Form 1120 L 2015

What is the Form 1120 L

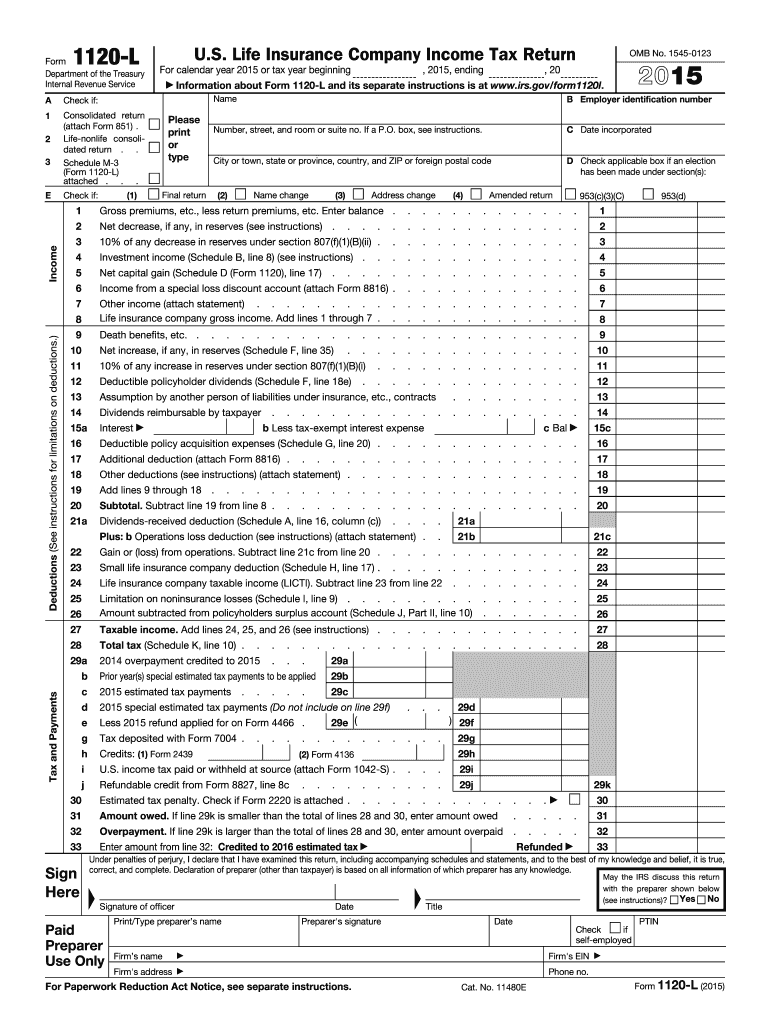

The Form 1120 L is a specific tax form used by life insurance companies in the United States to report their income, deductions, and tax liability. This form is essential for life insurance corporations to comply with federal tax regulations. It allows these companies to detail their financial activities, ensuring transparency and adherence to the Internal Revenue Service (IRS) guidelines. By using Form 1120 L, life insurance companies can accurately calculate their taxable income and determine their tax obligations.

How to use the Form 1120 L

To use Form 1120 L effectively, life insurance companies must first gather all necessary financial information, including income, expenses, and deductions. The form requires specific details about the company's operations, including premiums collected, claims paid, and investment income. Once all information is compiled, the company can fill out the form, ensuring that all sections are completed accurately. After completing the form, it should be reviewed for any errors before submission to the IRS.

Steps to complete the Form 1120 L

Completing Form 1120 L involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the identification section with the company’s name, address, and Employer Identification Number (EIN).

- Report total income, including premiums and investment earnings.

- Detail deductions such as claims paid and operating expenses.

- Calculate the taxable income and the tax due.

- Review the form for accuracy and completeness.

- Submit the completed form to the IRS by the designated deadline.

Filing Deadlines / Important Dates

Life insurance companies must adhere to specific filing deadlines for Form 1120 L. Typically, the form is due on the fifteenth day of the third month following the end of the tax year. For companies operating on a calendar year, this means the form is due by March 15. If additional time is needed, companies can file for an extension, which allows for an additional six months to submit the form. However, any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 1120 L can be submitted in various ways, depending on the preferences of the filing company. The IRS allows for electronic filing, which can streamline the submission process and reduce the likelihood of errors. Alternatively, companies may choose to mail the completed form to the appropriate IRS address. In-person submissions are generally not available for this form, as the IRS encourages electronic or mailed submissions to ensure proper processing.

