Form TR 579 1 CT821New York State Authorization for Electronic Funds Withdrawal for Tax Year Corporation Tax Extensionstr579 1ct 2021

What is the Form TR 579 1 CT?

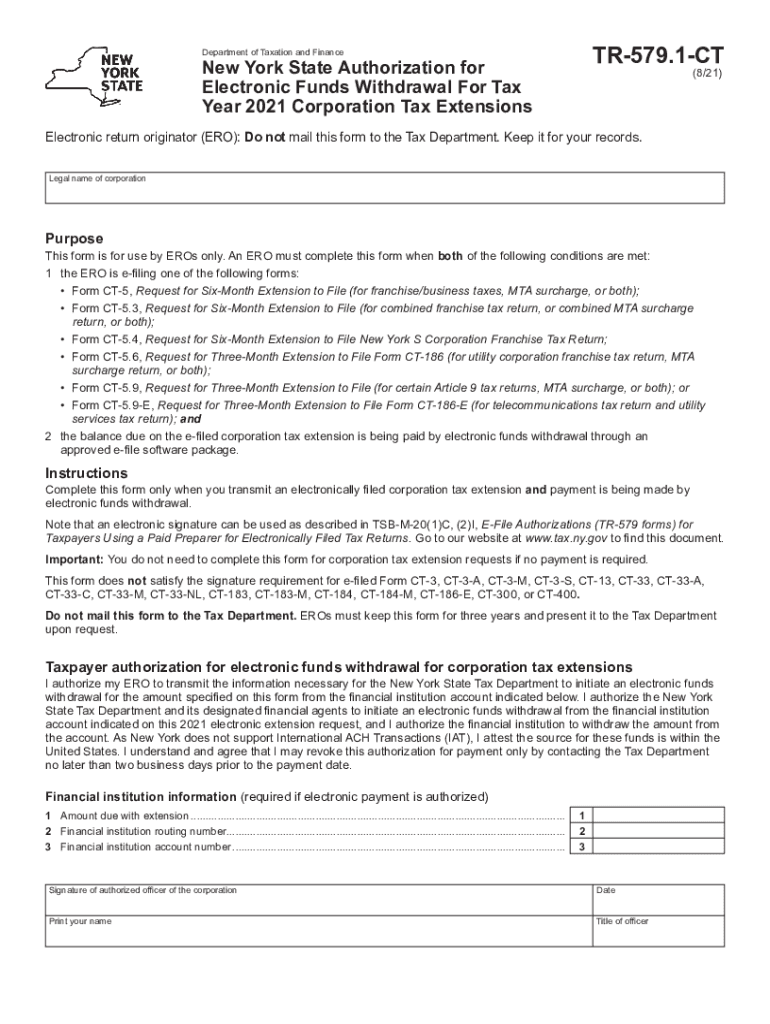

The Form TR 579 1 CT is the New York State Authorization for Electronic Funds Withdrawal for tax year corporation tax extensions. This form allows corporations to authorize the New York State Department of Taxation and Finance to withdraw funds electronically for tax payments. It is essential for businesses seeking to extend their tax deadlines while ensuring timely payment of any owed taxes. Understanding the purpose and requirements of this form is crucial for compliance and efficient tax management.

Steps to Complete the Form TR 579 1 CT

Completing the Form TR 579 1 CT involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, such as your corporation's name, Employer Identification Number (EIN), and the amount to be withdrawn. Next, fill out the form with precise details, ensuring that all fields are completed accurately. After filling out the form, review it for any errors before submission. Finally, submit the form electronically or via mail, depending on your preference, ensuring it is sent before the deadline to avoid penalties.

Legal Use of the Form TR 579 1 CT

The legal use of the Form TR 579 1 CT is governed by New York State tax regulations. This form must be filled out correctly and submitted on time to ensure that electronic withdrawals are authorized for tax payments. Failure to comply with the requirements set forth by the New York State Department of Taxation and Finance may result in penalties or delays in processing. It is vital for corporations to understand their legal obligations when using this form to maintain compliance with state tax laws.

Key Elements of the Form TR 579 1 CT

Key elements of the Form TR 579 1 CT include the corporation's identifying information, the specific tax year for which the extension is requested, and the amount to be withdrawn. Additionally, the form requires the signature of an authorized representative of the corporation, affirming that all information provided is accurate. These elements are crucial for the form's validity and for ensuring that the electronic funds withdrawal is processed smoothly.

Filing Deadlines / Important Dates

Filing deadlines for the Form TR 579 1 CT are critical for corporations to adhere to in order to avoid penalties. The form must be submitted by the due date for the corporation's tax return, which is typically the 15th day of the third month following the end of the tax year. It is advisable to check the New York State Department of Taxation and Finance website for any updates or changes to deadlines, as these can vary based on specific circumstances or changes in legislation.

Form Submission Methods

The Form TR 579 1 CT can be submitted through various methods, including online electronic submission via the New York State Department of Taxation and Finance website, by mail, or in person at designated locations. Electronic submission is often preferred for its speed and efficiency, allowing for immediate confirmation of receipt. When submitting by mail, ensure that the form is sent well in advance of the deadline to allow for processing time.

Quick guide on how to complete form tr 5791 ct821new york state authorization for electronic funds withdrawal for tax year 2021 corporation tax

Effortlessly prepare Form TR 579 1 CT821New York State Authorization For Electronic Funds Withdrawal For Tax Year Corporation Tax Extensionstr579 1ct on any platform

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form TR 579 1 CT821New York State Authorization For Electronic Funds Withdrawal For Tax Year Corporation Tax Extensionstr579 1ct on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to adjust and electronically sign Form TR 579 1 CT821New York State Authorization For Electronic Funds Withdrawal For Tax Year Corporation Tax Extensionstr579 1ct effortlessly

- Find Form TR 579 1 CT821New York State Authorization For Electronic Funds Withdrawal For Tax Year Corporation Tax Extensionstr579 1ct and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as an ink signature.

- Review all the information, then click on the Done button to confirm your changes.

- Decide how you want to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Form TR 579 1 CT821New York State Authorization For Electronic Funds Withdrawal For Tax Year Corporation Tax Extensionstr579 1ct to ensure exceptional communication throughout your document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tr 5791 ct821new york state authorization for electronic funds withdrawal for tax year 2021 corporation tax

Create this form in 5 minutes!

How to create an eSignature for the form tr 5791 ct821new york state authorization for electronic funds withdrawal for tax year 2021 corporation tax

How to create an e-signature for a PDF file in the online mode

How to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the tr 579 ct and how does it work with airSlate SignNow?

The tr 579 ct is a specific document type that can be easily managed using airSlate SignNow's electronic signature platform. With airSlate SignNow, you can upload, sign, and send your tr 579 ct documents seamlessly. This ensures a quick and efficient workflow for all your signing needs.

-

What are the pricing options for using airSlate SignNow for tr 579 ct documents?

airSlate SignNow offers various pricing plans that cater to different organizational needs. Depending on your requirements, you can choose a plan that best fits your budget while facilitating the handling of your tr 579 ct documents. Each plan provides comprehensive features to streamline your document management process.

-

What features does airSlate SignNow provide for managing tr 579 ct documents?

airSlate SignNow offers a range of features for efficient management of tr 579 ct documents, including customizable templates, automated workflows, and real-time tracking. These functionalities help ensure that your documents are signed quickly and securely. Additionally, users can easily collaborate with others directly on the platform.

-

How does airSlate SignNow enhance the process of signing tr 579 ct documents?

With airSlate SignNow, the process of signing tr 579 ct documents is streamlined and user-friendly. The platform allows for instant eSignatures, which eliminates the need for printing and scanning. This not only saves time but also reduces overall costs associated with paper-based documentation.

-

Can I integrate airSlate SignNow with other software for handling tr 579 ct documents?

Yes, airSlate SignNow seamlessly integrates with a variety of business applications to facilitate the efficient handling of tr 579 ct documents. This includes CRM systems, cloud storage solutions, and project management tools. Such integrations enhance collaboration and accessibility for your team.

-

What are the benefits of using airSlate SignNow for tr 579 ct document management?

Using airSlate SignNow for managing tr 579 ct documents offers numerous benefits, including enhanced security, time savings, and increased efficiency. The platform complies with various industry standards for data protection, ensuring that your documents are secure. Moreover, the intuitive interface makes it easy for all users to adopt.

-

Is mobile access available for managing tr 579 ct documents with airSlate SignNow?

Yes, airSlate SignNow provides mobile access for managing your tr 579 ct documents on-the-go. This feature allows you to send and sign documents from your smartphone or tablet, ensuring you can handle important tasks wherever you are. The mobile app maintains the same level of security and functionality as the desktop version.

Get more for Form TR 579 1 CT821New York State Authorization For Electronic Funds Withdrawal For Tax Year Corporation Tax Extensionstr579 1ct

- Marital legal separation and property settlement agreement where minor children and no joint property or debts and divorce 497296568 form

- Marital legal separation and property settlement agreement where minor children and no joint property or debts that is 497296569 form

- Marital legal separation and property settlement agreement where minor children and parties may have joint property or debts 497296570 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts effective form

- Arkansas marital property form

- Property no children form

- Marital legal separation and property settlement agreement no children parties may have joint property or debts effective 497296574 form

- Legal separation and property settlement agreement with adult children marital parties may have joint property or debts divorce form

Find out other Form TR 579 1 CT821New York State Authorization For Electronic Funds Withdrawal For Tax Year Corporation Tax Extensionstr579 1ct

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors