Tax Refund Calculator 2022

Understanding the Tax Refund Calculator

The Tax Refund Calculator is a useful tool designed to help taxpayers estimate their potential tax refunds based on their financial information. By inputting data such as income, deductions, and credits, users can get a clearer picture of what they might expect when filing their taxes. This calculator is particularly beneficial for individuals looking to plan their finances effectively and understand their tax liability.

How to Use the Tax Refund Calculator

Using the Tax Refund Calculator is straightforward. Users typically need to provide key financial details, including total income, filing status, and any deductions or credits they qualify for. After entering this information, the calculator processes the data and provides an estimated refund amount. It’s essential to ensure that all provided information is accurate to get the most reliable estimate.

Required Documents for Accurate Calculations

To use the Tax Refund Calculator effectively, having the following documents on hand can be beneficial:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Information on any tax credits

- Last year's tax return for reference

Having these documents ready can streamline the process and improve the accuracy of the refund estimation.

IRS Guidelines for Tax Refund Calculations

The IRS provides guidelines that outline how to calculate tax refunds, including the necessary forms and documentation. Understanding these guidelines helps ensure compliance with tax laws and accurate reporting. Taxpayers should refer to the IRS website or consult with tax professionals for the most current regulations and practices regarding tax refunds.

Filing Deadlines and Important Dates

Awareness of filing deadlines is crucial for taxpayers. Generally, the tax filing deadline for individuals is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also note any extensions they may apply for and the associated deadlines, as these can affect their tax refund timeline.

Penalties for Non-Compliance

Failure to comply with tax regulations can result in penalties, including late filing and late payment fees. The IRS may impose these penalties if taxpayers do not file their returns on time or fail to pay the taxes owed. Understanding these potential penalties can motivate taxpayers to file accurately and on time, avoiding unnecessary financial burdens.

Quick guide on how to complete tax refund calculator

Easily Prepare Tax Refund Calculator on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Tax Refund Calculator on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

Effortlessly Modify and eSign Tax Refund Calculator

- Locate Tax Refund Calculator and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method of sending your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device. Modify and eSign Tax Refund Calculator and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax refund calculator

Create this form in 5 minutes!

How to create an eSignature for the tax refund calculator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

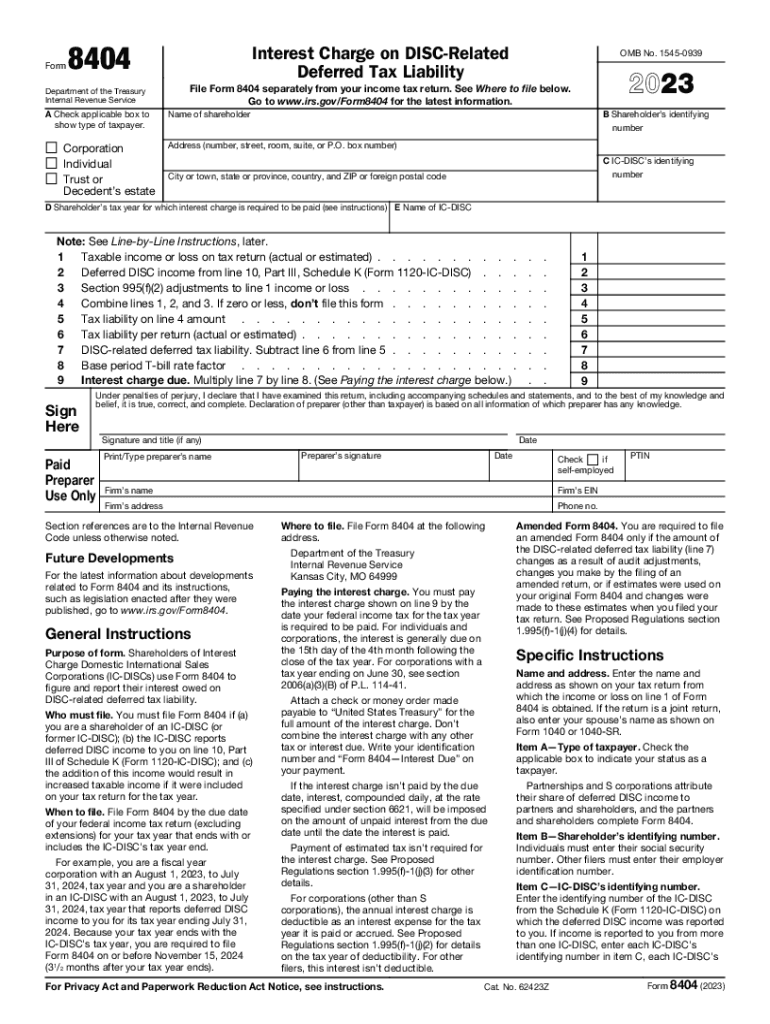

What is form 8404 and how can airSlate SignNow help with it?

Form 8404 is used to report information regarding tax-related matters. airSlate SignNow streamlines the signing process for form 8404, allowing users to prepare, share, and eSign the document easily. With our platform, you can ensure that your form 8404 is sent securely and promptly.

-

Is there a cost to use airSlate SignNow for submitting form 8404?

airSlate SignNow offers a pricing model that caters to different business needs. While there is a subscription fee, the cost is designed to be cost-effective, especially when considering the time saved when handling form 8404. You can start with a free trial to see if it meets your requirements before committing.

-

What features does airSlate SignNow provide for form 8404?

With airSlate SignNow, you can easily create, edit, and eSign form 8404. The platform offers features such as templates, document tracking, and secure cloud storage, ensuring that your form 8404 is managed effectively and accessed whenever needed. Our user-friendly interface makes it simple to navigate through these features.

-

Can I integrate airSlate SignNow with other applications for form 8404 processing?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your form 8404 processing. This includes popular platforms such as Google Drive, Salesforce, and Microsoft apps, ensuring that your workflow is efficient. These integrations help in automating document related tasks associated with form 8404.

-

How does airSlate SignNow ensure the security of form 8404?

Security is a top priority for airSlate SignNow when handling form 8404. We implement bank-level encryption and secure authentication measures to protect your documents. This means your sensitive information on form 8404 is safeguarded against unauthorized access.

-

Can I track the status of my form 8404 in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features for your form 8404. You will receive notifications when the document is viewed, signed, and completed, ensuring you stay updated throughout the process and can take necessary actions promptly.

-

What are the benefits of using airSlate SignNow for form 8404?

Using airSlate SignNow for form 8404 allows for greater efficiency and speed in document management. Benefits include reduced paperwork, quicker turnaround times, and the ability to sign from anywhere, thus enhancing productivity. Our user-friendly platform ensures a hassle-free experience.

Get more for Tax Refund Calculator

Find out other Tax Refund Calculator

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later