Department of Taxation and Finance Claim for College Tuition 2020

What is the Department of Taxation and Finance Claim for College Tuition?

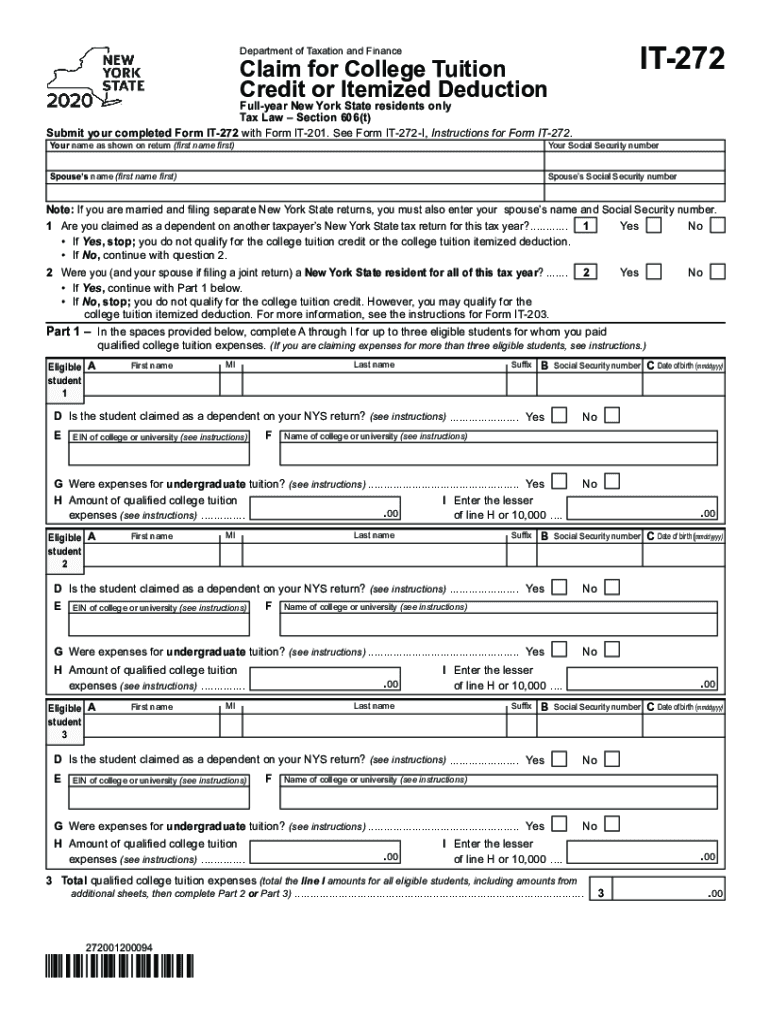

The Department of Taxation and Finance Claim for College Tuition, commonly referred to as the IT-272 form, is a tax document used by eligible taxpayers in New York to claim a credit for college tuition expenses. This form allows individuals to receive financial relief for tuition paid for themselves or their dependents attending eligible colleges or universities. The IT-272 form is particularly important for students and families looking to offset the costs of higher education through available tax credits.

Key Elements of the Department of Taxation and Finance Claim for College Tuition

Understanding the key elements of the IT-272 form is crucial for successful completion. The form requires taxpayers to provide personal information, including Social Security numbers, and details about the educational institution attended. Additionally, it necessitates documentation of tuition payments made during the tax year. Key elements include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Educational Institution Details: Name and address of the college or university.

- Tuition Amount: Total tuition paid during the tax year.

- Dependent Information: If claiming tuition for a dependent, their details must also be included.

Steps to Complete the Department of Taxation and Finance Claim for College Tuition

Completing the IT-272 form involves several important steps to ensure accuracy and compliance. Follow these steps to fill out the form correctly:

- Gather necessary documents, including tuition payment receipts and personal identification.

- Fill in your personal information at the top of the form.

- Provide details about the educational institution attended.

- Enter the total amount of tuition paid during the tax year.

- If applicable, include information for any dependents for whom you are claiming tuition credits.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Eligibility Criteria for the Department of Taxation and Finance Claim for College Tuition

To qualify for the IT-272 form, taxpayers must meet specific eligibility criteria. These criteria ensure that only those who have incurred qualifying tuition expenses can benefit from the tax credit. Key eligibility requirements include:

- The taxpayer must be a resident of New York State.

- The tuition must be paid for an eligible college or university.

- Tuition expenses must be incurred during the tax year for which the claim is being made.

- Taxpayers must not exceed income limits set by the state for claiming the credit.

Form Submission Methods for the Department of Taxation and Finance Claim for College Tuition

The IT-272 form can be submitted through various methods, allowing taxpayers flexibility in how they file their claims. The available submission methods include:

- Online Submission: Taxpayers can file electronically through the New York State Department of Taxation and Finance website.

- Mail: The completed form can be printed and mailed to the appropriate address specified on the form.

- In-Person: Taxpayers may also choose to submit the form in person at designated tax offices.

Required Documents for the Department of Taxation and Finance Claim for College Tuition

When completing the IT-272 form, certain documents are required to substantiate the claim for tuition credits. These documents help verify the information provided on the form. Required documents include:

- Tuition Payment Receipts: Proof of payment for tuition expenses.

- Form 1098-T: This form is issued by educational institutions and provides information on tuition paid.

- Identification Documents: Personal identification, such as a Social Security card, may be necessary.

Quick guide on how to complete department of taxation and finance claim for college tuition

Easily Create Department Of Taxation And Finance Claim For College Tuition on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed forms, allowing you to access the correct document and securely save it on the web. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage Department Of Taxation And Finance Claim For College Tuition on any device with the airSlate SignNow apps for Android or iOS and enhance any document-driven process now.

How to Modify and eSign Department Of Taxation And Finance Claim For College Tuition Effortlessly

- Obtain Department Of Taxation And Finance Claim For College Tuition and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that are specifically provided by airSlate SignNow for that intent.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to share your form, either via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or inaccuracies that require printing new versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Department Of Taxation And Finance Claim For College Tuition and ensure exceptional communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of taxation and finance claim for college tuition

Create this form in 5 minutes!

How to create an eSignature for the department of taxation and finance claim for college tuition

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to it 272?

airSlate SignNow is a digital signature solution that enables businesses to send and eSign documents quickly and securely. The connection to it 272 lies in its ability to streamline workflows and enhance efficiency, ensuring that documents are handled in compliance with industry standards.

-

How much does airSlate SignNow cost in relation to it 272?

The pricing for airSlate SignNow varies based on the selected plan, but it offers competitive rates for businesses looking to improve their document management processes with it 272. There are multiple tiers available, which allow organizations to choose a suitable option that fits their budget and requirements.

-

What features does airSlate SignNow offer that make it suitable for it 272?

airSlate SignNow offers a range of features including customizable templates, advanced security options, and real-time tracking of document status. These features cater specifically to the needs of businesses implementing it 272, helping them manage contracts and agreements effectively.

-

Can I integrate airSlate SignNow with other platforms for it 272?

Yes, airSlate SignNow provides integration capabilities with various third-party applications such as CRM systems and cloud storage services. This ensures that users who require it 272 can seamlessly incorporate the eSigning process into their existing workflows.

-

What are the benefits of using airSlate SignNow in the context of it 272?

Using airSlate SignNow provides signNow benefits such as reducing turnaround times on contracts and increasing overall operational efficiency. For businesses focusing on it 272, these advantages translate to quicker decision-making and improved customer satisfaction.

-

Is airSlate SignNow compliant with regulations that affect it 272?

Yes, airSlate SignNow adheres to various compliance standards, ensuring that its eSignatures are legally binding and secure. This compliance is particularly crucial for companies involved with it 272, as it assures them of the legality and reliability of their document transactions.

-

How does airSlate SignNow enhance security for it 272 transactions?

airSlate SignNow employs advanced encryption and multi-factor authentication to ensure the security of all documents and signatures. These security measures are vital for businesses using it 272, as they protect sensitive data throughout the eSigning process.

Get more for Department Of Taxation And Finance Claim For College Tuition

Find out other Department Of Taxation And Finance Claim For College Tuition

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form