Use This Worksheet Only If You Plan to Itemize Deductions, Claim Certain Credits, Adjustments to Income, or an Additional Standa Form

Understanding the Worksheet for Itemizing Deductions and Credits

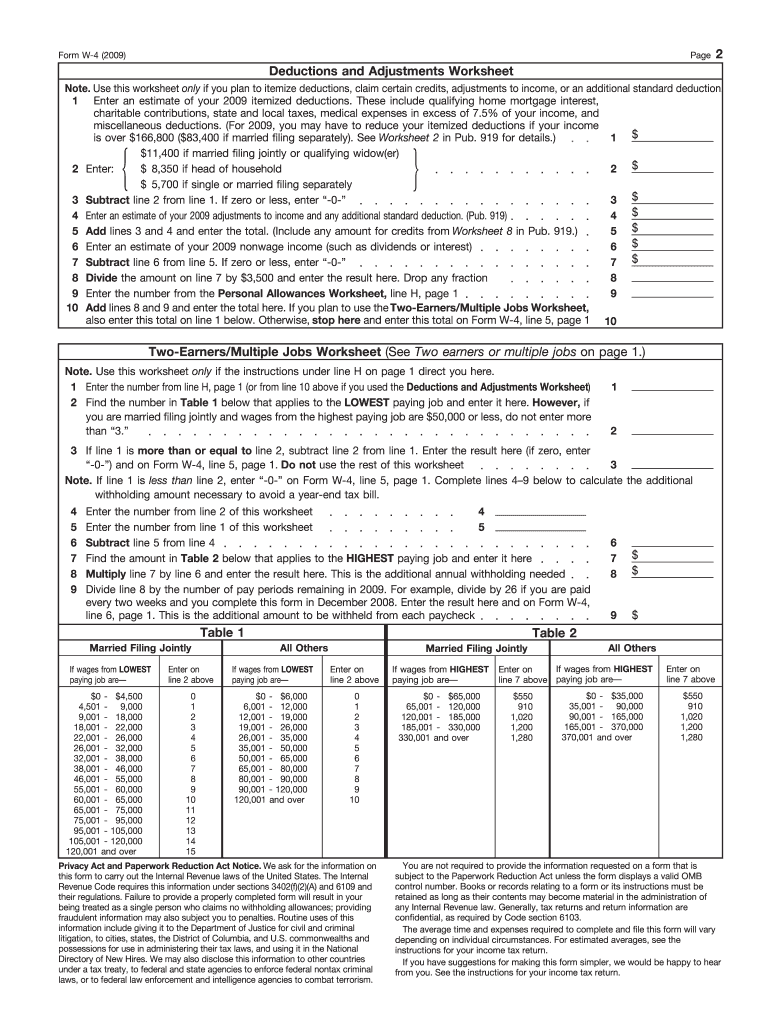

The worksheet is designed for taxpayers who intend to itemize deductions, claim specific credits, make adjustments to income, or apply for an additional standard deduction. This form helps you assess your eligibility for these options and provides a structured approach to maximize your tax benefits. By using this worksheet, you can determine whether itemizing or taking the standard deduction is more advantageous for your financial situation.

How to Complete the Worksheet

To effectively use the worksheet, gather all relevant financial documents, including W-2s, 1099s, and receipts for deductible expenses. Follow the instructions provided on the worksheet closely. Begin by listing all potential deductions, such as mortgage interest, medical expenses, and charitable contributions. Then, calculate your total itemized deductions and compare this figure to the standard deduction available for your filing status. This comparison will guide your decision on which deduction method to choose.

Key Elements of the Worksheet

The worksheet includes several critical components that guide you through the itemization process. Key elements typically involve:

- Personal Information: Basic details like your name, Social Security number, and filing status.

- Income Sources: A section to report all income, including wages, interest, and dividends.

- Deductions: A detailed list of potential itemized deductions, including categories such as medical expenses, taxes paid, and mortgage interest.

- Credits and Adjustments: Areas to claim any applicable tax credits and adjustments to your income.

IRS Guidelines for Using the Worksheet

The Internal Revenue Service (IRS) provides guidelines on when and how to use this worksheet. It is essential to refer to the latest IRS publications and instructions to ensure compliance with current tax laws. The IRS outlines eligibility criteria for itemizing deductions and provides examples of qualified expenses. Staying informed about these guidelines helps prevent errors and ensures that you take full advantage of the deductions available to you.

Examples of Using the Worksheet

Consider a scenario where a taxpayer has significant medical expenses and mortgage interest. By using the worksheet, they can calculate their total itemized deductions and compare it against the standard deduction. If their itemized deductions exceed the standard deduction, it may be beneficial to itemize. Another example could involve a self-employed individual who incurs business expenses. The worksheet can help them determine how these expenses affect their taxable income and overall tax liability.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with your tax return. Generally, the deadline for filing individual tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these dates ensures timely submission and compliance with tax regulations.

Quick guide on how to complete use this worksheet only if you plan to itemize deductions claim certain credits adjustments to income or an additional standard

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the features needed to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Use This Worksheet Only If You Plan To Itemize Deductions, Claim Certain Credits, Adjustments To Income, Or An Additional Standa

Create this form in 5 minutes!

How to create an eSignature for the use this worksheet only if you plan to itemize deductions claim certain credits adjustments to income or an additional standard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to 'Use This Worksheet Only If You Plan To Itemize Deductions'?

Using this worksheet is essential if you're planning to itemize deductions on your tax returns. It helps to identify allowable expenses such as medical payments, charitable contributions, and mortgage interest, ensuring that you maximize your tax benefits. Remember, to 'Use This Worksheet Only If You Plan To Itemize Deductions, Claim Certain Credits, Adjustments To Income, Or An Additional Standard Deduction' to get a clearer view of your tax situation.

-

How can airSlate SignNow assist with claiming tax credits?

airSlate SignNow streamlines your document signing processes, making it easier to prepare and submit your tax forms, including those related to tax credits. This efficient tool will help ensure that you have all necessary documents in order, especially when you 'Use This Worksheet Only If You Plan To Itemize Deductions, Claim Certain Credits, Adjustments To Income, Or An Additional Standard Deduction.'

-

Is there a cost associated with using airSlate SignNow?

Yes, airSlate SignNow offers several pricing plans tailored to suit different business needs. Each plan includes features designed to enhance your document management process. If you're looking to 'Use This Worksheet Only If You Plan To Itemize Deductions, Claim Certain Credits, Adjustments To Income, Or An Additional Standard Deduction,' it's worth considering how these plans can fit your budget.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a variety of features, including eSigning, document templates, and real-time collaboration. These tools are designed to make your workflows smoother, especially when you need to 'Use This Worksheet Only If You Plan To Itemize Deductions, Claim Certain Credits, Adjustments To Income, Or An Additional Standard Deduction.' Efficient document management plays a pivotal role in tax preparation.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with various third-party applications such as CRMs, cloud storage services, and productivity tools. This allows for seamless document handling and management, which can support your efforts to 'Use This Worksheet Only If You Plan To Itemize Deductions, Claim Certain Credits, Adjustments To Income, Or An Additional Standard Deduction' more effectively.

-

What benefits can I expect from using airSlate SignNow?

By utilizing airSlate SignNow, you can expect enhanced productivity, cost savings, and simplified document workflows. The platform's user-friendly design ensures that you can quickly and securely manage your documentation. This is particularly useful if you need to 'Use This Worksheet Only If You Plan To Itemize Deductions, Claim Certain Credits, Adjustments To Income, Or An Additional Standard Deduction.'

-

Who can benefit from using airSlate SignNow?

Business professionals, tax preparers, and individuals alike can benefit from airSlate SignNow. Its features are designed to cater to a diverse user base, especially for those needing to 'Use This Worksheet Only If You Plan To Itemize Deductions, Claim Certain Credits, Adjustments To Income, Or An Additional Standard Deduction.' No matter your expertise, this solution can help streamline your document processes.

Get more for Use This Worksheet Only If You Plan To Itemize Deductions, Claim Certain Credits, Adjustments To Income, Or An Additional Standa

Find out other Use This Worksheet Only If You Plan To Itemize Deductions, Claim Certain Credits, Adjustments To Income, Or An Additional Standa

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation