Form 1120 L U S Life Insurance Company Income Tax Return 2016

What is the Form 1120 L U S Life Insurance Company Income Tax Return

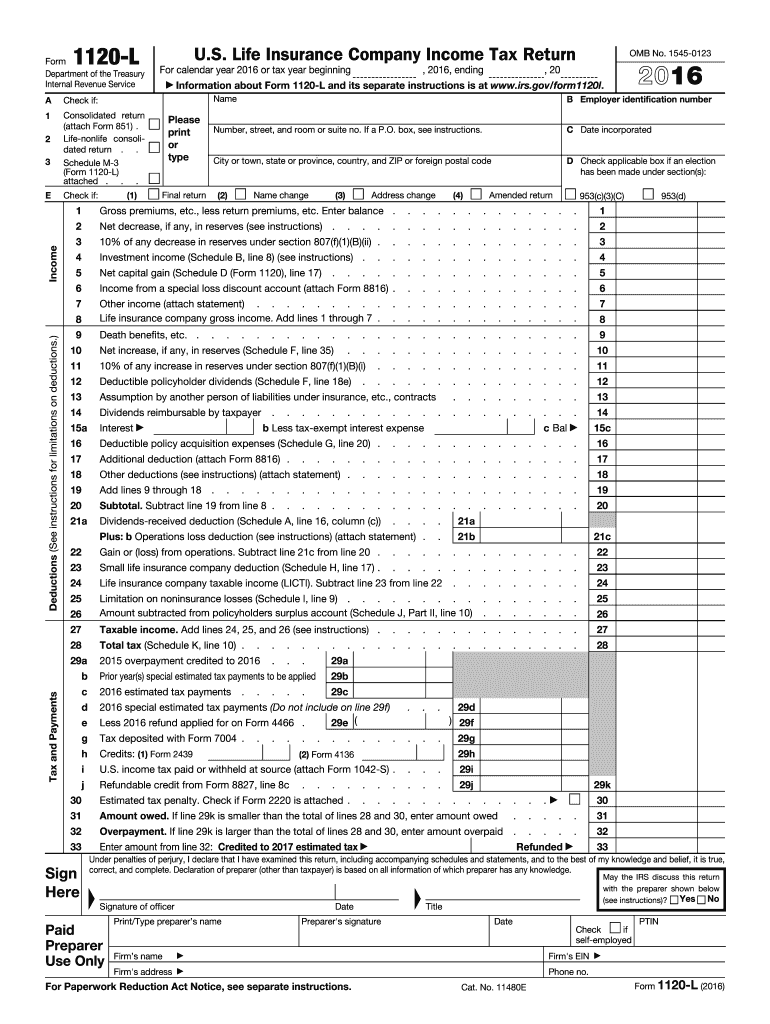

The Form 1120 L U S Life Insurance Company Income Tax Return is a specialized tax form used by life insurance companies operating in the United States. This form is designed to report income, deductions, and tax liabilities specific to life insurance companies, ensuring compliance with federal tax regulations. It is essential for these entities to accurately complete this form to reflect their financial activities and obligations to the Internal Revenue Service (IRS).

How to use the Form 1120 L U S Life Insurance Company Income Tax Return

Using the Form 1120 L involves several steps that require careful attention to detail. Companies must first gather all relevant financial information, including premium income, claims paid, and investment income. After collecting this data, businesses should complete each section of the form, ensuring that all required fields are filled out accurately. It is important to review the form for any discrepancies before submission to avoid potential penalties.

Steps to complete the Form 1120 L U S Life Insurance Company Income Tax Return

Completing the Form 1120 L involves a systematic approach:

- Gather financial records, including income statements and balance sheets.

- Fill out the identification section with the company’s details.

- Report income from premiums and investments in the appropriate sections.

- Deduct allowable expenses, such as claims and operating costs.

- Calculate the taxable income and the corresponding tax liability.

- Review the form for accuracy and completeness.

- Submit the completed form to the IRS by the designated deadline.

Filing Deadlines / Important Dates

Life insurance companies must adhere to specific deadlines for filing the Form 1120 L. Typically, the form is due on the fifteenth day of the third month following the end of the tax year. For companies operating on a calendar year, this means the form is due by March 15. It is crucial for companies to be aware of these deadlines to avoid late filing penalties and ensure compliance with IRS regulations.

Required Documents

To complete the Form 1120 L, several supporting documents are necessary. Companies should prepare:

- Financial statements, including income statements and balance sheets.

- Documentation of premiums received and claims paid.

- Records of investment income and expenses.

- Any applicable schedules or attachments required by the IRS.

Legal use of the Form 1120 L U S Life Insurance Company Income Tax Return

The legal use of the Form 1120 L is mandated by the IRS for all life insurance companies operating in the United States. Filing this form accurately is not only a legal requirement but also a critical component of maintaining good standing with tax authorities. Companies must ensure that they are using the most current version of the form and that it is filled out in accordance with IRS guidelines to avoid legal repercussions.

Quick guide on how to complete 2016 form 1120 l us life insurance company income tax return

Discover the simplest method to complete and sign your Form 1120 L U S Life Insurance Company Income Tax Return

Are you still spending valuable time preparing your official documents on paper instead of handling them online? airSlate SignNow presents a superior way to fill out and sign your Form 1120 L U S Life Insurance Company Income Tax Return and associated forms for public services. Our intelligent eSignature solution provides you with all the tools necessary to manage paperwork swiftly and in compliance with regulatory standards – robust PDF editing, management, protection, signing, and sharing features are easily accessible within a user-friendly platform.

