Form it 272 "Claim for College Tuition Credit or Itemized 2022

What is the Form IT 272?

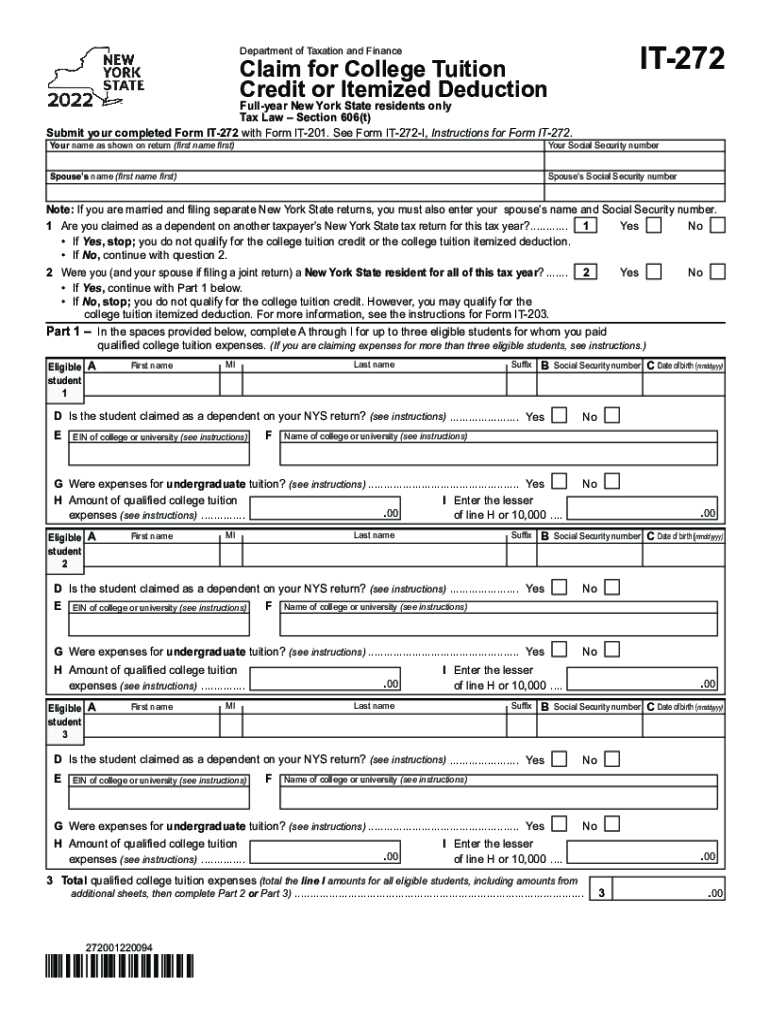

The IT 272 form, officially known as the "Claim for College Tuition Credit or Itemized Deduction," is a tax form used by residents of New York to claim a credit for eligible college tuition expenses. This form is specifically designed to help taxpayers reduce their state tax liability by allowing them to deduct certain educational costs associated with higher education. The form is essential for individuals seeking to benefit from the New York college tuition credit, which can significantly alleviate the financial burden of education.

Steps to Complete the Form IT 272

Completing the IT 272 form involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering all necessary documentation, including proof of tuition payments and enrollment details. Next, fill out the personal information section accurately, ensuring that your name, address, and Social Security number are correct. Then, detail the tuition expenses you are claiming, including the institution's name and the amount paid. Finally, review the form for any errors before submitting it to ensure that your claim is processed without delays.

Eligibility Criteria for the IT 272

To qualify for the New York college tuition credit using the IT 272 form, taxpayers must meet specific eligibility criteria. This includes being a resident of New York State, having incurred qualified tuition expenses for an eligible institution, and ensuring that the student for whom the tuition was paid is enrolled in a degree or certificate program. Additionally, the taxpayer's income must fall within certain limits to qualify for the full credit. Understanding these criteria is crucial for successfully claiming the credit.

Required Documents for the IT 272

When filing the IT 272 form, it is important to have all required documents ready to support your claim. This typically includes tuition statements from the educational institution, proof of payment, and any relevant tax documents that may affect your eligibility. Additionally, if you are claiming expenses for multiple students, ensure you have documentation for each one. Having these documents organized will facilitate a smoother filing process and help avoid potential issues with your claim.

Filing Deadlines for the IT 272

Timely submission of the IT 272 form is essential to ensure that you receive the college tuition credit. The filing deadline typically aligns with New York State's tax return deadlines, which is usually April fifteenth of each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to check for any updates or changes to the deadlines each tax year to avoid missing out on potential credits.

Form Submission Methods for the IT 272

The IT 272 form can be submitted through various methods to accommodate different preferences. Taxpayers can file the form online using approved tax software, which often simplifies the process by guiding users through each step. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its advantages, and choosing the right one can help ensure a smooth filing experience.

Quick guide on how to complete form it 272 ampquotclaim for college tuition credit or itemized

Complete Form IT 272 "Claim For College Tuition Credit Or Itemized effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you require to create, adjust, and eSign your documents swiftly without delays. Handle Form IT 272 "Claim For College Tuition Credit Or Itemized on any device using airSlate SignNow's Android or iOS apps and streamline any document-related process today.

The easiest way to modify and eSign Form IT 272 "Claim For College Tuition Credit Or Itemized without stress

- Locate Form IT 272 "Claim For College Tuition Credit Or Itemized and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about losing or misplacing files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IT 272 "Claim For College Tuition Credit Or Itemized and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 272 ampquotclaim for college tuition credit or itemized

Create this form in 5 minutes!

How to create an eSignature for the form it 272 ampquotclaim for college tuition credit or itemized

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IT 272 instructions for using airSlate SignNow?

IT 272 instructions for airSlate SignNow provide users with essential guidelines on how to effectively utilize the platform for electronic signatures. These instructions cover everything from account setup to document management. By following these instructions, users can streamline their signing processes and improve workflow efficiency.

-

Are there any costs associated with following IT 272 instructions?

Using airSlate SignNow is designed to be cost-effective, and the IT 272 instructions can help you maximize your investment. While the platform has subscription fees based on different tiers, the instructions provided help clarify any costs involved in the process. This ensures transparency and helps users budget accordingly.

-

What features are highlighted in the IT 272 instructions for airSlate SignNow?

The IT 272 instructions detail various features of airSlate SignNow, including document templates, automated workflows, and in-app integrations. These features are aimed at enhancing productivity and simplifying the e-signing process. Understanding these features is crucial for optimizing your use of the platform.

-

How do IT 272 instructions improve document security with airSlate SignNow?

The IT 272 instructions emphasize the security protocols that airSlate SignNow incorporates to protect your documents. These include encryption, secure access controls, and audit trails, which ensure that all signatures and documents are secure and compliant. Following these instructions aids businesses in maintaining data integrity.

-

Can I integrate airSlate SignNow with other applications using IT 272 instructions?

Yes, the IT 272 instructions guide users on how to integrate airSlate SignNow with various applications such as CRM systems, cloud storage, and project management tools. These integrations enhance the functionality of the platform and create a seamless workflow. This is especially beneficial for businesses looking to streamline their processes.

-

What are the benefits of following IT 272 instructions when using airSlate SignNow?

Following IT 272 instructions brings numerous benefits, such as improved efficiency, reduced turnaround times, and increased accuracy in document handling. Users equipped with these guidelines can leverage all functionalities of airSlate SignNow effectively. This ultimately leads to enhanced customer satisfaction and better business outcomes.

-

How long does it take to implement IT 272 instructions for airSlate SignNow?

Implementing the IT 272 instructions for airSlate SignNow can vary depending on your familiarity with the platform but is generally straightforward. Most users can complete the setup and begin using the platform within a few hours. The clear guidance of the instructions helps in minimizing the learning curve.

Get more for Form IT 272 "Claim For College Tuition Credit Or Itemized

- 10 day notice to terminate week to week lease for residential from landlord to tenant tennessee form

- Tennessee month to month form

- 10 day notice to terminate week to week lease for residential property from tenant to landlord tennessee form

- Tennessee 30 form

- 30 day notice to terminate for material noncompliance with lease 14 days to cure for residential from landlord to tenant form

- Tennessee breach form

- Notice to terminate for nonpayment of rent residential tennessee form

- Tn liens form

Find out other Form IT 272 "Claim For College Tuition Credit Or Itemized

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template