Ny Tr Extensions 2023-2026

Understanding the TR 579 CT Extensions

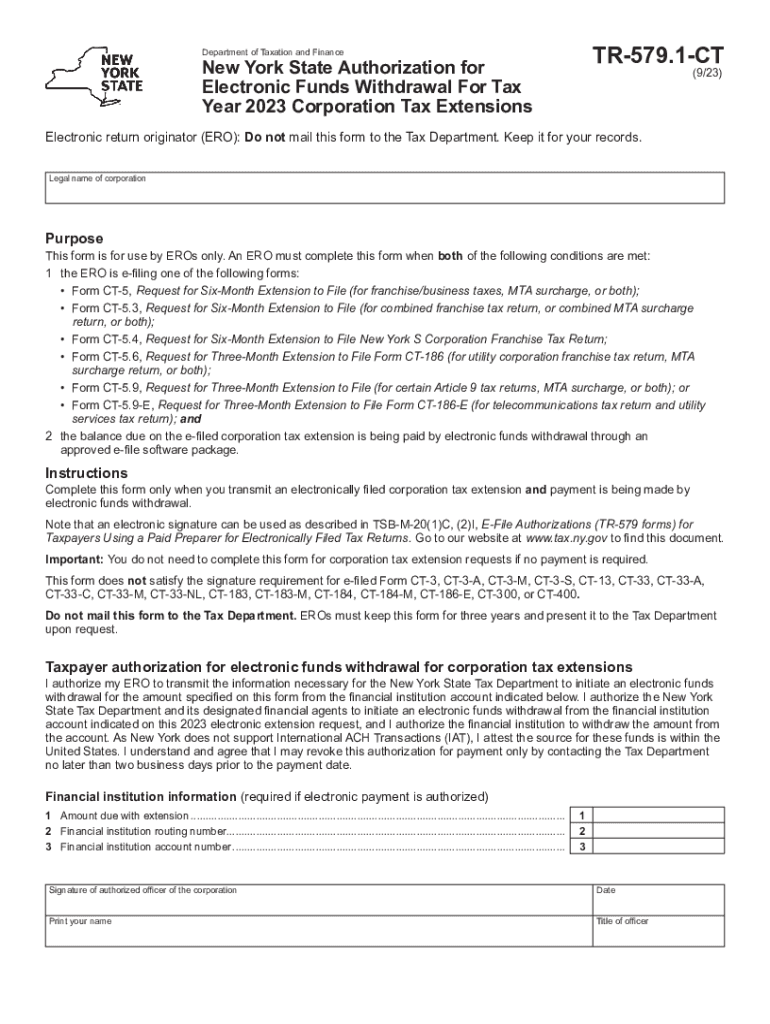

The TR 579 CT form is a crucial document for taxpayers in Connecticut seeking to request an extension for filing their state tax returns. This form allows individuals and businesses to extend their filing deadlines, providing additional time to prepare their tax documents without incurring immediate penalties. The TR 579 CT is particularly relevant for those who may need extra time due to various reasons, such as unforeseen circumstances or complex financial situations.

Steps to Complete the TR 579 CT Form

Completing the TR 579 CT form involves several straightforward steps:

- Gather necessary information, including your Social Security number or Employer Identification Number.

- Indicate the type of extension you are requesting, ensuring you meet the eligibility criteria.

- Clearly state the reason for your extension request in the designated section.

- Review the form for accuracy before submission to avoid any delays in processing.

Once completed, the form can be submitted online or via mail, depending on your preference.

Filing Deadlines for the TR 579 CT

Understanding the filing deadlines associated with the TR 579 CT form is essential for compliance. Typically, the extension request must be filed by the original due date of your tax return. For most individual taxpayers, this is April 15. Businesses may have different deadlines based on their fiscal year. Failing to submit the TR 579 CT on time could result in penalties, so it is crucial to adhere to these dates.

Legal Use of the TR 579 CT Extensions

The TR 579 CT extension is legally recognized by the Connecticut Department of Revenue Services. It grants taxpayers the right to extend their filing deadlines without facing immediate penalties, as long as the form is submitted correctly and on time. However, it is important to note that while the extension allows for more time to file, it does not extend the time to pay any taxes owed. Taxpayers should ensure that any estimated taxes are paid by the original due date to avoid interest and penalties.

Required Documents for the TR 579 CT

When filing the TR 579 CT form, taxpayers should have the following documents ready:

- Previous year’s tax return for reference.

- Any relevant income statements, such as W-2s or 1099s.

- Documentation supporting the reason for the extension, if applicable.

Having these documents on hand will facilitate the completion of the form and ensure all necessary information is included.

Examples of Using the TR 579 CT

The TR 579 CT form can be beneficial in various scenarios. For instance, a self-employed individual may encounter unexpected delays in gathering their financial documents, making it difficult to file on time. In such cases, submitting the TR 579 CT form allows them to extend their deadline while ensuring compliance with state tax regulations. Similarly, businesses facing unforeseen circumstances, such as natural disasters or significant operational changes, may also find this extension useful to avoid penalties.

Quick guide on how to complete ny tr extensions

Complete Ny Tr Extensions seamlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Ny Tr Extensions on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Ny Tr Extensions with ease

- Locate Ny Tr Extensions and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, whether via email, SMS, an invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Ny Tr Extensions to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny tr extensions

Create this form in 5 minutes!

How to create an eSignature for the ny tr extensions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the main function of airSlate SignNow and how does it relate to tr 579 1 it?

airSlate SignNow is designed to empower businesses to send and eSign documents easily and efficiently. The integration of tr 579 1 it within our platform ensures compliance and enhances your document management experience, making it easy to adopt these standards.

-

How much does airSlate SignNow cost for businesses looking to implement tr 579 1 it?

The pricing for airSlate SignNow varies based on the features and number of users required. Our plans are cost-effective, and we provide specific packages that support tr 579 1 it compliance, ensuring businesses get the best value for their investment.

-

What features of airSlate SignNow support the needs of tr 579 1 it users?

airSlate SignNow offers several features tailored to users adhering to tr 579 1 it standards, such as customizable templates, secure eSigning capabilities, and advanced tracking. These features streamline document processes while ensuring compliance.

-

How can airSlate SignNow benefit organizations needing tr 579 1 it compliance?

By implementing airSlate SignNow, organizations can enhance their workflow efficiency, reduce turnaround times for document processing, and maintain strict compliance with tr 579 1 it. The platform automates many tasks, allowing teams to focus on their core operations.

-

What integrations does airSlate SignNow offer that can assist with tr 579 1 it?

airSlate SignNow integrates seamlessly with various third-party applications, allowing businesses to streamline their operations that require tr 579 1 it compliance. These integrations enable automatic data transfer and reduce the risk of errors in document handling.

-

Is airSlate SignNow easy to implement for companies focusing on tr 579 1 it?

Yes, airSlate SignNow is user-friendly and designed for easy implementation, even for companies focusing on tr 579 1 it. Our intuitive interface and comprehensive onboarding support ensure that teams can quickly adapt and start utilizing the software effectively.

-

Can airSlate SignNow enhance security for documents requiring tr 579 1 it?

Absolutely, airSlate SignNow prioritizes security, making it a reliable choice for documents requiring tr 579 1 it compliance. Our platform utilizes encryption and secure storage protocols to safeguard sensitive information throughout the signing process.

Get more for Ny Tr Extensions

- Small claims court default entry by clerkdefault judgment default entry by clerkdefault judgment guamselfhelp form

- Small claims court notice of attachment employer notice of attachment employer guamselfhelp form

- Hawaii commercial agreement form

- Concealed weapons idaho state police idahogov form

- Affidavit of service special process server afdvtspc11 form

- Request for preparation of record on appeal 12 218 239 form

- Illinois statutory summary suspension 44183668 form

- In the circuit court for the sixteenth judicial circuit subpoena duces tecum form

Find out other Ny Tr Extensions

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document