Only a few steps are required to fill out and sign your Form 1120 L U S Life Insurance Company Income Tax Return:

- Load the editable template into the editor using the Get Form option.

- Verify the information you need to input in your Form 1120 L U S Life Insurance Company Income Tax Return.

- Navigate through the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the top menu.

- Emphasize important details or Obscure sections that are no longer relevant.

- Select Sign to create a legally enforceable eSignature using any method of your choice.

- Add the Date next to your signature and finalize your work with the Done button.

Store your finished Form 1120 L U S Life Insurance Company Income Tax Return in the Documents folder of your account, download it, or transfer it to your chosen cloud storage. Our platform also facilitates easy form sharing. There's no need to print your documents when sending them to the appropriate public office - use email, fax, or request a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1120 l us life insurance company income tax return

FAQs

-

Recently I received intimation u/s 143(1) (a) of Income Tax Act, 1961. Though I filled IT Return within time and with correct information about my Income according to my Form 16. Now what should I do?

This shouldn't be much of of a problem. This is usually sent where there is a mismatch between the income tax department records and the return filed. You could follow the steps mentioned below:Go through your Form 16 thoroughly and compare the same with your return filedCheck whether you claimed any loss in that year but filed tour return after the due dateCheck whether you have offered all your income to tax including your FD interest income, if anyCheck if there are any airthmetical errorsOnce you have identified the error, you could rectify by filing a revised return.In case there is no error, you could file a reply to the department explaining the causes along with supportings and also specifying why your claim should be accepted.In case you need further help in this regard, please contact me at anr.invests@gmail.com and provide necessary documents to take this forward.Stay tuned and click on Follow for further updates and information regarding my upcoming blog on investing, taxes and policy review.Disclaimer: The above answer is a personal opinion of the author. This does not provide a binding or legal opinion on the issue and should not be construed to be a professional advice. Please contact a tax expert before taking any position on the above. The answer provided was only for information purposes.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1120 l us life insurance company income tax return

How to create an eSignature for your 2016 Form 1120 L Us Life Insurance Company Income Tax Return online

How to create an eSignature for the 2016 Form 1120 L Us Life Insurance Company Income Tax Return in Chrome

How to generate an eSignature for putting it on the 2016 Form 1120 L Us Life Insurance Company Income Tax Return in Gmail

How to create an electronic signature for the 2016 Form 1120 L Us Life Insurance Company Income Tax Return straight from your mobile device

How to generate an eSignature for the 2016 Form 1120 L Us Life Insurance Company Income Tax Return on iOS

How to create an electronic signature for the 2016 Form 1120 L Us Life Insurance Company Income Tax Return on Android OS

People also ask

-

What is the Form 1120 L U S Life Insurance Company Income Tax Return?

The Form 1120 L U S Life Insurance Company Income Tax Return is a tax return specifically designed for life insurance companies in the United States. It provides a detailed account of a company's income, deductions, and tax liabilities. Properly completing this form ensures compliance with IRS regulations and helps avoid potential penalties.

-

How can airSlate SignNow help in preparing the Form 1120 L U S Life Insurance Company Income Tax Return?

AirSlate SignNow offers a streamlined process for preparing and electronically signing the Form 1120 L U S Life Insurance Company Income Tax Return. With its versatile features, businesses can easily collaborate, review, and finalize their tax documents securely. This enhances efficiency and reduces the time spent on paperwork.

-

What are the pricing options for airSlate SignNow when dealing with the Form 1120 L U S Life Insurance Company Income Tax Return?

AirSlate SignNow offers competitive pricing plans to accommodate varying business needs, which include provisions for handling the Form 1120 L U S Life Insurance Company Income Tax Return. You can choose from monthly or annual subscriptions, enabling flexibility and cost-effectiveness according to your specific requirements.

-

What features does airSlate SignNow provide to assist with the Form 1120 L U S Life Insurance Company Income Tax Return?

AirSlate SignNow includes features such as electronic signatures, document templates, and automated workflows that simplify the preparation of the Form 1120 L U S Life Insurance Company Income Tax Return. These tools enhance accuracy and save time, making tax season less stressful for businesses.

-

Are there specific integrations available for preparing the Form 1120 L U S Life Insurance Company Income Tax Return?

Yes, airSlate SignNow integrates with various accounting and financial software that can assist in preparing the Form 1120 L U S Life Insurance Company Income Tax Return. This integration ensures a seamless flow of information, reducing data entry errors and improving overall efficiency in document management.

-

What are the benefits of using airSlate SignNow for the Form 1120 L U S Life Insurance Company Income Tax Return?

Using airSlate SignNow provides numerous benefits, including enhanced security for sensitive tax information, easy access from any device, and the ability to track the status of documents. These advantages ensure that your Form 1120 L U S Life Insurance Company Income Tax Return is managed professionally and efficiently.

-

Can airSlate SignNow help with eSigning the Form 1120 L U S Life Insurance Company Income Tax Return?

Absolutely! AirSlate SignNow allows for the easy and legally binding eSigning of the Form 1120 L U S Life Insurance Company Income Tax Return. This feature not only speeds up the signing process but also eliminates the need for printing and mailing, making it a more environmentally friendly option.

Get more for Form 1120 L U S Life Insurance Company Income Tax Return

- Form 19 release of student information our lady of victory school

- Ha 0780 0510p form

- Signature verification form nyc gov nyc

- Florida certificate of fetal death form

- Software nda agreement template form

- Software master service agreement template form

- Software non disclosure agreement template form

- Software maintenance and support agreement template form

Find out other Form 1120 L U S Life Insurance Company Income Tax Return

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile