Form Company Tax 2014

What is the Form Company Tax

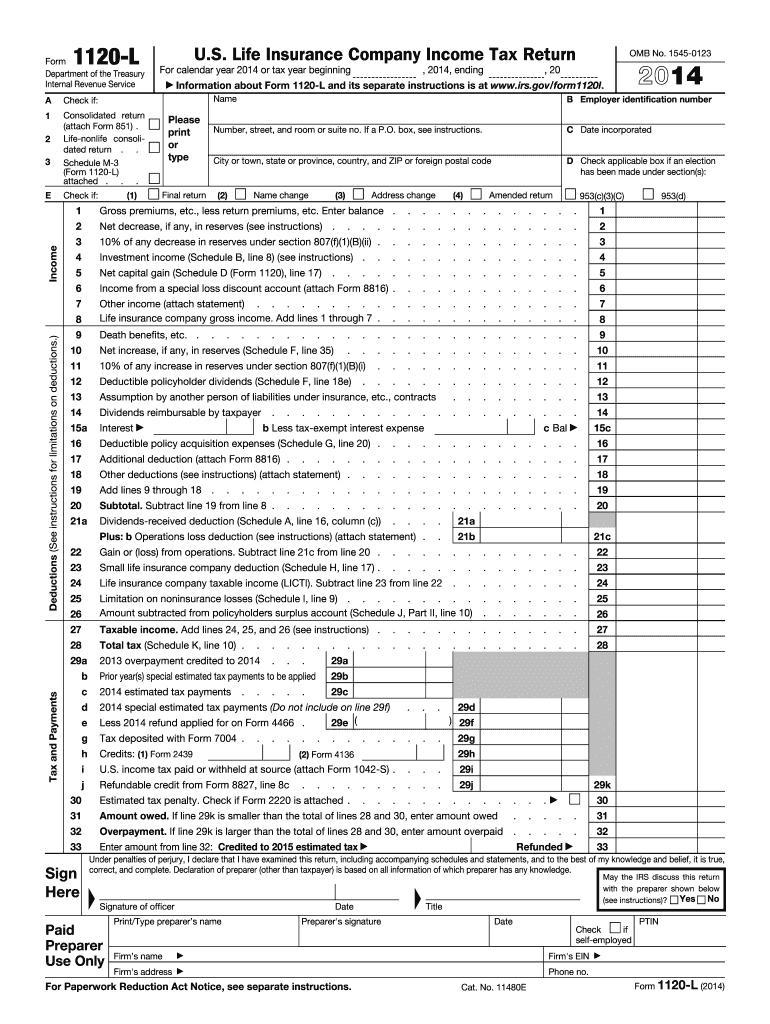

The Form Company Tax is a crucial document used by businesses in the United States to report their income, expenses, and other tax-related information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax laws and accurately calculating the amount of tax owed. Different business entities, including corporations, partnerships, and limited liability companies (LLCs), may have specific versions of this form tailored to their structure. Understanding the purpose and requirements of the Form Company Tax is vital for any business owner.

How to use the Form Company Tax

Using the Form Company Tax involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with precise information regarding your business's financial activities for the tax year. It is important to review the form carefully for any errors before submission. Depending on your business structure, you may need to attach additional schedules or forms. Once completed, submit the form to the IRS by the designated deadline.

Steps to complete the Form Company Tax

Completing the Form Company Tax requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income and expense records.

- Download the correct version of the form based on your business entity type.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any mistakes or missing information.

- Attach any necessary schedules or additional documentation.

- Submit the form electronically or via mail, as per IRS guidelines.

Legal use of the Form Company Tax

The legal use of the Form Company Tax is essential for compliance with U.S. tax laws. Businesses must use the most current version of the form to avoid penalties or issues with the IRS. Additionally, it is important to ensure that all information provided is truthful and accurate. Misrepresentation or errors can lead to audits or legal consequences. Keeping records of submitted forms and any correspondence with the IRS is also advisable for legal protection.

Filing Deadlines / Important Dates

Filing deadlines for the Form Company Tax vary based on the business entity type and the tax year. Generally, corporations must file by the fifteenth day of the fourth month following the end of their fiscal year, while partnerships and LLCs may have different deadlines. It is crucial to be aware of these dates to avoid late fees and penalties. Marking important dates on your calendar can help ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Form Company Tax. The IRS allows electronic filing, which is often faster and more efficient. Alternatively, businesses can mail their completed forms to the appropriate IRS address. In-person submissions are typically not available, but certain tax professionals may offer assistance in filing. Regardless of the method chosen, it is important to keep a copy of the submitted form for your records.

Quick guide on how to complete 2014 form company tax

Uncover the most efficient method to complete and endorse your Form Company Tax

Are you still spending time handling your formal paperwork on physical copies instead of processing it online? airSlate SignNow provides a superior way to complete and endorse your Form Company Tax and associated forms for public services. Our advanced eSignature solution equips you with everything required to manage documents swiftly and in compliance with official standards - robust PDF editing, organizing, securing, signing, and sharing capabilities all available within an intuitive interface.

There are just a few steps needed to finalize the completion and endorsement of your Form Company Tax:

- Add the editable template to the editor using the Get Form button.

- Verify what details you need to include in your Form Company Tax.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is crucial or Obscure sections that are no longer relevant.

- Select Sign to generate a legally binding eSignature using any method you prefer.

- Add the Date alongside your signature and conclude your task with the Done button.

Store your completed Form Company Tax in the Documents folder within your profile, download it, or export it to your favorite cloud storage. Our solution also facilitates flexible file sharing. There’s no need to print your forms when you need to submit them to the appropriate public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 2014 form company tax

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What is your view on Subramanian Swamy’s statement of abolishing income tax?

Q : What's your take on Subramanian Swamy calling for the abolition of IT?A : Even if the message is right, it has to be shared at at the right time and at a right place. I do not think the present time is right to abolish Income Tax. Income Tax is direct tax which the tax payer has to pay from his pocket while GST is indirect tax which is included in the price of the product itself. Needless to mention that all the people whether poor or rich pay GST whereas only those who have their income above taxable limit pay income tax. Therefore, in a way GST is compulsory while while paying Income Tax the businessman do resort to certain accounting jugglery to evade tax.Ideally the direct taxes should get more revenue to government treasury than indirect taxes so that the burden of taxes goes on shoulder of the rich than the poor. However in India whose population is around 132+ crore not even 10 crore people pay income tax. Although the gross revenue figure out of income tax has increased by around 84% since 2014, it it still less. The tax base needs to be enhanced to include more and more people. This is still not the case in India.Many film actors like the Bachchans and the Kapoors are agriculturists who club their unaccounted income as agricultural income and evade the tax. These are really rich people who should be paying 30% income tax, however, because of the prevailing legal provisions these people legalize their black money without paying any tax. Therefore, for abolishing income tax, I don’t think this is the right time. Let at least 25% of middle aged Indians start paying some income tax and more specifically the some tax be levied on agriculture. After this move the threshold income tax rates can be lowered and basic exemption limits can be enhanced.However, the income tax cannot be abolished.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the 2014 form company tax

How to create an electronic signature for your 2014 Form Company Tax online

How to make an electronic signature for your 2014 Form Company Tax in Google Chrome

How to generate an electronic signature for putting it on the 2014 Form Company Tax in Gmail

How to create an eSignature for the 2014 Form Company Tax straight from your smart phone

How to generate an electronic signature for the 2014 Form Company Tax on iOS

How to generate an electronic signature for the 2014 Form Company Tax on Android

People also ask

-

What is the process to Form Company Tax using airSlate SignNow?

To Form Company Tax using airSlate SignNow, simply create your document template, input the necessary tax information, and send it out for eSignature. Our platform allows you to streamline the entire process, ensuring compliance and accuracy in your tax forms. With user-friendly features, you can easily track the status of your document in real-time.

-

How does airSlate SignNow help simplify Form Company Tax?

airSlate SignNow simplifies the Form Company Tax process by providing an easy-to-use interface for creating and managing documents. With automation features, you can reduce manual errors and save time on tax compliance tasks. This efficiency allows your team to focus on more strategic activities.

-

What pricing plans are available for businesses needing to Form Company Tax?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses looking to Form Company Tax. Each plan includes essential features, unlimited document sends, and user support. Explore our pricing pages to find a plan that best fits your company size and budget.

-

Are there any features in airSlate SignNow that assist with Form Company Tax compliance?

Yes, airSlate SignNow includes features specifically designed to assist with Form Company Tax compliance. This includes secure eSignature capabilities, document templates that adhere to tax regulations, and audit trails for record-keeping purposes. These tools ensure that your documents meet regulatory requirements.

-

Can I integrate airSlate SignNow with my existing accounting software for Form Company Tax?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software. This capability allows you to easily import and export data while ensuring that your Form Company Tax process is streamlined and efficient.

-

What are the benefits of using airSlate SignNow to Form Company Tax compared to traditional methods?

Using airSlate SignNow to Form Company Tax provides numerous benefits over traditional methods, such as increased speed, reduced paperwork, and improved accuracy. The eSignature process allows for quick approvals, while automated workflows minimize human error. Overall, it enhances productivity and ensures timely submissions.

-

Is there customer support available for issues related to Form Company Tax?

Yes, airSlate SignNow offers dedicated customer support for any issues related to Form Company Tax. Our support team can assist you via various channels, including chat, email, and phone. We are committed to ensuring your experience is seamless and that all your questions are addressed promptly.

Get more for Form Company Tax

- Illustrator letter of agreement form

- Order for possession 32612 ccm n114 in the circuit court of cook county illinois municipal department district plaintiffs no 12 form

- Fenwick rebate form

- Commerce township building department form

- Ration card assam pdf form

- Rcp e 74b 1 lawyers certificate of service of application for a certificate of appointment of estate trustee form

- Doh 669 321 form

- Software distribution agreement template form

Find out other Form Company Tax

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template