Should I Include My Middle Initial on W9 Form? Rtaxhelp 2022

Understanding the Kansas K-40 Form

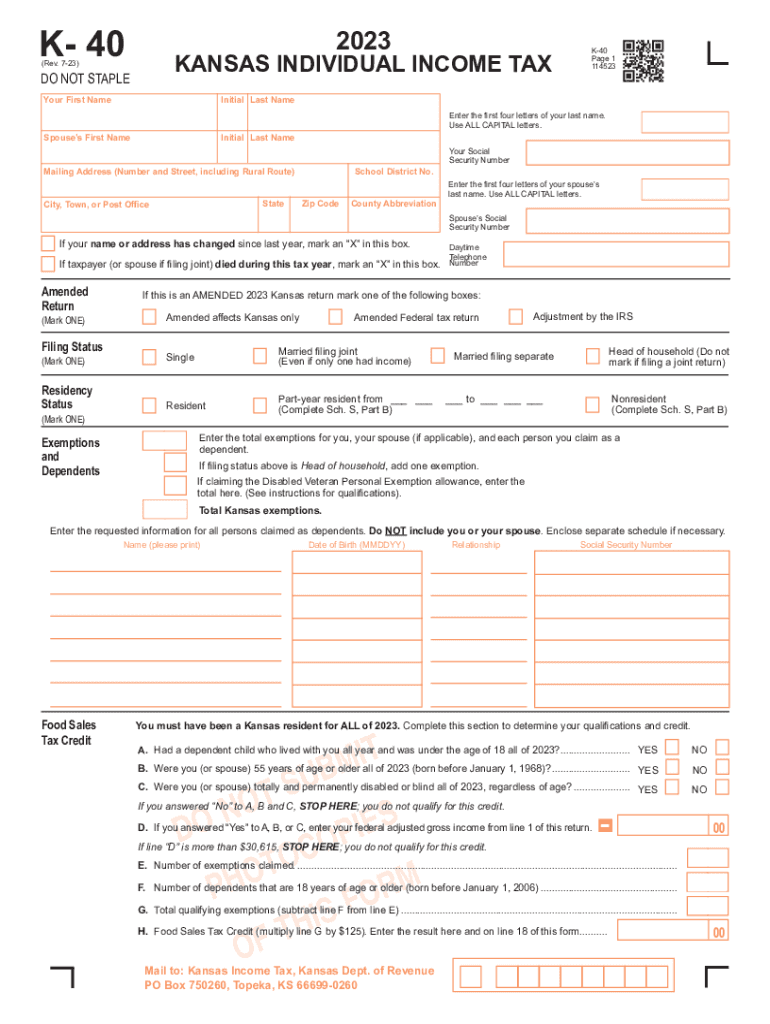

The Kansas K-40 form is the primary document used for filing individual income tax in the state of Kansas. This form is essential for residents who need to report their income and calculate their tax liability. It is crucial to use the correct version of the K-40 form for the tax year you are filing, as instructions and requirements may change annually. For 2023, ensure you are using the Kansas K-40 instructions 2023 to guide you through the process.

Steps to Complete the Kansas K-40 Form

Completing the Kansas K-40 form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, dividends, and any other sources of income.

- Calculate your deductions and credits as per the Kansas K-40 instructions.

- Determine your tax liability using the appropriate tax tables provided in the instructions.

- Sign and date the form before submission.

Key Elements of the Kansas K-40 Form

When filling out the Kansas K-40 form, pay attention to the following key elements:

- Filing Status: Choose the correct filing status, such as single, married filing jointly, or head of household.

- Income Reporting: Accurately report all sources of income to avoid discrepancies.

- Deductions: Be aware of standard and itemized deductions available to Kansas taxpayers.

- Tax Credits: Explore available tax credits that may reduce your overall tax liability.

Filing Deadlines for the Kansas K-40 Form

It is important to adhere to filing deadlines to avoid penalties. The standard deadline for filing the Kansas K-40 form is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also consider any extensions that may be available for filing their returns.

Digital vs. Paper Version of the Kansas K-40 Form

Taxpayers have the option to file the Kansas K-40 form either digitally or via paper. Filing electronically can streamline the process, reduce errors, and expedite refunds. However, some individuals may prefer the traditional paper method. Ensure that whichever method you choose, you follow the specific instructions for that format to ensure compliance with Kansas tax regulations.

Common Mistakes to Avoid on the Kansas K-40 Form

When completing the Kansas K-40 form, it is essential to avoid common mistakes that can lead to delays or penalties:

- Incorrect personal information, such as misspelled names or wrong Social Security numbers.

- Omitting income or failing to report all sources of income.

- Errors in calculations, which can affect your tax liability.

- Not signing and dating the form before submission.

Quick guide on how to complete should i include my middle initial on w9 form rtaxhelp

Prepare Should I Include My Middle Initial On W9 Form? Rtaxhelp effortlessly on any device

Online document management has become widespread among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Should I Include My Middle Initial On W9 Form? Rtaxhelp on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The easiest way to modify and eSign Should I Include My Middle Initial On W9 Form? Rtaxhelp with ease

- Locate Should I Include My Middle Initial On W9 Form? Rtaxhelp and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you would like to submit your form, via email, text message (SMS), or a shared link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and eSign Should I Include My Middle Initial On W9 Form? Rtaxhelp to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct should i include my middle initial on w9 form rtaxhelp

Create this form in 5 minutes!

How to create an eSignature for the should i include my middle initial on w9 form rtaxhelp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Kansas printable and how does it work with airSlate SignNow?

Kansas printable refers to the option of creating printable documents tailored for businesses within Kansas. With airSlate SignNow, you can easily prepare, send, and eSign these documents digitally, streamlining your workflows while ensuring compliance with local regulations.

-

How much does airSlate SignNow cost for Kansas printable documents?

Pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses in Kansas. You can explore different subscription options suitable for your needs, ensuring you get the best value when managing Kansas printable documents.

-

What features does airSlate SignNow offer for handling Kansas printable documents?

AirSlate SignNow offers robust features such as document templates, customizable fields, and secure eSignature options that enhance the management of Kansas printable documents. You can also enjoy integration with popular apps, making your document handling more seamless.

-

Are there any benefits of using airSlate SignNow for Kansas printable documents?

Using airSlate SignNow for Kansas printable documents provides businesses with improved efficiency, reduced paperwork, and quicker turnaround times for signatures. The eSigning process is user-friendly, which minimizes delays and enhances productivity.

-

Can I integrate airSlate SignNow with other software for Kansas printable workflows?

Yes, airSlate SignNow supports integrations with various applications, allowing you to streamline your Kansas printable workflows. Whether you use CRM software or document management systems, you can enhance your efficiency by connecting them to airSlate SignNow.

-

Is airSlate SignNow compliant with Kansas regulations for printable documents?

Absolutely! airSlate SignNow is compliant with Kansas regulations regarding electronic signatures and document handling, ensuring that all Kansas printable documents meet legal standards. This compliance offers peace of mind when conducting business electronically.

-

How can I get started with airSlate SignNow for Kansas printable?

To get started with airSlate SignNow for Kansas printable documents, simply visit our website and sign up for an account. Once registered, you can explore features, create documents, and begin utilizing eSigning for your business needs.

Get more for Should I Include My Middle Initial On W9 Form? Rtaxhelp

- Unpermitted dwelling unit udu inter agency referral form

- Energy intake form csd 43

- Lausd form 34 eh 17

- Lodi ca unified work permit request form

- Live scan service form bcii 8016

- Los angeles unified school districtunified enrollment 333 form

- Verification of intent to earn associate of arts science degree transfer form

- Ds 058 form

Find out other Should I Include My Middle Initial On W9 Form? Rtaxhelp

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement