Form 8959 for Year 2013

What is the Form 8959 For Year

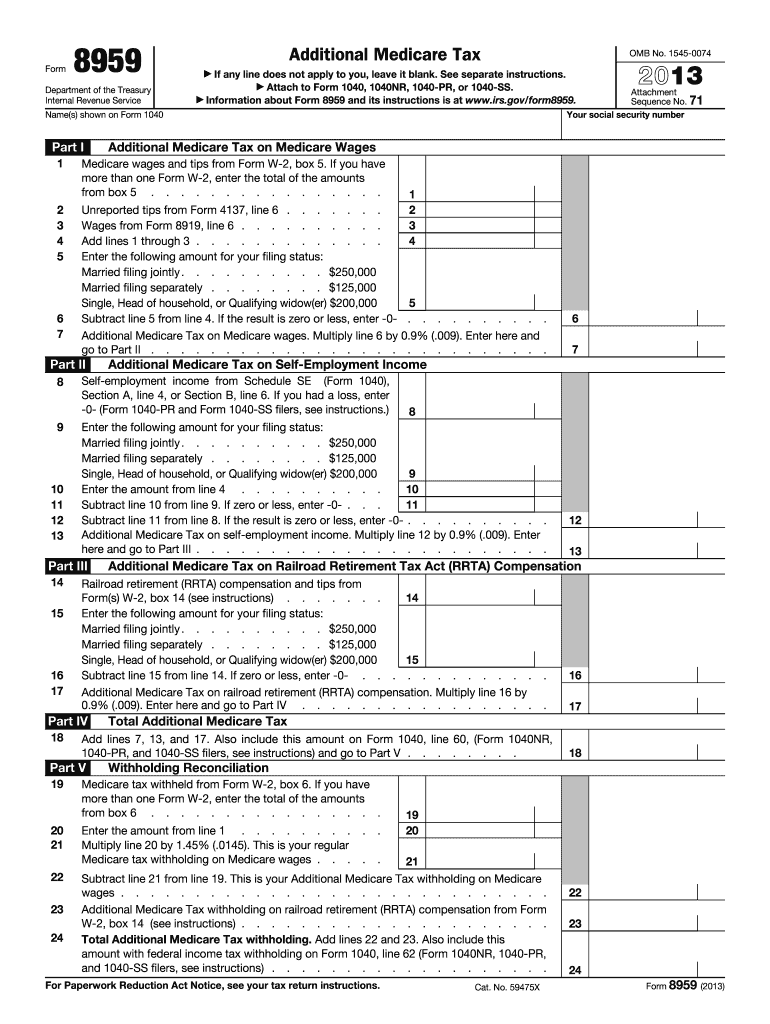

The Form 8959 is a tax form used by individuals in the United States to calculate and report Additional Medicare Tax. This tax applies to high-income earners and is an important component of the overall tax obligations for those who exceed certain income thresholds. The form must be filed along with the individual's federal income tax return, and it is essential for accurately determining the amount owed for the Additional Medicare Tax based on wages, self-employment income, and other applicable earnings.

How to use the Form 8959 For Year

Using the Form 8959 involves several steps to ensure accurate reporting. First, gather all relevant income information, including W-2 forms and any self-employment income documentation. Next, determine if your income exceeds the threshold for Additional Medicare Tax, which is $200,000 for single filers and $250,000 for married couples filing jointly. Once you confirm your eligibility, complete the form by entering the necessary figures, including total wages and the calculated tax amount. Finally, include the completed Form 8959 with your federal tax return when filing.

Steps to complete the Form 8959 For Year

Completing the Form 8959 requires careful attention to detail. Begin with the following steps:

- Gather your income documents, such as W-2s and 1099s.

- Identify your filing status and income threshold applicable to you.

- Fill out the form by entering your total wages and self-employment income.

- Calculate the Additional Medicare Tax based on the excess income over the threshold.

- Review the form for accuracy and ensure all necessary information is included.

- Submit the form along with your federal tax return by the filing deadline.

Legal use of the Form 8959 For Year

The legal use of Form 8959 is governed by IRS regulations. It is essential for taxpayers to file the form accurately to comply with tax laws. Failing to report Additional Medicare Tax can lead to penalties and interest on unpaid amounts. The form serves as a formal declaration of the taxpayer's income and tax obligations, making it crucial for maintaining compliance with federal tax requirements.

Filing Deadlines / Important Dates

Filing deadlines for Form 8959 align with the general tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes in deadlines and ensure that Form 8959 is submitted on time to avoid penalties. Additionally, if an extension is filed for the overall tax return, it may also apply to the Form 8959 submission.

Form Submission Methods (Online / Mail / In-Person)

Form 8959 can be submitted through various methods. Taxpayers have the option to file electronically using tax software, which often simplifies the process and ensures accuracy. Alternatively, the form can be printed and mailed to the IRS. It is important to follow the specific mailing instructions provided by the IRS for the correct address based on the taxpayer's location. In-person submission is generally not available for this form, as it is primarily processed through electronic or mail channels.

Quick guide on how to complete form 8959 for year 2013

Effortlessly Prepare Form 8959 For Year on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to acquire the proper format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Administer Form 8959 For Year on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Alter and eSign Form 8959 For Year Stress-Free

- Find Form 8959 For Year and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your adjustments.

- Choose how you would like to deliver your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8959 For Year to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8959 for year 2013

Create this form in 5 minutes!

How to create an eSignature for the form 8959 for year 2013

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 8959 For Year?

Form 8959 For Year is used to calculate the Additional Medicare Tax on high income earners. It is essential for taxpayers who had wages, compensation, or self-employment income above certain thresholds during the fiscal year. Understanding how to properly fill out this form is crucial to avoid underpayment penalties.

-

How can airSlate SignNow assist with Form 8959 For Year?

airSlate SignNow simplifies the process of eSigning and sending Form 8959 For Year, making it easier to manage tax documents electronically. With its user-friendly interface, you can efficiently send, sign, and archive important tax forms, reducing paperwork and organization challenges. This streamlines your tax preparation process and ensures compliance.

-

What features does airSlate SignNow offer for managing Form 8959 For Year?

Our platform provides a robust set of features for managing Form 8959 For Year, such as customizable templates, secure electronic signatures, and document tracking. You can create, edit, and share forms in real-time, ensuring that your tax documents are up-to-date and accurate. This eliminates errors and enhances productivity.

-

Is airSlate SignNow a cost-effective solution for handling Form 8959 For Year?

Yes, airSlate SignNow is designed as a cost-effective solution for managing paperwork like Form 8959 For Year. Our competitive pricing models ensure that businesses of all sizes can afford access to essential eSignature features, enabling you to save money compared to traditional paper-based processes. Plus, our efficiency might even lower your overall operational costs.

-

Can I integrate airSlate SignNow with other tools for Form 8959 For Year?

Absolutely! airSlate SignNow integrates seamlessly with various business applications to facilitate the management of Form 8959 For Year. Whether it’s CRM, cloud storage, or workflow automation tools, these integrations enhance your document management processes, so you can connect seamlessly with existing systems.

-

What are the benefits of using airSlate SignNow for Form 8959 For Year?

Using airSlate SignNow for Form 8959 For Year offers numerous benefits, including enhanced security, speed, and easy access. By moving to a digital solution, you minimize the risk of losing important documents and can retrieve them from anywhere at any time. Our solution also accelerates the sign and approval process, which is critical during tax season.

-

What kind of support does airSlate SignNow offer for issues related to Form 8959 For Year?

airSlate SignNow provides comprehensive customer support tailored to assist you with issues related to Form 8959 For Year. Our support team is available via various channels, including live chat, email, and phone, ensuring that you receive prompt assistance whenever you encounter challenges. We are committed to your satisfaction and ensuring that you have a smooth experience.

Get more for Form 8959 For Year

- Amador county fair form

- Returning volunteer driver sjusd form

- Medication form for school

- Broker of record renewals sample letter for renewals on form

- Individual marketplace book of business transfer form here

- Fuhsd administrative regulation 1312 form

- Checks attach adding machine tape of itemized checks form

- Oral health notification form poway unified school district

Find out other Form 8959 For Year

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now