Sch S Supplemental Schedule Rev 7 23 Sch S Supplemental Schedule to Be Filed with K 40 2022

Understanding the Sch S Supplemental Schedule Rev 7 23

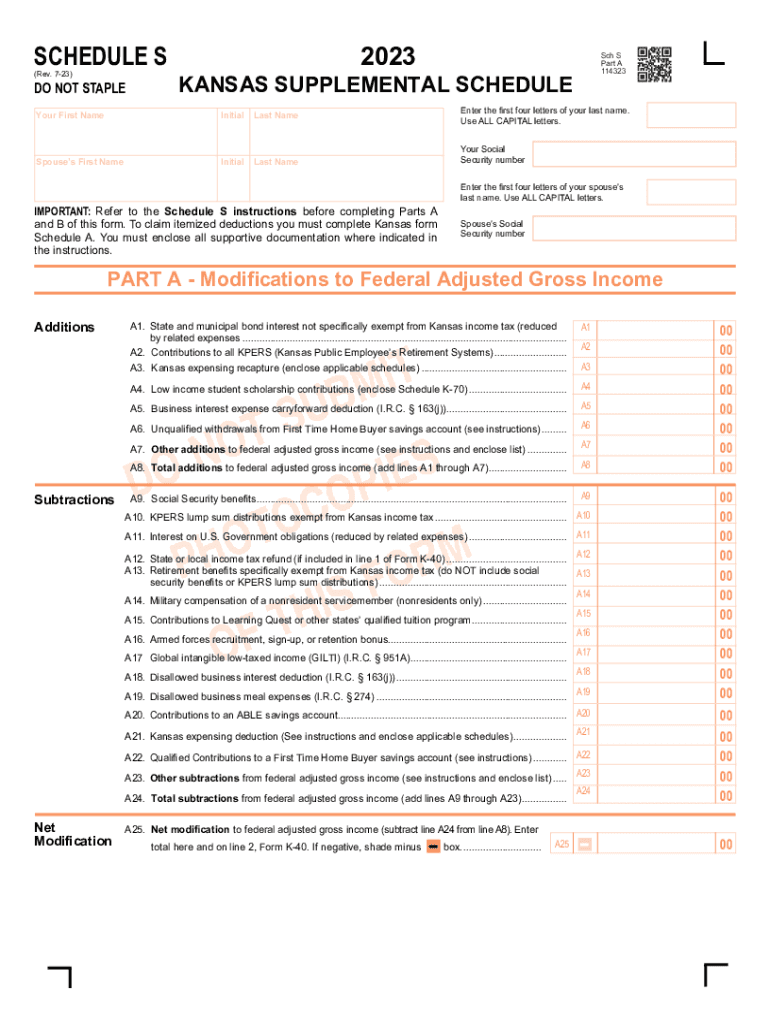

The Sch S Supplemental Schedule Rev 7 23 is a crucial form used in conjunction with the K-40 tax return in the United States. This schedule is specifically designed for reporting supplemental income and adjustments related to various sources, including rental properties, royalties, and other income types. By accurately completing this form, taxpayers can ensure they are compliant with IRS regulations and correctly report their income, which can affect their overall tax liability.

Steps to Complete the Sch S Supplemental Schedule Rev 7 23

Completing the Sch S Supplemental Schedule involves several key steps. First, gather all necessary financial documents, including income statements and expense receipts. Next, carefully fill out each section of the form, ensuring that all income sources are reported accurately. It is important to categorize income correctly, as this will impact the calculations of your total income. After completing the form, review it for accuracy before submitting it along with your K-40 return.

Obtaining the Sch S Supplemental Schedule Rev 7 23

The Sch S Supplemental Schedule Rev 7 23 can be obtained through the official IRS website or your state’s tax authority website. Many tax preparation software programs also include this form as part of their offerings, allowing for easy access and completion. Ensure you are using the most current version of the form to comply with the latest tax regulations.

Key Elements of the Sch S Supplemental Schedule Rev 7 23

Several key elements are essential to understand when working with the Sch S Supplemental Schedule. These include the identification of income sources, the calculation of expenses related to those sources, and the proper reporting of any deductions. Additionally, it is important to provide accurate information regarding any losses incurred, as these can be used to offset income in future tax years.

Legal Use of the Sch S Supplemental Schedule Rev 7 23

The Sch S Supplemental Schedule must be used in accordance with IRS guidelines to ensure legal compliance. This means accurately reporting all required information and submitting the form by the designated deadlines. Failure to comply with these regulations can result in penalties or audits, making it essential for taxpayers to understand the legal implications of their filings.

Filing Deadlines for the Sch S Supplemental Schedule Rev 7 23

Filing deadlines for the Sch S Supplemental Schedule are typically aligned with the K-40 tax return deadlines. Generally, individual taxpayers must file their returns by April fifteenth of each year. However, if additional time is needed, taxpayers can file for an extension, which may provide an additional six months to submit their forms. It is crucial to stay informed about any changes to these deadlines to avoid late filing penalties.

Quick guide on how to complete sch s supplemental schedule rev 7 23 sch s supplemental schedule to be filed with k 40

Accomplish Sch S Supplemental Schedule Rev 7 23 Sch S Supplemental Schedule To Be Filed With K 40 seamlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Sch S Supplemental Schedule Rev 7 23 Sch S Supplemental Schedule To Be Filed With K 40 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest method to alter and eSign Sch S Supplemental Schedule Rev 7 23 Sch S Supplemental Schedule To Be Filed With K 40 effortlessly

- Locate Sch S Supplemental Schedule Rev 7 23 Sch S Supplemental Schedule To Be Filed With K 40 and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which only takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Sch S Supplemental Schedule Rev 7 23 Sch S Supplemental Schedule To Be Filed With K 40 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sch s supplemental schedule rev 7 23 sch s supplemental schedule to be filed with k 40

Create this form in 5 minutes!

How to create an eSignature for the sch s supplemental schedule rev 7 23 sch s supplemental schedule to be filed with k 40

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sch S Supplemental Schedule Rev 7 23 Sch S Supplemental Schedule To Be Filed With K 40?

The Sch S Supplemental Schedule Rev 7 23 is a document required for filing with the K 40 tax form, detailing supplemental income. It allows taxpayers to report income deductions that are not accounted for in the standard filing process. Understanding this form is crucial for accurate tax reporting.

-

How does airSlate SignNow assist with the Sch S Supplemental Schedule Rev 7 23?

airSlate SignNow simplifies the process of filing the Sch S Supplemental Schedule Rev 7 23 by enabling users to easily prepare, sign, and send the document digitally. With our intuitive interface, users can ensure compliance and accuracy while saving valuable time during tax season. This makes managing taxes much more efficient.

-

What are the pricing options for using airSlate SignNow for the Sch S Supplemental Schedule Rev 7 23?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing the Sch S Supplemental Schedule Rev 7 23. Each plan provides different features suited for individual users or larger teams, ensuring you only pay for what you need. You can find detailed pricing information on our website.

-

Can I integrate airSlate SignNow with other tax software for handling the Sch S Supplemental Schedule Rev 7 23?

Yes, airSlate SignNow easily integrates with several popular tax software applications, making it seamless to handle the Sch S Supplemental Schedule Rev 7 23 alongside your existing tools. This integration enhances your workflow and ensures all necessary documents and data are synchronized efficiently. Streamlining your process has never been easier.

-

What benefits does airSlate SignNow provide for managing the Sch S Supplemental Schedule Rev 7 23?

Using airSlate SignNow for the Sch S Supplemental Schedule Rev 7 23 provides signNow benefits, including improved accuracy through digital document handling and quick turnaround times for signatures. Additionally, the platform helps in maintaining a secure and organized filing system, allowing users to access their documents anytime, anywhere, enhancing overall productivity.

-

Is airSlate SignNow user-friendly for filing the Sch S Supplemental Schedule Rev 7 23?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those who may not be tech-savvy. With straightforward navigation and guided steps for completing the Sch S Supplemental Schedule Rev 7 23, users can easily manage their tax documents without any hassle.

-

What security measures are in place when using airSlate SignNow for the Sch S Supplemental Schedule Rev 7 23?

AirSlate SignNow employs advanced security protocols to protect sensitive information when filing the Sch S Supplemental Schedule Rev 7 23. This includes encryption, access controls, and secure data storage. We prioritize user security to ensure that all your documents are safe and compliant with industry standards.

Get more for Sch S Supplemental Schedule Rev 7 23 Sch S Supplemental Schedule To Be Filed With K 40

- Navy child and youth programs registration form start date name of child last first middle requiring directive opnavinst 1700

- Registration bformb online courses goethe institut

- Phone number list template pdf form

- Self certification form national association of child care naccrra

- 5600 west 73rd street chicago il 60638 armymwr form

- Bucsfb laboratory animal resource center anesthesia record form

- Group ticket sales order form

- Uscis interview sample questions form

Find out other Sch S Supplemental Schedule Rev 7 23 Sch S Supplemental Schedule To Be Filed With K 40

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online