Legal use of the Form 1120 L

The legal use of Form 1120 L is crucial for compliance with federal tax laws. Life insurance companies must use this form to accurately report their financial activities to the IRS. Failure to use the correct form or to provide accurate information can result in penalties or audits. It is essential for companies to ensure that they are using the most current version of the form and that all information provided is truthful and complete.

Quick guide on how to complete form 1120 l 2015

Discover the most efficient method to complete and endorse your Form 1120 L

Are you still spending time preparing your important documents on paper instead of online? airSlate SignNow provides a superior way to complete and endorse your Form 1120 L and associated forms for public services. Our advanced electronic signature solution equips you with everything necessary to handle documents swiftly and in alignment with official standards - robust PDF editing, managing, securing, signing, and sharing tools all readily available within an intuitive interface.

There are only a few steps needed to successfully complete and endorse your Form 1120 L:

- Upload the editable template to the editor using the Get Form option.

- Verify what information you need to enter in your Form 1120 L.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize the important parts or Obscure sections that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finalized Form 1120 L in the Documents folder within your profile, download it, or export it to your chosen cloud storage. Our solution also offers flexible form sharing options. There’s no need to print your forms when you need to submit them to the appropriate public office - do so via email, fax, or by requesting USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct form 1120 l 2015

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

What is the link for filling out the CAT 2015 form?

CAT 2014

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

What is last date for filling out an application form for the MH MBA CET 2015?

Pramesh Shrivastava Does Glocal provide long distance MBA as well. Any update would be really appreciated.

Create this form in 5 minutes!

How to create an eSignature for the form 1120 l 2015

How to generate an electronic signature for your Form 1120 L 2015 online

How to make an electronic signature for your Form 1120 L 2015 in Google Chrome

How to create an eSignature for signing the Form 1120 L 2015 in Gmail

How to generate an eSignature for the Form 1120 L 2015 from your smartphone

How to make an eSignature for the Form 1120 L 2015 on iOS devices

How to make an electronic signature for the Form 1120 L 2015 on Android

People also ask

-

What is Form 1120 L and who needs it?

Form 1120 L is a specific tax return form for life insurance companies to report their income, gains, losses, and deductions. It is essential for life insurance businesses to accurately file this form to comply with IRS regulations and avoid penalties.

-

How can airSlate SignNow help with Form 1120 L?

airSlate SignNow simplifies the process of preparing and submitting Form 1120 L by providing an intuitive platform for eSigning and sending documents securely. This ensures that your important tax documentation is handled efficiently and in compliance with regulations.

-

Is there a cost associated with using airSlate SignNow for submitting Form 1120 L?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Whether you are a small business or a large corporation, you can find a plan that allows you to access the necessary features for managing forms like Form 1120 L effectively.

-

What features does airSlate SignNow offer for handling Form 1120 L?

airSlate SignNow provides features such as document templates, eSigning, and secure storage, making it easier to manage Form 1120 L. These tools enhance collaboration, streamline workflows, and ensure that all paperwork is organized and accessible.

-

Can I integrate airSlate SignNow with other tools for Form 1120 L preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, allowing you to enhance your efficiency when dealing with Form 1120 L. This integration helps ensure that all relevant data can be easily transferred and processed.

-

What are the benefits of using airSlate SignNow for eSigning Form 1120 L?

Using airSlate SignNow for eSigning Form 1120 L offers numerous benefits such as reducing turnaround times, increasing document security, and providing an audit trail for compliance purposes. You can confidently send and receive signed documents at any time, facilitating a smooth filing process.

-

How secure is airSlate SignNow when handling Form 1120 L?

airSlate SignNow prioritizes security by employing encryption and compliance measures that safeguard sensitive documents like Form 1120 L. This means your tax information is protected and only accessible to authorized users, ensuring confidentiality and trustworthiness.

Get more for Form 1120 L

- Regional kardex adult acute version medicines governance team medicinesgovernance hscni form

- Savers admin form

- Su594 form

- Redeterminationforms

- Wohnungsbescheinigung form

- Modifier59 website article 11 doc the icd 10 transition an introduction cms form

- Inpatient prospective payment system hospital and long term form

- Software integration agreement template form

Find out other Form 1120 L

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later