Arizona Form Arizona Fiduciary Income Tax Return 2022

What is the Arizona Form Arizona Fiduciary Income Tax Return

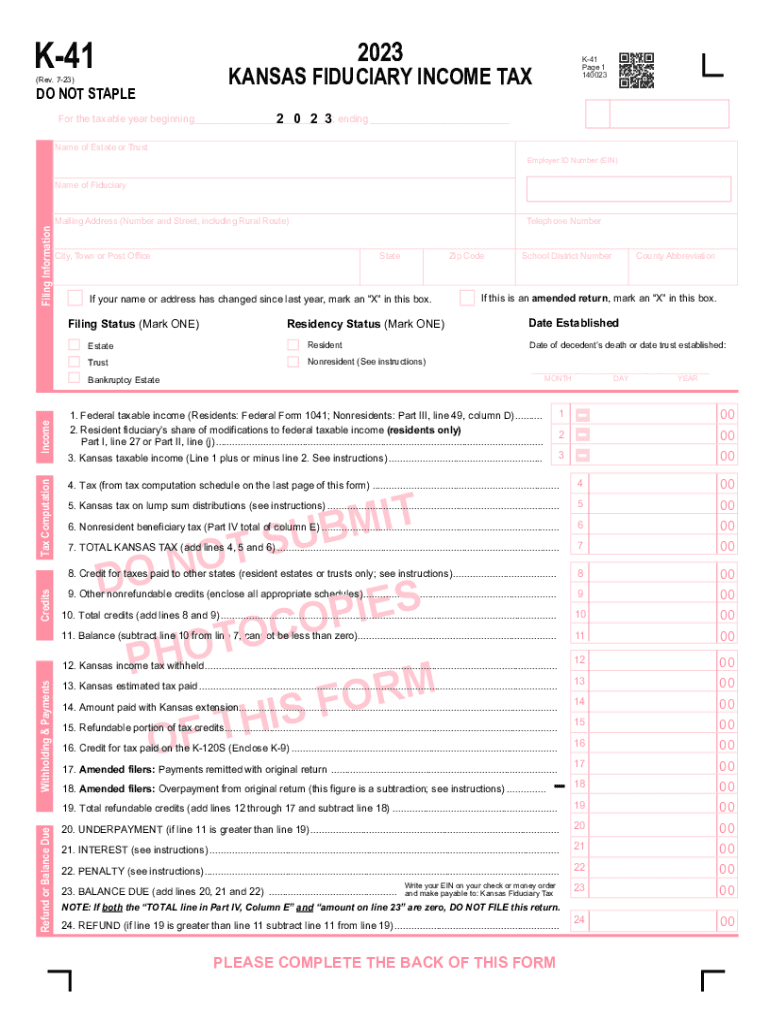

The Arizona Form Arizona Fiduciary Income Tax Return is a tax form specifically designed for fiduciaries, such as executors or trustees, who manage income generated by estates or trusts in Arizona. This form is essential for reporting the income earned by the estate or trust during the tax year. Fiduciaries are responsible for ensuring that all income is accurately reported and that any taxes owed are paid on behalf of the estate or trust. This form helps facilitate compliance with state tax laws and provides a clear record of the financial activities of the estate or trust.

Steps to complete the Arizona Form Arizona Fiduciary Income Tax Return

Completing the Arizona Form Arizona Fiduciary Income Tax Return involves several key steps:

- Gather all necessary financial documents, including income statements, expense records, and any previous tax returns related to the estate or trust.

- Fill out the form, ensuring that all sections are completed accurately. This includes providing information about the fiduciary, the estate or trust, and the income earned.

- Calculate the total income, deductions, and any credits applicable to the estate or trust.

- Review the completed form for accuracy and ensure all required signatures are present.

- Submit the form by the designated filing deadline, either electronically or via mail.

How to obtain the Arizona Form Arizona Fiduciary Income Tax Return

The Arizona Form Arizona Fiduciary Income Tax Return can be obtained through several channels. It is available for download from the Arizona Department of Revenue's official website. Additionally, physical copies of the form can often be found at local tax offices or public libraries. Tax professionals may also have copies available for their clients. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form Arizona Fiduciary Income Tax Return are crucial for compliance. Typically, the form must be filed on or before the fifteenth day of the fourth month following the end of the tax year. For estates or trusts operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to keep track of any changes to deadlines or extensions that may be announced by the Arizona Department of Revenue.

Key elements of the Arizona Form Arizona Fiduciary Income Tax Return

The Arizona Form Arizona Fiduciary Income Tax Return includes several key elements that must be accurately reported:

- Identification information for the fiduciary and the estate or trust.

- Details of income received, including dividends, interest, and rental income.

- Allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculation of the total tax liability based on the income reported.

- Signature of the fiduciary, affirming the accuracy of the information provided.

Legal use of the Arizona Form Arizona Fiduciary Income Tax Return

The Arizona Form Arizona Fiduciary Income Tax Return is legally required for fiduciaries managing estates or trusts that generate taxable income. Filing this form ensures compliance with Arizona tax laws and helps avoid potential penalties for non-compliance. It is important for fiduciaries to understand their legal obligations and to maintain accurate records to support the information reported on the form. Proper use of this form can also aid in the efficient administration of the estate or trust, benefiting both the fiduciary and the beneficiaries.

Quick guide on how to complete arizona form arizona fiduciary income tax return

Complete Arizona Form Arizona Fiduciary Income Tax Return effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Arizona Form Arizona Fiduciary Income Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign Arizona Form Arizona Fiduciary Income Tax Return with ease

- Find Arizona Form Arizona Fiduciary Income Tax Return and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools offered by airSlate SignNow designed specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Arizona Form Arizona Fiduciary Income Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form arizona fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the arizona form arizona fiduciary income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form Arizona Fiduciary Income Tax Return?

The Arizona Form Arizona Fiduciary Income Tax Return is a state tax form that trusts and estates must file to report income and determine tax liability. It provides a clear outline of fiduciary income, deductions, and credits, ensuring compliance with Arizona tax laws. Understanding this form is crucial for managing the tax responsibilities of a trust or estate effectively.

-

How can airSlate SignNow help me with the Arizona Form Arizona Fiduciary Income Tax Return?

airSlate SignNow simplifies the process of preparing and signing the Arizona Form Arizona Fiduciary Income Tax Return. With our intuitive e-signature solution, you can effortlessly gather signatures and securely send your completed documents. This not only saves time but also ensures that your returns are filed accurately and on schedule.

-

What features does airSlate SignNow offer for managing tax documents like the Arizona Form Arizona Fiduciary Income Tax Return?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and user-friendly document editing tools. These capabilities make it easy to create, modify, and send the Arizona Form Arizona Fiduciary Income Tax Return without the hassle of traditional paper forms. Additionally, our platform supports various document formats for versatile use.

-

Is airSlate SignNow cost-effective for filing the Arizona Form Arizona Fiduciary Income Tax Return?

Yes, airSlate SignNow is a cost-effective solution for filing the Arizona Form Arizona Fiduciary Income Tax Return. Our competitive pricing plans cater to different needs and budgets, ensuring that you only pay for the features that suit your requirements. This affordability allows you to manage essential tax documents without breaking the bank.

-

Can airSlate SignNow integrate with other tax software for the Arizona Form Arizona Fiduciary Income Tax Return?

Absolutely! airSlate SignNow seamlessly integrates with various tax software solutions, allowing you to streamline your workflow when preparing the Arizona Form Arizona Fiduciary Income Tax Return. This integration ensures that your documents can be easily exported and shared, enhancing efficiency in your tax preparation process.

-

What benefits does using airSlate SignNow bring for preparing the Arizona Form Arizona Fiduciary Income Tax Return?

Using airSlate SignNow offers several benefits, including increased efficiency, enhanced security, and improved collaboration. You can prepare the Arizona Form Arizona Fiduciary Income Tax Return quickly while ensuring that sensitive information is protected. Our platform also allows multiple users to collaborate in real-time, making document preparation straightforward and effective.

-

Is it safe to use airSlate SignNow for submitting the Arizona Form Arizona Fiduciary Income Tax Return?

Yes, it is safe to use airSlate SignNow for submitting the Arizona Form Arizona Fiduciary Income Tax Return. We prioritize data security with advanced encryption and secure authentication measures. You can confidently manage your tax documents, knowing that your information is well-protected throughout the submission process.

Get more for Arizona Form Arizona Fiduciary Income Tax Return

Find out other Arizona Form Arizona Fiduciary Income Tax Return

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document