New York State Authorization for Electronic Funds Withdrawal 2022

What is the New York State Authorization for Electronic Funds Withdrawal

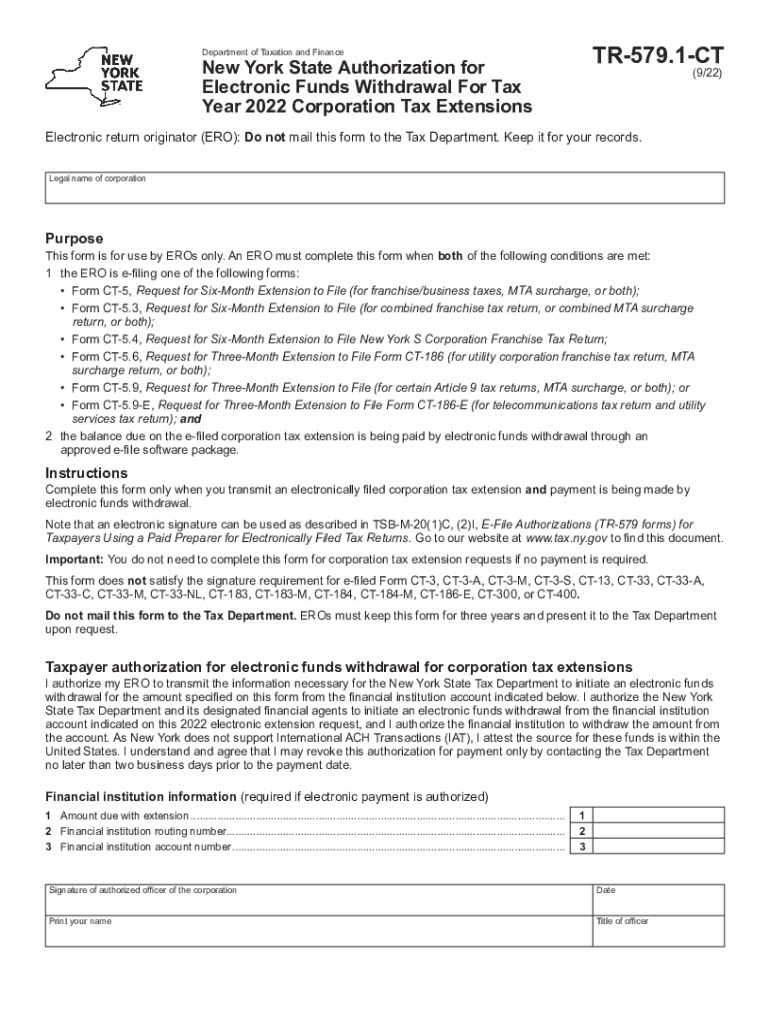

The New York State Authorization for Electronic Funds Withdrawal, commonly referred to as the TR-579 CT, is a form that allows taxpayers to authorize the New York State Department of Taxation and Finance to withdraw funds electronically for tax payments. This form is essential for individuals and businesses who prefer to manage their tax obligations through electronic means, providing a convenient and efficient way to handle payments.

This authorization is particularly useful for those who may be filing their taxes electronically, as it streamlines the payment process. By completing the TR-579 CT, taxpayers can ensure that their funds are withdrawn directly from their bank accounts on the specified date, reducing the risk of late payments and associated penalties.

How to use the New York State Authorization for Electronic Funds Withdrawal

Using the TR-579 CT involves a straightforward process that ensures your electronic funds withdrawal is set up correctly. First, you will need to complete the form with accurate information, including your name, address, and bank account details. It is crucial to double-check these details to avoid any issues with the withdrawal.

Once the form is completed, it can be submitted electronically along with your tax return or mailed to the appropriate tax office. Ensure that you keep a copy of the authorization for your records. When the form is processed, the New York State Department of Taxation and Finance will initiate the withdrawal on the date specified in your tax filing, making it a seamless experience.

Steps to complete the New York State Authorization for Electronic Funds Withdrawal

Completing the TR-579 CT requires careful attention to detail. Here are the steps to follow:

- Obtain the TR-579 CT form from the New York State Department of Taxation and Finance website or your tax preparer.

- Fill in your personal information, including your name, address, and Social Security number or Employer Identification Number.

- Provide your bank account information, ensuring that you include the correct account number and routing number.

- Select the date on which you want the funds to be withdrawn.

- Review the completed form for accuracy.

- Submit the form electronically with your tax return or mail it to the designated address.

Legal use of the New York State Authorization for Electronic Funds Withdrawal

The TR-579 CT is legally binding when completed and submitted according to the guidelines set forth by the New York State Department of Taxation and Finance. To ensure its legal standing, the form must be filled out accurately and submitted in a timely manner. Compliance with the relevant regulations surrounding electronic signatures and funds withdrawal is essential for the authorization to be valid.

Utilizing this form in accordance with state laws not only facilitates a smooth transaction but also helps avoid potential legal complications related to tax payments. It is advisable to keep records of all submissions and confirmations to maintain a clear audit trail.

Filing Deadlines / Important Dates

When using the TR-579 CT, it is important to be aware of key filing deadlines to avoid penalties. Typically, the form should be submitted along with your tax return by the due date for your specific tax year. For most individual taxpayers, this date falls on April fifteenth each year.

If you are filing for an extension, ensure that the TR-579 CT is submitted by the extended deadline. Keeping track of these dates is crucial to ensure that your electronic funds withdrawal is processed on time and that you remain compliant with state tax regulations.

Form Submission Methods

The TR-579 CT can be submitted in various ways, providing flexibility for taxpayers. The most common methods include:

- Online Submission: If you are filing your tax return electronically, you can submit the TR-579 CT as part of your online filing process.

- Mail: You may also print the completed form and send it to the appropriate address provided by the New York State Department of Taxation and Finance.

- In-Person: For those who prefer personal interaction, visiting a local tax office to submit the form is also an option.

Quick guide on how to complete new york state authorization for electronic funds withdrawal

Easily Prepare New York State Authorization For Electronic Funds Withdrawal on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely save it on the web. airSlate SignNow equips you with all the features required to create, alter, and electronically sign your documents promptly without any holdups. Manage New York State Authorization For Electronic Funds Withdrawal effortlessly on any device with the airSlate SignNow apps for Android or iOS, and simplify your document-related processes today.

The easiest way to modify and eSign New York State Authorization For Electronic Funds Withdrawal with ease

- Locate New York State Authorization For Electronic Funds Withdrawal and select Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize crucial parts of your documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or a link invitation, or download it to your computer.

Say goodbye to lost or mislaid files, cumbersome form navigation, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign New York State Authorization For Electronic Funds Withdrawal to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state authorization for electronic funds withdrawal

Create this form in 5 minutes!

People also ask

-

What is the TR 579 CT and how does it relate to airSlate SignNow?

The TR 579 CT is a classification in electronic signature legislation that aligns with our core services at airSlate SignNow. Understanding this classification helps businesses comply with legal standards when using our eSignature solutions, ensuring documents are signed securely and recognized legally.

-

What features does airSlate SignNow offer for TR 579 CT compliance?

airSlate SignNow provides advanced features such as secure document storage, timestamping, and audit trails, all crucial for TR 579 CT compliance. These features ensure that the electronic signatures are legally binding and maintain integrity throughout the document lifecycle.

-

Is there a free trial available for airSlate SignNow with TR 579 CT functionalities?

Yes, airSlate SignNow offers a free trial that allows you to explore our features related to TR 579 CT compliance. This trial helps you understand how our eSignature solution can meet your business's legal and operational needs before making a commitment.

-

How can airSlate SignNow improve my business processes regarding TR 579 CT?

By implementing airSlate SignNow, your business can streamline its document signing processes in alignment with TR 579 CT requirements. This results in faster turnaround times, reduced paperwork, and enhanced security, ultimately improving overall operational efficiency.

-

What is the pricing structure for airSlate SignNow concerning TR 579 CT services?

airSlate SignNow offers competitive pricing plans that cater to various business sizes. Each plan includes features that support TR 579 CT compliance, ensuring you get the best value for your investment while meeting legal requirements.

-

Can I integrate airSlate SignNow with other tools to handle TR 579 CT processes?

Yes, airSlate SignNow integrates seamlessly with various business applications like CRM and document management systems, enhancing your workflow related to TR 579 CT. These integrations allow for a more streamlined process from document creation to signing.

-

What are the security measures taken by airSlate SignNow for TR 579 CT?

Security is a top priority at airSlate SignNow, particularly for TR 579 CT compliance. We implement bank-level encryption, multifactor authentication, and regular security audits to ensure that all documents and signatures are protected from unauthorized access.

Get more for New York State Authorization For Electronic Funds Withdrawal

- Partial release of property from deed of trust for corporation idaho form

- Partial release of property from deed of trust for individual idaho form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy idaho form

- Warranty deed for parents to child with reservation of life estate idaho form

- Idaho community property form

- Warranty deed for separate or joint property to joint tenancy idaho form

- Warranty deed to separate property of one spouse to both spouses as joint tenants idaho form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries idaho form

Find out other New York State Authorization For Electronic Funds Withdrawal

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile