficiently.

-

How can airSlate SignNow help with the Pennsylvania REV 65 form?

With airSlate SignNow, you can easily upload, eSign, and share the Pennsylvania REV 65 form with stakeholders. Our user-friendly platform streamlines the document management process, ensuring that your form is completed and submitted swiftly. This convenience can save your organization time and resources.

-

Is there a cost associated with using airSlate SignNow for the Pennsylvania REV 65 form?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. You can start with a free trial and explore our features for managing documents like the Pennsylvania REV 65 form before committing to a plan. Our service provides a cost-effective solution for eSigning and document management.

-

What features does airSlate SignNow offer for handling the Pennsylvania REV 65 form?

airSlate SignNow provides features such as document templates, eSignature capabilities, and real-time tracking for the Pennsylvania REV 65 form. You can easily customize the form, ensure compliance, and track who has signed it. These features enhance your document workflow and improve efficiency.

-

Can I integrate airSlate SignNow with other tools for the Pennsylvania REV 65 form?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Dropbox. This integration allows you to store and manage the Pennsylvania REV 65 form alongside other important documents in one place. Our platform ensures that you have access to all your tools when processing essential forms.

-

How secure is the submission of the Pennsylvania REV 65 form using airSlate SignNow?

The security of your documents, including the Pennsylvania REV 65 form, is our top priority. airSlate SignNow employs advanced encryption protocols and security measures to protect your sensitive information. You can confidently send and sign documents knowing that they are safeguarded.

-

What benefits does eSigning the Pennsylvania REV 65 form provide?

eSigning the Pennsylvania REV 65 form through airSlate SignNow offers numerous benefits, including faster processing times and enhanced flexibility. You can sign documents from anywhere, on any device, which simplifies the approval process. Additionally, electronic signatures are legally recognized, ensuring that your submissions are valid.

Get more for Board Of Appeals EPetition Center Business Tax E Services

Find out other Board Of Appeals EPetition Center Business Tax E Services

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word