Payment Coupon 2018

What is the Payment Coupon

The 2018 payment coupon is a form used by taxpayers to submit payments for their tax liabilities. It serves as a convenient method for individuals and businesses to ensure that their payments are processed correctly and on time. The coupon typically includes essential details such as the taxpayer's identification information, payment amount, and the tax period for which the payment is being made. Using a payment coupon helps streamline the payment process and can reduce the likelihood of errors in submission.

How to use the Payment Coupon

To use the 2018 payment coupon effectively, follow these steps:

- Obtain the correct coupon for your tax type, ensuring it corresponds to the year and tax period.

- Fill in your personal or business information accurately, including your name, address, and taxpayer identification number.

- Indicate the payment amount clearly, ensuring it matches your tax liability for the specified period.

- Review the completed coupon for accuracy before submitting it.

Once the coupon is filled out, it can be submitted via mail or electronically, depending on the guidelines provided by the IRS or state tax authority.

Steps to complete the Payment Coupon

Completing the 2018 payment coupon involves several key steps:

- Download or print the payment coupon from the official tax authority website.

- Enter your taxpayer information in the designated fields, ensuring all details are current and correct.

- Specify the payment amount, making sure it is accurate and reflects your tax obligations.

- Sign and date the coupon if required, confirming that the information provided is true to the best of your knowledge.

- Submit the coupon according to the instructions provided, either by mailing it to the appropriate address or submitting it electronically if allowed.

Legal use of the Payment Coupon

The 2018 payment coupon is legally recognized as a valid method for submitting tax payments. It is essential to use the correct form and ensure that all information is filled out accurately to avoid any legal complications. Taxpayers should retain a copy of the completed coupon and any confirmation of payment for their records. This documentation may be necessary in case of audits or disputes regarding payment status.

Filing Deadlines / Important Dates

Filing deadlines for the 2018 payment coupon are crucial to avoid penalties and interest. Generally, payments should be made by the tax due date, which is typically April 15 for individual taxpayers. However, specific deadlines may vary based on the type of tax being paid and any extensions that may apply. It is advisable to check with the IRS or state tax authority for the most accurate and up-to-date information regarding important dates.

IRS Guidelines

The IRS provides specific guidelines for using the 2018 payment coupon. These guidelines include instructions on how to fill out the form correctly, submission methods, and payment options. Taxpayers should familiarize themselves with these guidelines to ensure compliance and avoid potential issues. Following IRS instructions helps ensure that payments are processed efficiently and accurately, reducing the risk of penalties.

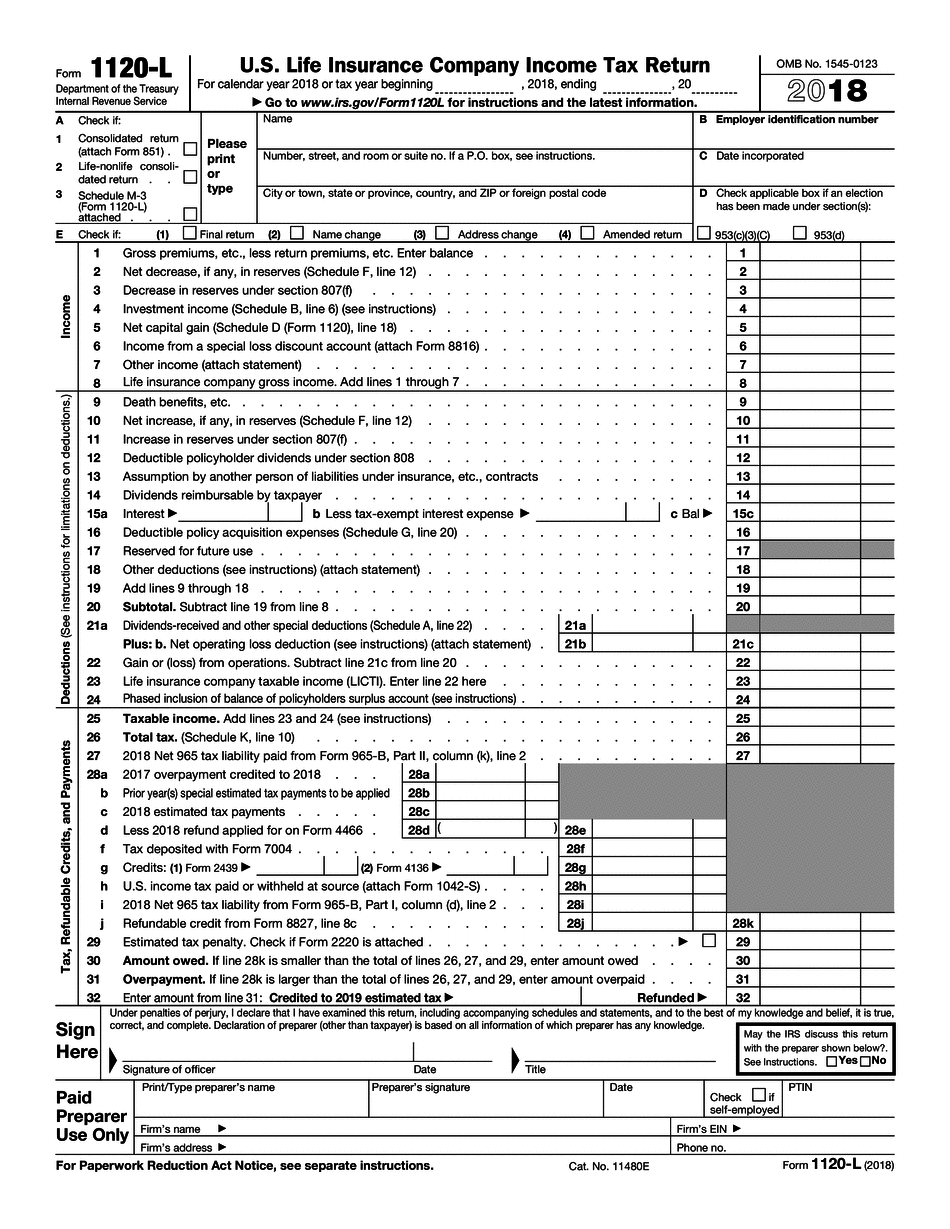

Quick guide on how to complete 1120 l 2018 2019 form

Uncover the simplest approach to complete and endorse your Payment Coupon

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior method to finalize and endorse your Payment Coupon and associated forms for public services. Our intelligent electronic signature solution provides you with all the tools necessary to manage documentation swiftly and in compliance with legal standards - robust PDF editing, administration, safeguarding, signing, and sharing tools all accessible in an easy-to-use interface.

Only a few steps are required to fill in and endorse your Payment Coupon:

- Incorporate the fillable template into the editor using the Get Form button.

- Verify the information you need to supply in your Payment Coupon.

- Navigate between the fields with the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Modify the content with Text boxes or Images from the top menu.

- Emphasize what is truly important or Hide sections that are no longer relevant.

- Select Sign to create a legally enforceable electronic signature using your preferred method.

- Include the Date next to your signature and conclude your task with the Done button.

Store your finished Payment Coupon in the Documents directory within your profile, download it, or transfer it to your preferred cloud storage. Our solution also provides versatile file sharing. There’s no necessity to print your templates when you need to submit them to the appropriate public office - accomplish it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 1120 l 2018 2019 form

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the 1120 l 2018 2019 form

How to make an electronic signature for your 1120 L 2018 2019 Form in the online mode

How to create an eSignature for your 1120 L 2018 2019 Form in Google Chrome

How to make an electronic signature for signing the 1120 L 2018 2019 Form in Gmail

How to generate an eSignature for the 1120 L 2018 2019 Form straight from your smart phone

How to make an electronic signature for the 1120 L 2018 2019 Form on iOS

How to make an electronic signature for the 1120 L 2018 2019 Form on Android OS

People also ask

-

What is a 2018 payment coupon for airSlate SignNow?

The 2018 payment coupon for airSlate SignNow is a promotional offer that allows users to access discounts on their subscription plans. This coupon provides a cost-effective way to utilize our eSigning services, making it easier for businesses to manage documents.

-

How can I redeem my 2018 payment coupon?

To redeem your 2018 payment coupon for airSlate SignNow, simply enter the coupon code during the checkout process on our website. Ensure that the code is entered correctly to apply the discount to your chosen subscription plan.

-

Does the 2018 payment coupon apply to all subscription plans?

Yes, the 2018 payment coupon can be applied to all available subscription plans of airSlate SignNow. This gives you the flexibility to choose the plan that best fits your business needs while enjoying a reduced rate.

-

What are the main features included with airSlate SignNow subscriptions?

With airSlate SignNow subscriptions, users gain access to a range of features, including unlimited document signing, templates, and team collaboration tools. The platform is designed to streamline the eSigning process and enhance document management efficiency.

-

What benefits can businesses expect from using airSlate SignNow?

Businesses can expect signNowly reduced turnaround times for documents and enhanced security for sensitive information. The airSlate SignNow platform, combined with the 2018 payment coupon, ensures that companies can adopt a reliable and cost-effective solution.

-

Are there any integration options available with airSlate SignNow?

AirSlate SignNow offers seamless integration with popular applications like Google Drive, Dropbox, and Salesforce. These integrations make it easier to manage documents from various platforms and enhance overall workflow efficiency.

-

How can I find additional discounts for airSlate SignNow in the future?

Keep an eye on our official website and subscribe to our newsletter for updates on special promotions and future discounts, including any 2018 payment coupons that may still be available. We frequently offer exclusive deals to help you save on your subscriptions.

Get more for Payment Coupon

- 21 final default judgment of divorce final default judgment of divorce form

- 2848 form

- Nj workers compensation adjournment form

- Patient follow up sheet form

- Form itr 1 indian tax solutions

- B6f continuation fill in formform 1207

- Software project agreement template form

- Software pilot agreement template form

Find out other Payment Coupon

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form