IRS 8959DSA Fill and Sign Printable Template Online US Legal Forms 2022

Understanding Form 8959

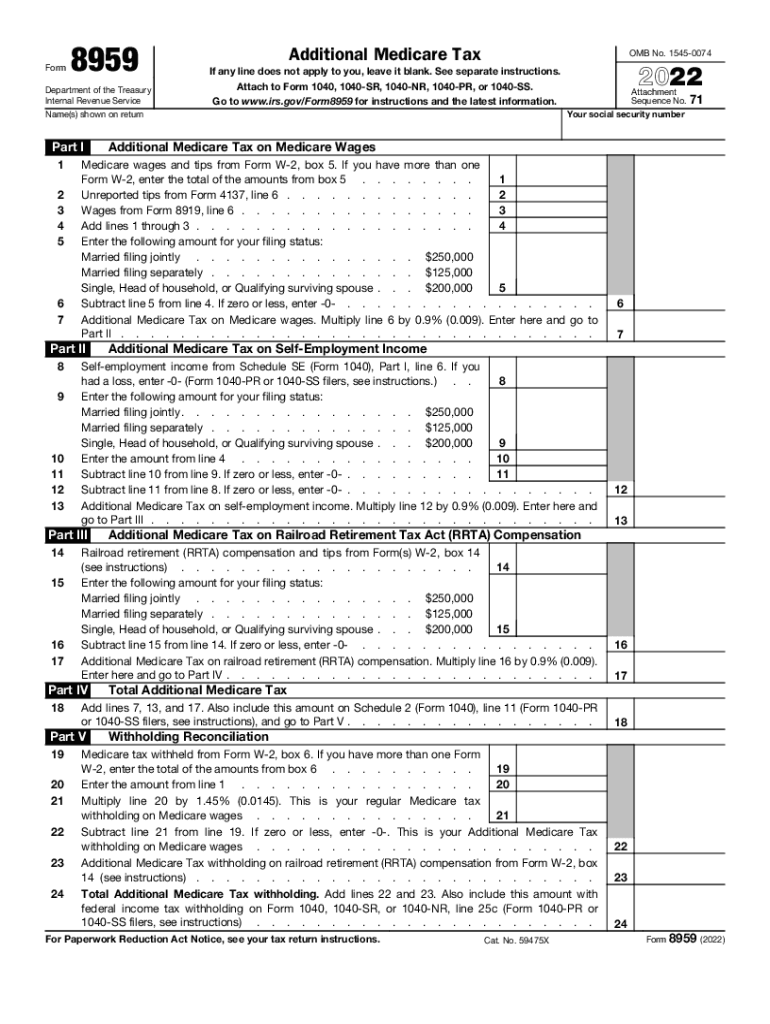

Form 8959, also known as the Additional Medicare Tax form, is a document used by the Internal Revenue Service (IRS) to assess the Additional Medicare Tax on high-income earners. This tax applies to wages, compensation, and self-employment income that exceed certain thresholds. For individuals, the threshold is $200,000, and for married couples filing jointly, it is $250,000. This form is essential for reporting the Additional Medicare Tax, which is separate from the standard Medicare tax.

Steps to Complete Form 8959

Filling out Form 8959 involves several key steps:

- Gather necessary financial documents, including W-2 forms and any self-employment income records.

- Determine if your income exceeds the threshold for the Additional Medicare Tax.

- Complete the form by entering your total wages, compensation, and self-employment income.

- Calculate the Additional Medicare Tax owed based on the excess income over the threshold.

- Review the form for accuracy before submission.

Filing Deadlines for Form 8959

Form 8959 must be filed along with your annual income tax return, typically due on April 15 of the following year. If you are unable to file by this date, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is crucial to keep track of any changes in tax laws that could affect filing deadlines.

Form Submission Methods

You can submit Form 8959 in several ways:

- Online: Use IRS e-file options available through approved tax software.

- By Mail: Send a paper form to the address specified in the form instructions.

- In-Person: Visit a local IRS office for assistance with filing.

Legal Use of Form 8959

Form 8959 is legally required for individuals whose income exceeds the specified thresholds. Accurate completion and timely submission are essential to comply with IRS regulations. Failure to file or underreporting income can result in penalties. It is advisable to consult a tax professional if you have questions about your obligations regarding this form.

IRS Guidelines for Form 8959

The IRS provides specific guidelines for completing Form 8959, including detailed instructions on how to calculate the Additional Medicare Tax. It is important to refer to the latest IRS publications and resources to ensure compliance with current tax laws. These guidelines help taxpayers understand their responsibilities and the implications of the Additional Medicare Tax on their overall tax liability.

Quick guide on how to complete irs 8959dsa fill and sign printable template online us legal forms

Complete IRS 8959DSA Fill And Sign Printable Template Online US Legal Forms seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage IRS 8959DSA Fill And Sign Printable Template Online US Legal Forms on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and electronically sign IRS 8959DSA Fill And Sign Printable Template Online US Legal Forms effortlessly

- Find IRS 8959DSA Fill And Sign Printable Template Online US Legal Forms and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or mask sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and electronically sign IRS 8959DSA Fill And Sign Printable Template Online US Legal Forms and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 8959dsa fill and sign printable template online us legal forms

Create this form in 5 minutes!

People also ask

-

What is Form 8959 and why is it important?

Form 8959 is used by taxpayers to report Additional Medicare Tax on their income. Understanding this form is crucial for ensuring compliance with tax regulations and avoiding penalties. airSlate SignNow simplifies the process by providing an efficient platform for managing and signing Form 8959.

-

How can airSlate SignNow help me with Form 8959?

airSlate SignNow allows you to easily create, send, and eSign Form 8959. Our intuitive platform helps streamline the process, ensuring that you can complete your tax forms quickly and securely, reducing paperwork and saving time.

-

What features does airSlate SignNow offer for managing Form 8959?

With airSlate SignNow, you have access to features such as templates for Form 8959, real-time tracking, and cloud storage. These features enhance your workflow, making it easier to manage your tax documents efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for Form 8959?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses of all sizes. Each plan provides access to essential features for managing documents like Form 8959, ensuring you have the tools you need at a competitive price.

-

Can I integrate other tools with airSlate SignNow when handling Form 8959?

Absolutely! airSlate SignNow provides integrations with numerous applications, making it easy to incorporate other tools into your workflow. This means you can seamlessly connect your financial software to manage Form 8959 and other documents.

-

What are the benefits of using airSlate SignNow for Form 8959?

Using airSlate SignNow for Form 8959 allows for faster processing, enhanced security, and easier collaboration. This platform ensures that all signers can review and complete the form quickly, improving the overall efficiency of your submission process.

-

Is airSlate SignNow secure for eSigning Form 8959?

Yes, airSlate SignNow employs advanced security measures to protect your data and documents, including eSigned Form 8959. With encryption and secure access controls, you can trust that your information is safe throughout the entire signing process.

Get more for IRS 8959DSA Fill And Sign Printable Template Online US Legal Forms

Find out other IRS 8959DSA Fill And Sign Printable Template Online US Legal Forms

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure