When to Use Tax Form 4137 Tax on Unreported Tip Income 2022

Understanding Tax Form 4137 for Unreported Tip Income

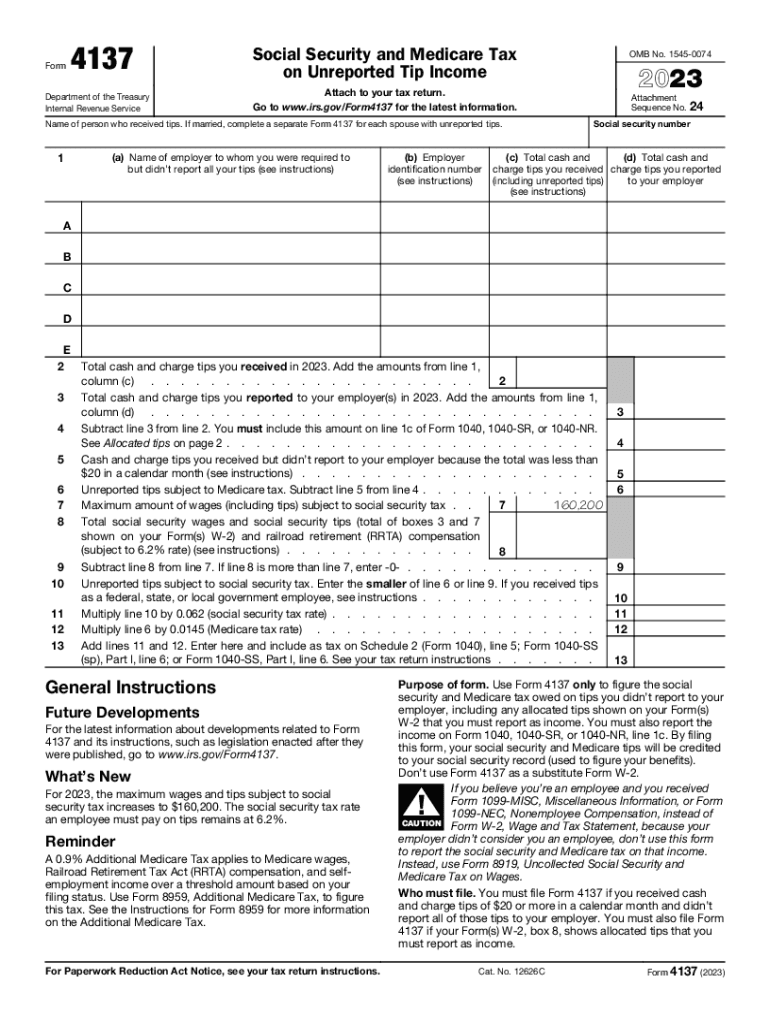

Tax Form 4137 is specifically designed for reporting unreported tip income. This form is crucial for employees who receive tips that are not reported to their employer. It ensures that all income is accounted for when filing taxes. Typically, this form is used by individuals in the service industry, such as waitstaff or hairdressers, where tipping is common. By using Form 4137, taxpayers can accurately report their tip income, which is essential for compliance with IRS regulations.

How to Complete Tax Form 4137

Completing Tax Form 4137 involves several steps. First, gather all necessary information regarding your unreported tips for the tax year. This includes the total amount of tips received and any tips reported to your employer. Next, fill out the form by entering your personal information, such as your name and Social Security number. Then, calculate the total unreported tips and enter this amount on the form. Finally, ensure that you sign and date the form before submitting it with your tax return.

Obtaining Tax Form 4137

Tax Form 4137 can be obtained directly from the IRS website or through tax preparation software. It is available as a downloadable PDF, which allows you to print and fill it out manually. Additionally, many tax professionals can provide this form as part of their services. Ensure you have the most current version of the form to avoid any issues during filing.

Key Elements of Tax Form 4137

Several key elements are essential when filling out Tax Form 4137. These include:

- Personal Information: Your name, address, and Social Security number.

- Total Unreported Tips: This is the total amount of tips you received that were not reported to your employer.

- Employer Information: The name and address of your employer, if applicable.

- Signature: Your signature and the date are required to validate the form.

Filing Deadlines for Tax Form 4137

It is important to be aware of the filing deadlines associated with Tax Form 4137. Generally, this form should be submitted along with your annual tax return by April 15 of the following year. If you are unable to meet this deadline, you may file for an extension, but ensure that you still report any unreported tips to avoid penalties.

Penalties for Non-Compliance

Failing to report unreported tip income using Tax Form 4137 can lead to significant penalties. The IRS may impose fines for underreporting income, which can include both monetary penalties and interest on unpaid taxes. It is crucial to accurately report all income to avoid these consequences and ensure compliance with tax regulations.

Quick guide on how to complete when to use tax form 4137 tax on unreported tip income

Complete When To Use Tax Form 4137 Tax On Unreported Tip Income seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to access the correct form and securely store it on the web. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without any hiccups. Handle When To Use Tax Form 4137 Tax On Unreported Tip Income on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign When To Use Tax Form 4137 Tax On Unreported Tip Income effortlessly

- Find When To Use Tax Form 4137 Tax On Unreported Tip Income and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the instruments that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere moments and holds the same legal significance as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign When To Use Tax Form 4137 Tax On Unreported Tip Income while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct when to use tax form 4137 tax on unreported tip income

Create this form in 5 minutes!

How to create an eSignature for the when to use tax form 4137 tax on unreported tip income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tax Form 4137 and why is it important?

Tax Form 4137 is used to report Unreported Tip Income for individuals who receive tips. Understanding when to use Tax Form 4137 is crucial to ensure compliance with tax regulations and avoid potential penalties. This form allows workers in the service industry to report income that may not have been fully declared.

-

When should I consider using Tax Form 4137?

You should use Tax Form 4137 when you have received tip income but did not report it to your employer. Knowing when to use Tax Form 4137 is essential for accurately reporting your income, particularly if you work in professions like hospitality or personal services where tips are common.

-

How does airSlate SignNow help with Tax Form 4137?

AirSlate SignNow simplifies the process of eSigning and sending Tax Form 4137. By using our platform, you can easily manage your tax documents in a secure and efficient manner. Our solution empowers you to quickly complete and file necessary documents, including Tax Form 4137.

-

Are there costs associated with using airSlate SignNow for tax forms?

Yes, there are subscription plans for airSlate SignNow that cater to different needs, providing a cost-effective solution for managing documents. When considering pricing, think about the benefits regarding the ease of signing and sending forms like Tax Form 4137. We offer various features to ensure you get the most out of your investment.

-

Can I integrate airSlate SignNow with other business tools?

Absolutely! airSlate SignNow supports integrations with a variety of business applications, enhancing your workflow. When to use Tax Form 4137 becomes even more efficient as you can integrate it with your existing software, reducing time spent on manual entries.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow offers features such as eSignatures, document templates, and tracking capabilities. These features ensure that when to use Tax Form 4137 is streamlined, allowing you to manage and submit your tax forms securely. Our platform also offers cloud storage for easy access to your documents.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with various legal and tax regulations, ensuring your documents are handled appropriately. When using our platform for forms such as Tax Form 4137, you can trust that your data is secure and your submissions meet regulatory standards.

Get more for When To Use Tax Form 4137 Tax On Unreported Tip Income

- Eagle ridge middle school mathcounts permission form 2017

- 2019 college softbal form

- Lsus transcript request form

- Declaration of intent examples form

- John william tamblyn auburn university cla auburn form

- Thank you for your interest in the spalding university rn to bsn program form

- Performance rubric

- Forms library policies amp forms student resources college of

Find out other When To Use Tax Form 4137 Tax On Unreported Tip Income

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation