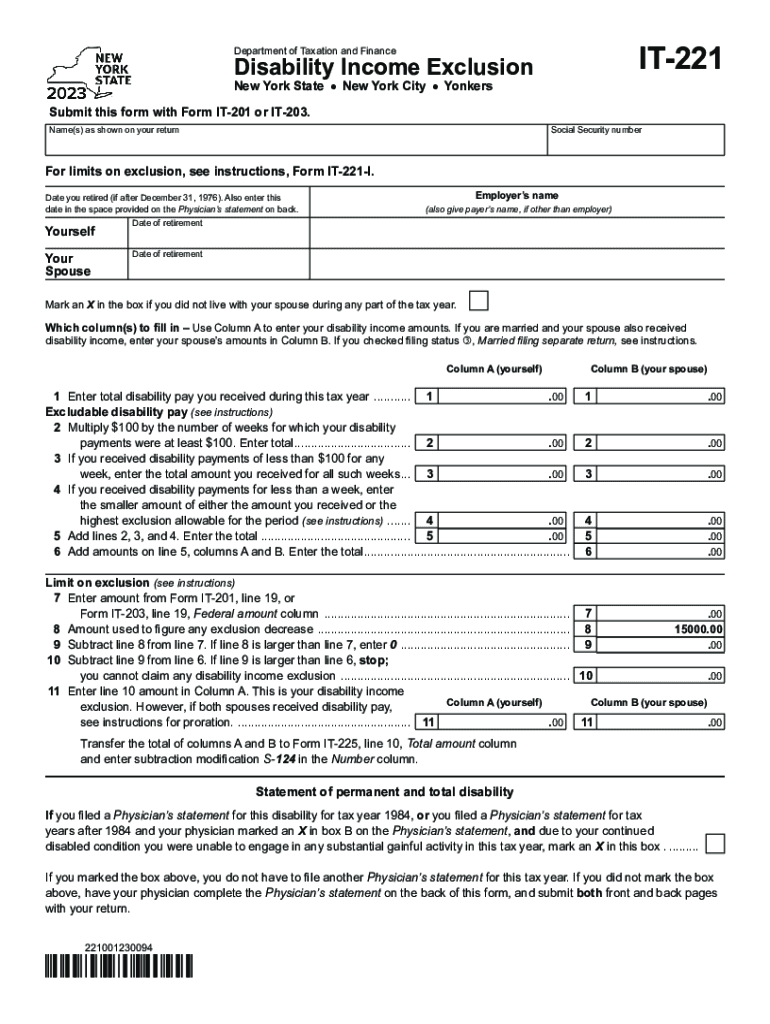

Fillable Online Tax Ny Form it 221 , Disability Income 2023

Understanding the IT-201 Form

The IT-201 form is the New York State resident income tax return, used by individuals to report their income and calculate their tax liability. This form is essential for residents who need to file their state taxes, ensuring compliance with New York tax laws. The IT-201 captures various income types, deductions, and credits, allowing taxpayers to determine their overall tax responsibility accurately.

Steps to Complete the IT-201 Form

Completing the IT-201 form involves several key steps:

- Gather necessary documents, including W-2s, 1099 forms, and records of any additional income.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim deductions and credits applicable to your situation, such as standard deductions or itemized deductions.

- Calculate your total tax liability and any refund or amount due.

Once completed, review the form for accuracy before submission.

Required Documents for Filing IT-201

To file the IT-201 form accurately, you will need several documents:

- W-2 forms from your employer(s) showing your annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or investment earnings.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

Having these documents ready will streamline the completion of your tax return.

Filing Deadlines for the IT-201 Form

It is crucial to be aware of the filing deadlines for the IT-201 form:

- The standard deadline for filing is typically April 15 of the following year.

- If you need additional time, you can file for an extension, which usually extends the deadline to October 15.

However, any taxes owed must be paid by the original deadline to avoid penalties and interest.

Form Submission Methods for IT-201

The IT-201 form can be submitted through various methods:

- Online via the New York State Department of Taxation and Finance website, using their e-filing system.

- By mail, sending the completed form to the appropriate address based on your location.

- In-person at designated tax offices, if you prefer face-to-face assistance.

Choosing the right submission method can help ensure your return is filed correctly and on time.

Eligibility Criteria for Using IT-201

To use the IT-201 form, you must meet specific eligibility criteria:

- You must be a resident of New York State for the entire tax year.

- Your income must meet the minimum filing requirements set by the state.

- Individuals who are married and filing jointly must include their spouse's income as well.

Understanding these criteria helps determine if the IT-201 form is the correct choice for your tax situation.

Key Elements of the IT-201 Form

The IT-201 form includes several key elements that taxpayers should be aware of:

- Personal information section to identify the taxpayer.

- Income section to report various income sources.

- Deductions and credits section to reduce taxable income.

- Calculation section to determine total tax owed or refund due.

Familiarity with these elements can facilitate a smoother filing process.

Quick guide on how to complete fillable online tax ny form it 221 disability income

Effortlessly Prepare Fillable Online Tax Ny Form IT 221 , Disability Income on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to swiftly create, modify, and electronically sign your documents without delays. Manage Fillable Online Tax Ny Form IT 221 , Disability Income on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Most Efficient Way to Edit and eSign Fillable Online Tax Ny Form IT 221 , Disability Income with Ease

- Find Fillable Online Tax Ny Form IT 221 , Disability Income and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark noteworthy sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for such tasks.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Modify and eSign Fillable Online Tax Ny Form IT 221 , Disability Income to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online tax ny form it 221 disability income

Create this form in 5 minutes!

How to create an eSignature for the fillable online tax ny form it 221 disability income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to IT 201?

airSlate SignNow is a cloud-based eSignature solution that streamlines the process of sending and signing documents electronically. Relevant to IT 201, it enhances document management by providing a secure and efficient way to handle contracts, agreements, and signatures.

-

How can I integrate airSlate SignNow with my existing IT 201 systems?

Integrating airSlate SignNow with your IT 201 systems is seamless, thanks to its robust API and numerous integrations with popular tools. This allows businesses to automate workflows and improve efficiency, ensuring a smooth transition between platforms.

-

What are the pricing options for airSlate SignNow in relation to IT 201?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those using IT 201. Each plan provides access to essential features for eSigning documents, enabling users to choose what fits their budget and requirements.

-

What features does airSlate SignNow provide that are beneficial for IT 201 users?

airSlate SignNow comes with features like customizable templates, reusable workflows, and advanced security options that are crucial for IT 201 users. These functionalities help simplify document management while ensuring compliance and data protection.

-

How does airSlate SignNow ensure the security of documents in IT 201?

Security is a top priority for airSlate SignNow, which includes features like data encryption, two-factor authentication, and audit trails. These measures protect sensitive information sent and signed through the platform, ensuring compliance with IT 201 standards.

-

What benefits can my business gain from using airSlate SignNow with IT 201?

By using airSlate SignNow with IT 201, businesses can increase operational efficiency, reduce turnaround times for document signing, and enhance customer satisfaction. The solution also minimizes the risk of errors and provides a reliable way to manage documents digitally.

-

Is training available for businesses adopting airSlate SignNow for IT 201?

Yes, airSlate SignNow offers comprehensive training resources for businesses looking to adopt the solution in conjunction with IT 201. Users can access tutorials, webinars, and support to ensure they get the most out of the platform right from the start.

Get more for Fillable Online Tax Ny Form IT 221 , Disability Income

- Continuing education declaration form

- California tb risk assessment form

- Pr 4 fillable form 2005 100318259

- Notice of approval for calfresh benefits california cdss ca form

- Lic 9214 form

- Wic pediatric referral form

- Osha appeal form 2014

- Medical transportation provider application package in the state of ohio 2013 form

Find out other Fillable Online Tax Ny Form IT 221 , Disability Income

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF