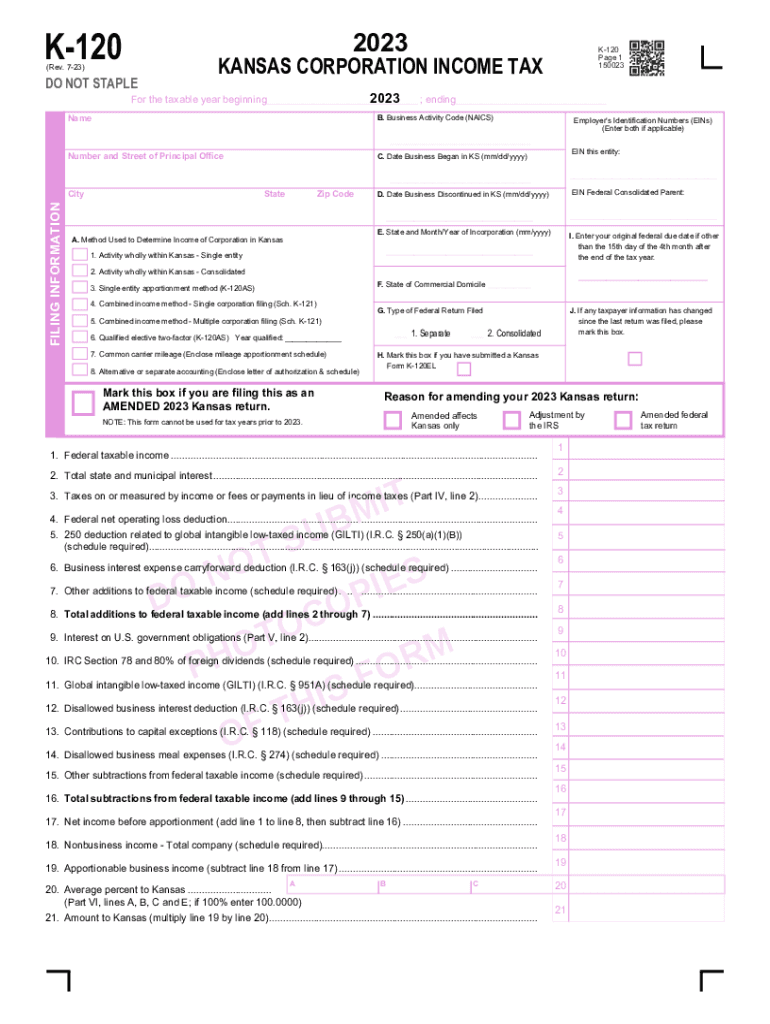

2022-2025 Form

Quick guide on how to complete k 120 corporation income tax return rev 7 23 return used to file for corporate income tax owed to kansas

Complete k 120 corporation income tax return rev 7 23 return used to file for corporate income tax owed to kansas form effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle k 120 corporation income tax return rev 7 23 return used to file for corporate income tax owed to kansas form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign k 120 corporation income tax return rev 7 23 return used to file for corporate income tax owed to kansas form effortlessly

- Locate k 120 corporation income tax return rev 7 23 return used to file for corporate income tax owed to kansas form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign k 120 corporation income tax return rev 7 23 return used to file for corporate income tax owed to kansas form and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing K 120 Corporation Income Tax Return Rev 7 23 Return Used To File For Corporate Income Tax Owed To Kansas Form

Instructions and help about K 120 Corporation Income Tax Return Rev 7 23 Return Used To File For Corporate Income Tax Owed To Kansas

Find and fill out the correct k 120 corporation income tax return rev 7 23 return used to file for corporate income tax owed to kansas

Related searches to K 120 Corporation Income Tax Return Rev 7 23 Return Used To File For Corporate Income Tax Owed To Kansas

Create this form in 5 minutes!

How to create an eSignature for the k 120 corporation income tax return rev 7 23 return used to file for corporate income tax owed to kansas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the K 120 Corporation Income Tax Return Rev 7 23?

The K 120 Corporation Income Tax Return Rev 7 23 is the official form used to file for corporate income tax owed to Kansas. This return collects essential financial information about your corporation and ensures compliance with state tax requirements.

-

How can I file my K 120 Corporation Income Tax Return Rev 7 23 electronically?

You can file the K 120 Corporation Income Tax Return Rev 7 23 electronically through various tax software that supports Kansas tax filings. Utilizing an eSignature solution like airSlate SignNow enables you to sign and authenticate your documents securely, streamlining the filing process.

-

What are the benefits of using airSlate SignNow for the K 120 Corporation Income Tax Return Rev 7 23?

Using airSlate SignNow to manage your K 120 Corporation Income Tax Return Rev 7 23 offers numerous benefits, including easy document management, secure eSigning, and the ability to track the filing process in real time. Our platform simplifies compliance and helps you avoid potential filing errors.

-

Are there any costs associated with filing the K 120 Corporation Income Tax Return Rev 7 23?

While the K 120 Corporation Income Tax Return Rev 7 23 itself may not have filing fees, using various software solutions or services like airSlate SignNow may incur charges. However, our service is designed to provide a cost-effective solution for businesses to manage their tax filings efficiently.

-

What information is required to complete the K 120 Corporation Income Tax Return Rev 7 23?

To complete the K 120 Corporation Income Tax Return Rev 7 23, you will need your Corporation's income statement, balance sheet, and records of expenses. It's essential to gather comprehensive financial documentation to ensure accuracy and compliance with Kansas tax regulations.

-

How does airSlate SignNow integrate with other tax software for the K 120 Corporation Income Tax Return Rev 7 23?

airSlate SignNow offers seamless integrations with popular tax preparation software, enhancing your ability to file the K 120 Corporation Income Tax Return Rev 7 23 efficiently. This integration simplifies the document signing process and helps keep your tax filings organized within one platform.

-

Can I access previous K 120 Corporation Income Tax Return Rev 7 23 filings through airSlate SignNow?

Yes, airSlate SignNow provides a secure platform where you can easily access previous K 120 Corporation Income Tax Return Rev 7 23 filings. This feature ensures that all your corporate tax documents are stored securely and can be retrieved whenever needed for future reference or audits.

Get more for K 120 Corporation Income Tax Return Rev 7 23 Return Used To File For Corporate Income Tax Owed To Kansas

Find out other K 120 Corporation Income Tax Return Rev 7 23 Return Used To File For Corporate Income Tax Owed To Kansas

- eSign Florida Courts Emergency Contact Form Secure

- eSign New Mexico Sports Letter Of Intent Safe

- eSign Florida Courts Emergency Contact Form Fast

- eSign New Mexico Sports Job Offer Fast

- eSign New Mexico Sports Agreement Online

- eSign New Mexico Sports Agreement Computer

- eSign Florida Courts Emergency Contact Form Simple

- eSign New Mexico Sports Agreement Mobile

- eSign New Mexico Sports Job Offer Simple

- eSign New Mexico Sports Agreement Now

- eSign Florida Courts Emergency Contact Form Easy

- eSign New Mexico Sports Agreement Later

- eSign Florida Courts Emergency Contact Form Safe

- eSign New Mexico Sports Job Offer Easy

- eSign New Mexico Sports Agreement Myself

- eSign New Mexico Sports Agreement Free

- eSign New Mexico Sports Agreement Secure

- eSign New Mexico Sports Agreement Fast

- eSign New Mexico Sports Job Offer Safe

- eSign New Mexico Sports Agreement Simple