Schedule M Form 990 Noncash Contributions 2022

What is the Schedule M Form 990 Noncash Contributions

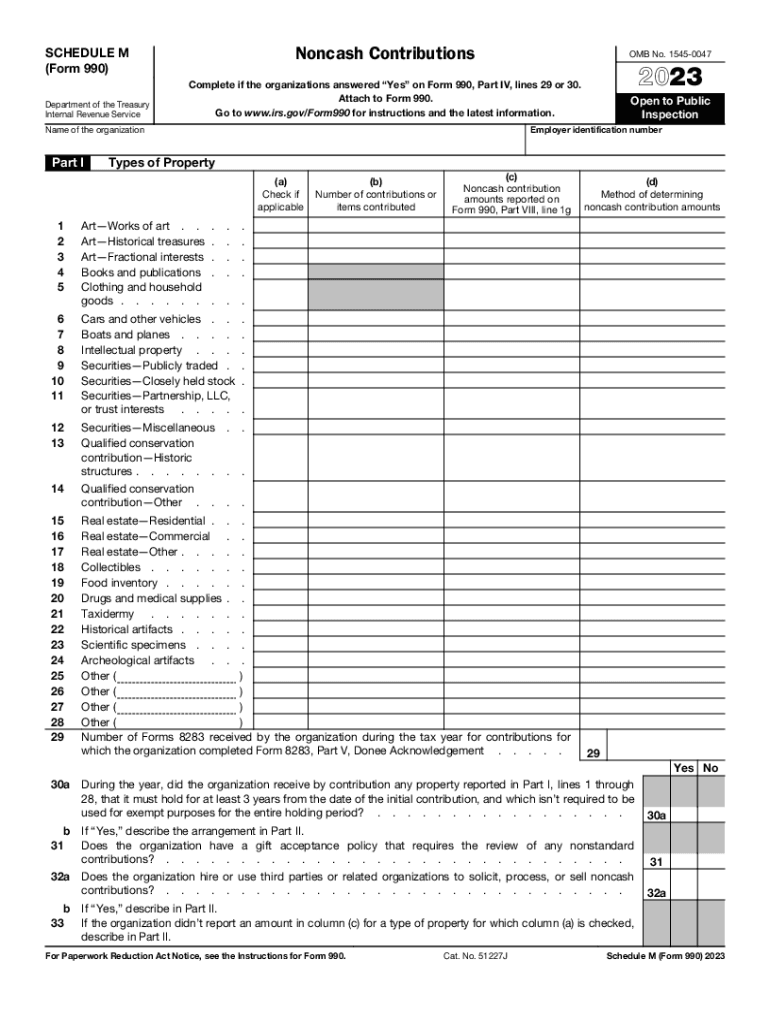

The Schedule M Form 990 is a document used by tax-exempt organizations to report noncash contributions. This form is specifically designed to provide detailed information about the types and values of noncash donations received during the tax year. Noncash contributions can include items such as clothing, vehicles, or real estate, which are not cash donations but still hold significant value for the organization. Understanding this form is crucial for compliance with IRS regulations and for accurately reporting the contributions that support the organization's mission.

How to use the Schedule M Form 990 Noncash Contributions

Using the Schedule M Form 990 involves several key steps. First, organizations must gather all relevant information about noncash contributions, including descriptions, fair market values, and the dates of receipt. Next, this information should be accurately recorded on the form, ensuring that all required fields are completed. It is also essential to maintain documentation for each noncash contribution, as this will support the values reported on the Schedule M and may be necessary for IRS audits. Finally, the completed form must be submitted along with the organization's main Form 990, ensuring that it is filed by the appropriate deadline.

Steps to complete the Schedule M Form 990 Noncash Contributions

Completing the Schedule M Form 990 requires a systematic approach:

- Collect documentation for all noncash contributions, including receipts and appraisals.

- Determine the fair market value of each noncash item at the time of donation.

- Fill out the Schedule M form, providing detailed descriptions and values for each contribution.

- Review the form for accuracy and completeness before submission.

- Submit the Schedule M along with the main Form 990 by the filing deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule M Form 990. Organizations must adhere to these guidelines to ensure compliance and avoid penalties. Key points include accurately reporting the fair market value of noncash contributions, maintaining proper documentation, and following the instructions provided in the IRS Form 990 instructions. Organizations should also be aware of the potential for audits and ensure that all reported values can be substantiated with appropriate evidence.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule M Form 990 align with the deadlines for the primary Form 990. Generally, tax-exempt organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May 15. Extensions may be available, but organizations should be aware of the implications of late filings and ensure they submit all required forms on time to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the requirements for the Schedule M Form 990 can result in significant penalties. Organizations may face fines for late filings, inaccuracies, or failure to report noncash contributions altogether. The IRS may impose penalties based on the size of the organization and the duration of the non-compliance. It is essential for organizations to understand these risks and take proactive measures to ensure that all forms are completed accurately and submitted on time.

Quick guide on how to complete schedule m form 990 noncash contributions

Complete Schedule M Form 990 Noncash Contributions effortlessly on any device

Digital document management has become popular with both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct version and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule M Form 990 Noncash Contributions on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Schedule M Form 990 Noncash Contributions easily

- Locate Schedule M Form 990 Noncash Contributions and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight relevant portions of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule M Form 990 Noncash Contributions to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule m form 990 noncash contributions

Create this form in 5 minutes!

How to create an eSignature for the schedule m form 990 noncash contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can I use it to schedule m?

airSlate SignNow is an intuitive platform that allows users to send and eSign documents efficiently. To schedule m, simply use our tools to set up reminders and deadlines for document signing, ensuring that all parties are aligned.

-

How much does it cost to use airSlate SignNow for schedule m?

Pricing for airSlate SignNow varies based on the plan you choose. Whether you're a solo user or a team, you can select a cost-effective solution that fits your needs to streamline your schedule m and document management.

-

What features support scheduling in airSlate SignNow?

airSlate SignNow offers features specifically designed to enhance your scheduling capabilities, such as automated reminders and customizable workflows. These features ensure that your schedule m remains organized and efficient.

-

Can I integrate airSlate SignNow with other applications for schedule m?

Yes, airSlate SignNow seamlessly integrates with various popular applications to help streamline your schedule m. By connecting tools you already use, you can create a cohesive document workflow that enhances efficiency.

-

What are the benefits of using airSlate SignNow for my schedule m?

Using airSlate SignNow for your schedule m simplifies the eSigning process and saves time. It eliminates the hassle of paper documents while providing a secure and trackable environment for your important agreements.

-

Is airSlate SignNow safe to use for sensitive documents during schedule m?

Absolutely, airSlate SignNow prioritizes security and uses encryption to protect sensitive documents. You can confidently manage your schedule m knowing that your information is kept safe and secure.

-

How do I get started with airSlate SignNow for schedule m?

To get started with airSlate SignNow for schedule m, simply sign up for an account on our website. Follow the onboarding steps, and access our beginner-friendly tools to easily manage your documents and schedules.

Get more for Schedule M Form 990 Noncash Contributions

- Disability questionnaire activities of daily living form

- Financial planning forms office of student financial

- Skip loan pay application form

- Payday loan application form

- Baker hughes payroll formxls southernfederalcu

- Chime dispute form

- Credit application bsmapincbbcomb form

- Account closure deactivation form

Find out other Schedule M Form 990 Noncash Contributions

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed