Draft Form RDC Application for Research and Development Expenses Tax Credit Virginia Form RDC Application for Research and Devel 2022

Understanding the Virginia RDC Tax Credit

The Virginia Research and Development (RDC) Tax Credit is designed to incentivize businesses engaged in research and development activities. This credit allows eligible companies to recover a portion of their development expenses, which can significantly reduce their overall tax liability. The credit is particularly beneficial for businesses in technology, manufacturing, and other innovative sectors. Understanding the eligibility criteria and application process is essential for maximizing the benefits of this tax credit.

Steps to Complete the Virginia RDC Tax Credit Form

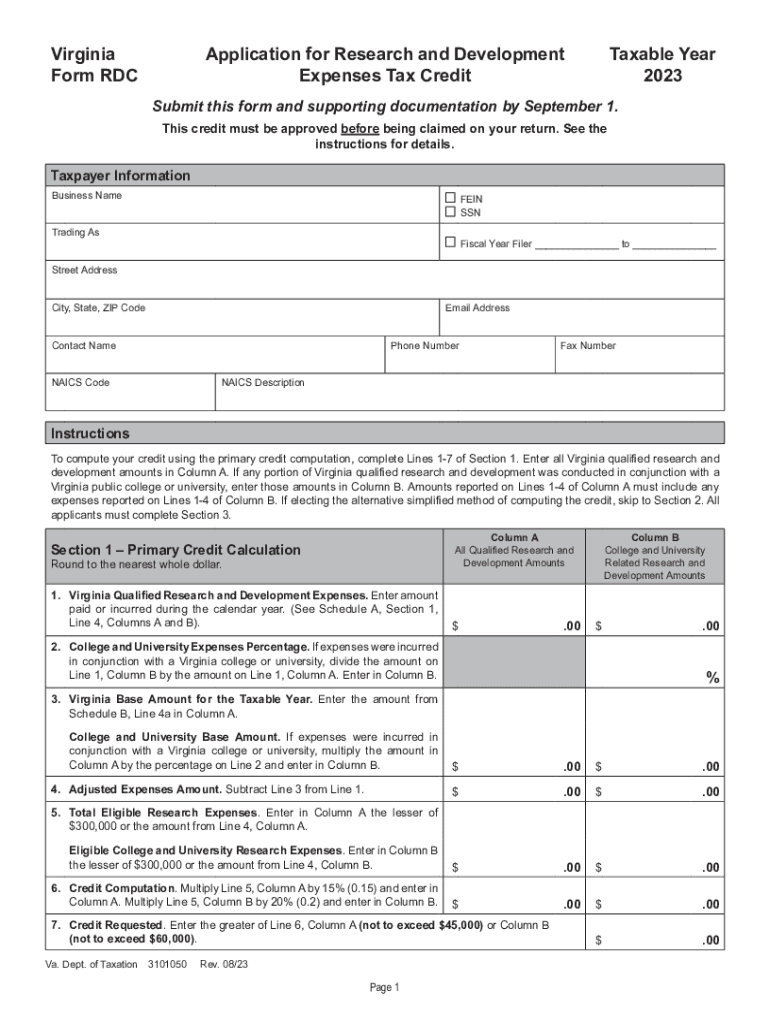

Filling out the Virginia RDC tax credit printable form requires careful attention to detail. Here are the steps to complete the form:

- Gather all necessary documentation, including financial records related to research and development expenses.

- Fill out the basic information section, including your business name, address, and tax identification number.

- Detail your eligible research and development expenses in the designated sections of the form.

- Calculate the total credit amount based on your expenses and the applicable credit rate.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria for the Virginia RDC Tax Credit

To qualify for the Virginia RDC tax credit, businesses must meet specific eligibility criteria. These include:

- The business must be registered in Virginia and actively engaged in qualified research activities.

- Eligible expenses include wages for employees directly involved in research, supplies, and contract research costs.

- The research must aim to develop or improve products, processes, or software.

Required Documents for the Virginia RDC Tax Credit Application

When applying for the Virginia RDC tax credit, it is essential to have the following documents ready:

- Financial statements that detail research and development expenditures.

- Payroll records for employees involved in qualifying research activities.

- Invoices for materials and supplies used in the research process.

Form Submission Methods for the Virginia RDC Tax Credit

Businesses can submit the Virginia RDC tax credit form through various methods, ensuring flexibility and convenience. The submission options include:

- Online submission through the Virginia Department of Taxation's website.

- Mailing a completed paper form to the appropriate tax office.

- In-person submission at designated tax offices for immediate processing.

Key Elements of the Virginia RDC Tax Credit Form

The Virginia RDC tax credit form consists of several key elements that applicants must complete accurately. These elements include:

- Identification of the business and tax year for which the credit is being claimed.

- A detailed breakdown of qualifying research expenses.

- Calculation of the credit amount based on the total eligible expenses.

Quick guide on how to complete draft form rdc application for research and development expenses tax credit virginia form rdc application for research and

Complete Draft Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Devel effortlessly on any device

Online document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Draft Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Devel on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The easiest way to modify and eSign Draft Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Devel without hassle

- Find Draft Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Devel and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant parts of your documents or redact sensitive information with the tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign Draft Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Devel and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct draft form rdc application for research and development expenses tax credit virginia form rdc application for research and

Create this form in 5 minutes!

How to create an eSignature for the draft form rdc application for research and development expenses tax credit virginia form rdc application for research and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia RDC tax credit printable?

The Virginia RDC tax credit printable is a document that allows eligible businesses in Virginia to claim tax credits under the Redevelopment and Conservation program. This printable form simplifies the application process, ensuring that companies can easily access the financial benefits to support redevelopment projects.

-

How can I obtain the Virginia RDC tax credit printable?

You can obtain the Virginia RDC tax credit printable directly from the Virginia Department of Taxation's website or through trusted tax preparation services. It’s essential to ensure that you are using the most current version of the form to accurately claim your credits.

-

Are there any costs associated with using the Virginia RDC tax credit printable?

Accessing the Virginia RDC tax credit printable is free; however, there may be costs associated with professional help if you choose to hire a tax advisor. Making sure to accurately complete the form is crucial to maximizing your potential tax savings.

-

What are the benefits of using the Virginia RDC tax credit printable?

Using the Virginia RDC tax credit printable can signNowly reduce your tax liability, providing financial relief for businesses involved in redevelopment projects. Additionally, claiming this credit can improve your company's cash flow and foster further investment in project development.

-

Can the Virginia RDC tax credit printable be integrated with other software?

Yes, the Virginia RDC tax credit printable can be integrated with various accounting and financial software, streamlining your tax filing process. Many tax preparation platforms allow you to upload the printable form directly, saving you time and reducing errors.

-

Who is eligible for the Virginia RDC tax credit printable?

Eligibility for the Virginia RDC tax credit printable typically includes businesses actively engaged in redevelopment activities within designated zones. It's crucial to check the specific criteria outlined by Virginia's tax regulations to determine your eligibility.

-

How does airSlate SignNow facilitate the use of the Virginia RDC tax credit printable?

airSlate SignNow makes it easy to manage and eSign the Virginia RDC tax credit printable securely and efficiently. With its intuitive interface, you can collaborate with your team and stakeholders on the necessary documents, ensuring a smooth submission process.

Get more for Draft Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Devel

- Seattle university bake sale information form

- Confidential school accident report alliance of schools form

- Forms ampampamp requisitionsalberta health services

- Aampampampps confidential and faculty form is to be be used for

- Mission vision ampamp values florida state college at jacksonville form

- Family education rights and privacy act ferpaschool form

- Troy university access your trojanpass profile form

- Satisfactory academic progress us department of education form

Find out other Draft Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Devel

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU