Form it 272 Claim for College Tuition Credit or Itemized 2021

What is the Form IT 272 Claim For College Tuition Credit Or Itemized

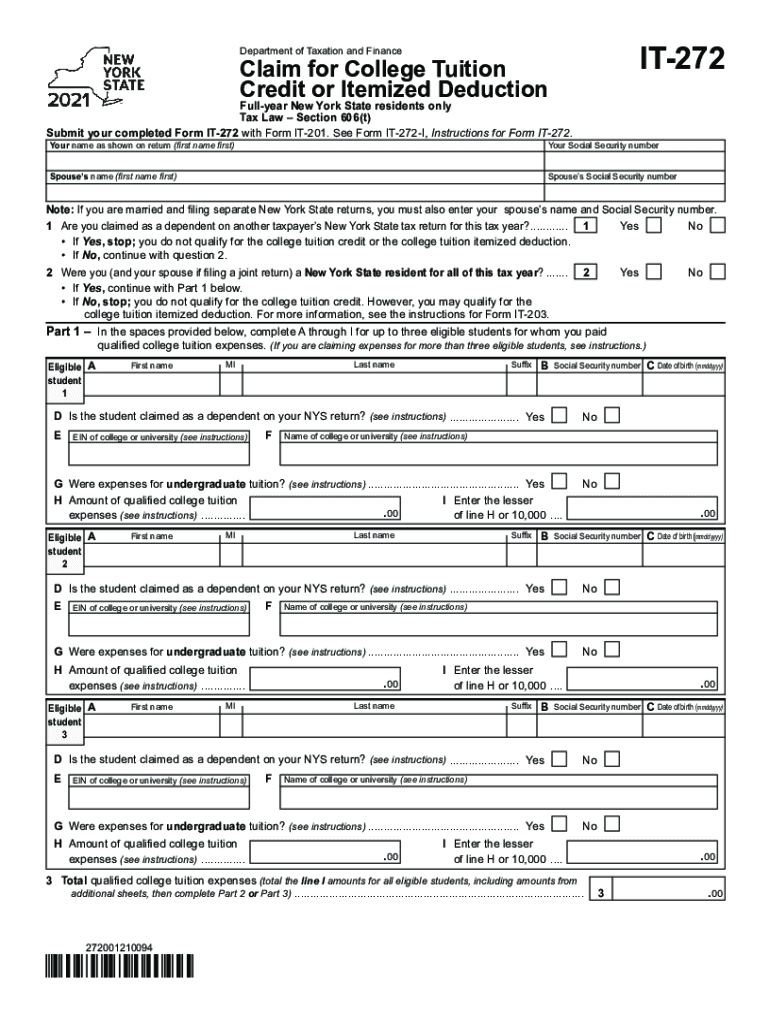

The Form IT 272 is a tax document used by New York residents to claim a credit for college tuition expenses. This form allows taxpayers to receive a credit against their New York State income tax for eligible tuition payments made for themselves or their dependents. The credit is designed to alleviate some of the financial burdens associated with higher education costs. It is essential to understand the specific eligibility criteria and the types of expenses that qualify for this credit to maximize potential benefits.

How to use the Form IT 272 Claim For College Tuition Credit Or Itemized

Using the Form IT 272 involves several steps. First, gather all necessary documentation, including proof of tuition payments and any relevant financial statements. Next, carefully fill out the form, ensuring that all information is accurate and complete. The form requires details such as the taxpayer's identification information, the amount of tuition paid, and the educational institution attended. After completing the form, it should be submitted along with the New York State income tax return. Understanding the instructions provided with the form is crucial for successful submission.

Steps to complete the Form IT 272 Claim For College Tuition Credit Or Itemized

Completing the Form IT 272 involves the following steps:

- Collect necessary documents, including tuition payment receipts and your tax return.

- Fill in your personal information, including your Social Security number and address.

- Provide details of the educational institution, including its name and the amount of tuition paid.

- Calculate the total credit amount based on the tuition expenses incurred.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the credit claimed on Form IT 272, taxpayers must meet specific eligibility requirements. The individual must be a resident of New York State and have incurred qualified tuition expenses for higher education. The credit is available for tuition paid for courses at eligible institutions, including colleges and universities. Additionally, the taxpayer or dependent must be enrolled in a degree program or a non-degree program that leads to a recognized credential. It is important to verify that the tuition payments fall within the specified limits set by the state.

Required Documents

When filing the Form IT 272, certain documents are required to substantiate the claim. These include:

- Proof of tuition payments, such as receipts or statements from the educational institution.

- Taxpayer identification information, including Social Security numbers for the taxpayer and any dependents.

- Completed New York State income tax return to which the Form IT 272 will be attached.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 272 can be submitted through various methods. Taxpayers have the option to file online using approved tax software that supports New York State tax forms. Alternatively, the completed form can be mailed to the appropriate tax office as indicated in the filing instructions. In some cases, taxpayers may also be able to submit the form in person at designated tax offices. It is important to verify the submission method that best suits individual circumstances and to ensure that the form is submitted by the deadline.

Quick guide on how to complete form it 272 claim for college tuition credit or itemized

Effortlessly Prepare Form IT 272 Claim For College Tuition Credit Or Itemized on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Manage Form IT 272 Claim For College Tuition Credit Or Itemized on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Form IT 272 Claim For College Tuition Credit Or Itemized Effortlessly

- Obtain Form IT 272 Claim For College Tuition Credit Or Itemized and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact private information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to secure your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form IT 272 Claim For College Tuition Credit Or Itemized and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 272 claim for college tuition credit or itemized

Create this form in 5 minutes!

How to create an eSignature for the form it 272 claim for college tuition credit or itemized

The best way to create an e-signature for your PDF document online

The best way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an e-signature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an e-signature for a PDF file on Android OS

People also ask

-

What is IT 272 and how does it relate to airSlate SignNow?

IT 272 refers to a specific aspect of airSlate SignNow's integration capabilities, enabling businesses to streamline their document processes efficiently. By incorporating IT 272 into your workflow, you can enhance efficiency and compliance while utilizing a seamless electronic signature solution.

-

How does airSlate SignNow's pricing structure work for IT 272 integration?

The pricing for airSlate SignNow's IT 272 integration is designed to be cost-effective and scalable based on your needs. You can explore various subscription plans that cater to different business sizes, ensuring that you receive the best value for the features related to IT 272.

-

What features of airSlate SignNow are enhanced by IT 272?

IT 272 enhances several key features of airSlate SignNow, including automating document workflows and ensuring secure electronic signatures. These features streamline your processes, making it easier to send, sign, and manage documents efficiently.

-

What are the benefits of using airSlate SignNow with IT 272?

Using airSlate SignNow with IT 272 provides benefits such as increased productivity, reduced turnaround times, and improved document security. This synergy allows businesses to focus more on their core operations while maintaining compliance with eSignature regulations.

-

Can airSlate SignNow integrate with other software solutions through IT 272?

Yes, airSlate SignNow can integrate with various software solutions via IT 272, allowing for a more comprehensive document management experience. This integration helps synchronize data across platforms, enhancing workflow and collaboration among teams.

-

Is there a free trial available for the IT 272 features in airSlate SignNow?

Yes, airSlate SignNow offers a free trial that includes access to IT 272 features, allowing you to evaluate the platform without any financial commitment. This trial period helps prospective customers assess how airSlate SignNow can meet their document management needs.

-

What industries can benefit from airSlate SignNow's IT 272 functionalities?

A wide range of industries, including healthcare, finance, and education, can benefit from airSlate SignNow's IT 272 functionalities. The platform is designed to support various use cases, helping businesses in different sectors enhance their document handling processes.

Get more for Form IT 272 Claim For College Tuition Credit Or Itemized

- Siding contract for contractor colorado form

- Refrigeration contract for contractor colorado form

- Drainage contract for contractor colorado form

- Foundation contract for contractor colorado form

- Plumbing contract for contractor colorado form

- Brick mason contract for contractor colorado form

- Roofing contract for contractor colorado form

- Electrical contract for contractor colorado form

Find out other Form IT 272 Claim For College Tuition Credit Or Itemized

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document