Form 8959 2023

What is the Form 8959

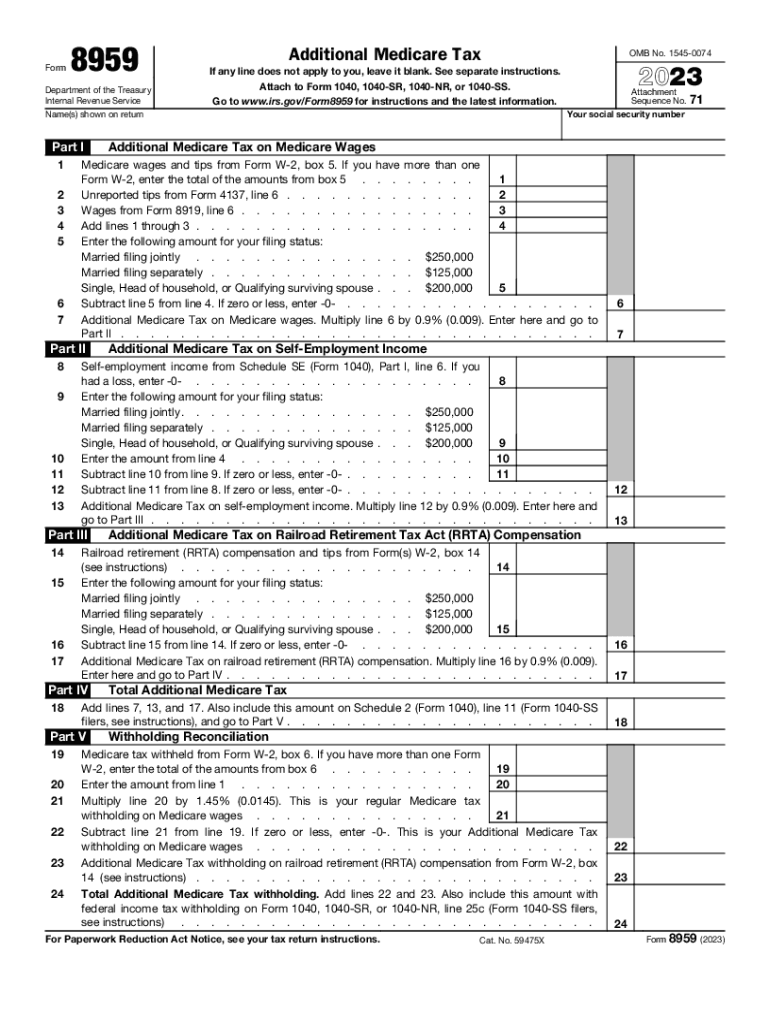

The Form 8959 is a tax form used by individuals to report and calculate the additional Medicare tax owed on their income. This tax applies to high-income earners and is an important aspect of federal tax compliance. The additional Medicare tax rate is 0.9% on wages and self-employment income that exceed certain thresholds. For single filers, the threshold is $200,000, while for married couples filing jointly, it is $250,000. Understanding this form is essential for ensuring accurate tax reporting and compliance with IRS regulations.

How to use the Form 8959

To use the Form 8959, taxpayers should first determine if they meet the income thresholds that require them to pay the additional Medicare tax. If applicable, the next step is to complete the form by reporting total wages, tips, and other compensation. Taxpayers must also calculate the amount of additional Medicare tax owed based on their income exceeding the thresholds. After completing the form, it should be submitted along with the individual’s income tax return, typically Form 1040.

Steps to complete the Form 8959

Completing the Form 8959 involves several key steps:

- Gather all relevant income information, including W-2 forms and any self-employment income.

- Identify if your income exceeds the applicable threshold for additional Medicare tax.

- Fill out the form by entering total wages and calculating the excess amount over the threshold.

- Calculate the additional Medicare tax owed by applying the 0.9% rate to the excess income.

- Review the form for accuracy before submitting it with your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8959. Taxpayers should refer to the IRS instructions for detailed information on eligibility, income thresholds, and filing requirements. It is crucial to follow these guidelines to avoid errors that could lead to penalties or delays in processing your tax return. The IRS also updates these guidelines periodically, so staying informed about any changes is essential for compliance.

Filing Deadlines / Important Dates

Form 8959 must be filed along with your annual income tax return, typically due on April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. For taxpayers who file for an extension, the form must still be submitted by the extended due date. It is important to mark these deadlines on your calendar to ensure timely compliance and avoid potential penalties.

Penalties for Non-Compliance

Failing to file Form 8959 when required can result in significant penalties. The IRS may impose fines for late filing or underpayment of the additional Medicare tax. Additionally, interest may accrue on any unpaid taxes. To mitigate these risks, taxpayers should ensure they accurately complete and submit the form by the deadlines. Understanding the consequences of non-compliance can help motivate timely and accurate tax reporting.

Quick guide on how to complete form 8959 702389889

Complete Form 8959 effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any holdups. Handle Form 8959 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and electronically sign Form 8959 with ease

- Obtain Form 8959 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would prefer to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8959 ensuring top-notch communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8959 702389889

Create this form in 5 minutes!

How to create an eSignature for the form 8959 702389889

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the additional Medicare tax and who does it apply to?

The additional Medicare tax is an extra 0.9% tax on earnings that exceed a certain threshold based on your filing status. It applies to high-income earners who make more than $200,000 for single filers and $250,000 for married couples filing jointly. Understanding this tax is crucial for effective financial planning.

-

How can airSlate SignNow help me manage documents related to additional Medicare tax?

With airSlate SignNow, you can easily create, sign, and manage documents that pertain to financial agreements and tax forms related to the additional Medicare tax. Our platform provides templates and automation tools that streamline the documentation process, making it simple to stay organized and compliant.

-

What features does airSlate SignNow offer for calculating additional Medicare tax?

While airSlate SignNow does not calculate taxes directly, it integrates seamlessly with accounting software that can help calculate the additional Medicare tax. By using our eSignature capabilities, you can ensure that any related documents are signed promptly and securely, facilitating better financial management.

-

Is airSlate SignNow a cost-effective solution for tax-related documentation?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our competitive pricing plans ensure that you can efficiently manage your tax-related documents, including those involving the additional Medicare tax, without overspending on resources.

-

Can I integrate airSlate SignNow with my existing payroll software for handling additional Medicare tax?

Absolutely! airSlate SignNow offers integrations with popular payroll and accounting software, allowing you to synchronize your tax-related data seamlessly. This means you can efficiently manage documents while ensuring compliance with regulations regarding the additional Medicare tax.

-

What benefits can I expect from using airSlate SignNow for tax document management?

Using airSlate SignNow provides numerous benefits, including faster document turnaround times, improved collaboration, and enhanced security for sensitive tax information. By automating the eSigning process for documents related to the additional Medicare tax, you can save time and reduce errors.

-

How does airSlate SignNow ensure the security of my tax-related documents?

airSlate SignNow employs advanced encryption protocols and strict access controls to safeguard your documents. With features like secure eSignatures and audit trails, you can be confident that your tax-related documents, including those involving the additional Medicare tax, are protected against unauthorized access.

Get more for Form 8959

Find out other Form 8959

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors